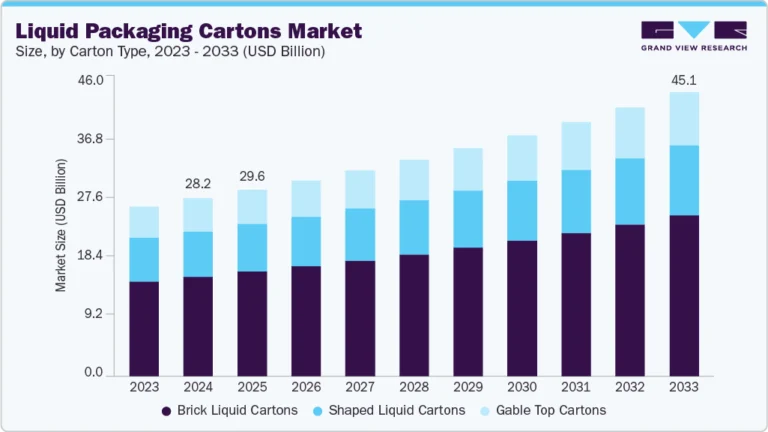

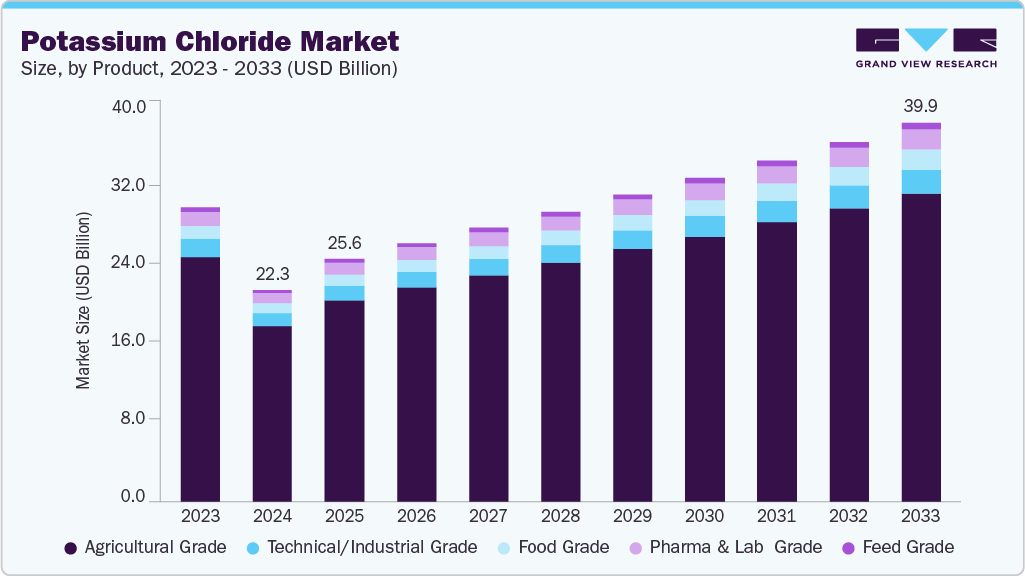

Potassium Chloride Market growing at a CAGR of 5.7% from 2025 to 2033

The global potassium chloride market size was estimated at USD 22,347.1 million in 2024 and is projected to reach USD 39,966.4 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Potassium chloride is widely used as a primary input in fertilizer formulations due to its nutrient content, compatibility with various soil types, and efficiency in supporting high-yield crop cycles.

Key Market Trends & Insights

- Asia Pacific dominated the potassium chloride market with the largest revenue share of 44.7% in 2024.

- The global potassium chloride market is projected to grow at a CAGR of 5.7% from 2025 to 2033.

- The agricultural grade segment dominated the market and accounted for the largest revenue share of 83.1% in 2024.

- The food grade segment is expected to grow at the fastest CAGR of 7.7% from 2025 to 2033.

- The chemical manufacturing segment dominated the market and accounted for the largest revenue share of 45.4% in 2024.

- The water treatment segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033.

Market Size & Forecasts

- 2024 Market Size: USD 22,347.1 Million

- 2033 Projected Market Size: USD 39,966.4 Million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/potassium-chloride-market-report/request/rs1

As global agricultural systems transition toward input-intensive farming to meet growing food requirements, the consumption of potassium chloride is projected to follow a sustained upward trend. Global food production faces mounting pressure from population growth, limited arable land, and the need for climate-resilient agricultural practices. Potassium chloride plays a central role in enhancing crop quality, improving water use efficiency, and supporting plant metabolism under stress conditions. These agronomic benefits are essential for meeting yield targets in regions experiencing soil degradation and resource constraints. Fertilizer adoption programs, government subsidies, and agricultural development initiatives in regions such as Asia-Pacific, Africa, and Latin America are driving market expansion. Countries with limited domestic potash resources are increasing imports and entering into long-term supply agreements to ensure consistent fertilizer availability.

Industrial applications are also contributing to market growth. Potassium chloride is used in the manufacturing of products across pharmaceuticals, food processing, and chemical sectors. It is incorporated in saline formulations, electrolyte replacements, and as a processing aid in packaged food products. In chemical production, potassium chloride serves as a precursor for potassium-based compounds used in detergents, batteries, and specialty glass manufacturing. These non-agricultural uses are supporting demand diversification and reducing market dependency on seasonal crop cycles. Increasing investment in downstream processing capacity is expected to widen the industrial consumption base in the forecast period.

Market structure is influenced by the geographic concentration of reserves, trade flows, and the vertical integration of mining operations. Canada, Russia, and Belarus account for a significant share of global production, shaping international pricing and supply strategies. Export policies, infrastructure investments, and resource management frameworks in these countries affect the stability of the global supply chain. Companies operating in the potassium chloride sector are expanding capacity, adopting cost-efficient extraction technologies, and developing distribution partnerships to address regional demand fluctuations. These strategies are enabling a more resilient and scalable supply environment aligned with long-term agricultural and industrial requirements.

Market Concentration & Characteristics

The industry is fragmented, with a limited number of large-scale producers holding a significant portion of global supply while smaller participants operate at regional or niche levels. This structure reflects the high capital intensity and resource dependency of potassium chloride production, which is often concentrated in regions with substantial natural reserves. Despite fragmentation in terms of the number of participants, market control tends to be centralized due to the geographic concentration of large deposits and established mining infrastructure. This concentration influences global trade dynamics, pricing power, and the strategic importance of long-term supply agreements. Many importing regions depend heavily on external sources, which increases the importance of logistics coordination and geopolitical stability in ensuring uninterrupted supply chains.

The market is characterized by long production cycles, substantial entry barriers, and the need for consistent regulatory compliance related to environmental impact and land use. Demand is primarily driven by agricultural consumption, with seasonal and regional variations in application rates. Non-agricultural uses, including industrial and pharmaceutical applications, provide moderate diversification but do not yet account for a significant portion of overall consumption. Price fluctuations are influenced by factors such as crop demand, transportation costs, export policies, and currency volatility. Innovation in extraction technologies, sustainability practices, and tailored nutrient solutions is gradually shaping competitive differentiation. Overall, the market presents a complex interplay of natural resource dependency, trade-driven supply logistics, and cyclical demand patterns, making strategic alignment and supply chain resilience critical for sustained market participation.

Potassium Chloride Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 25,641.4 million |

|

Revenue forecast in 2033 |

USD 39,966.4 million |

|

Growth rate |

CAGR of 5.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Brazil; Argentina; Colombia; Germany; UK; Italy; Spain; Russia; China; Japan; South Korea; Australia; Saudi Arabia; Iran; Jordan; South Africa |

|

Key companies profiled |

Nutrien Ltd.; The Mosaic Company; Uralkali PJSC; Belaruskali; EuroChem Group; Qinghai Salt Lake Potash Company; K+S Aktiengesellschaft; Arab Potash Company; SQM (Sociedad Química y Minera de Chile); Asia-Potash International Investment |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |