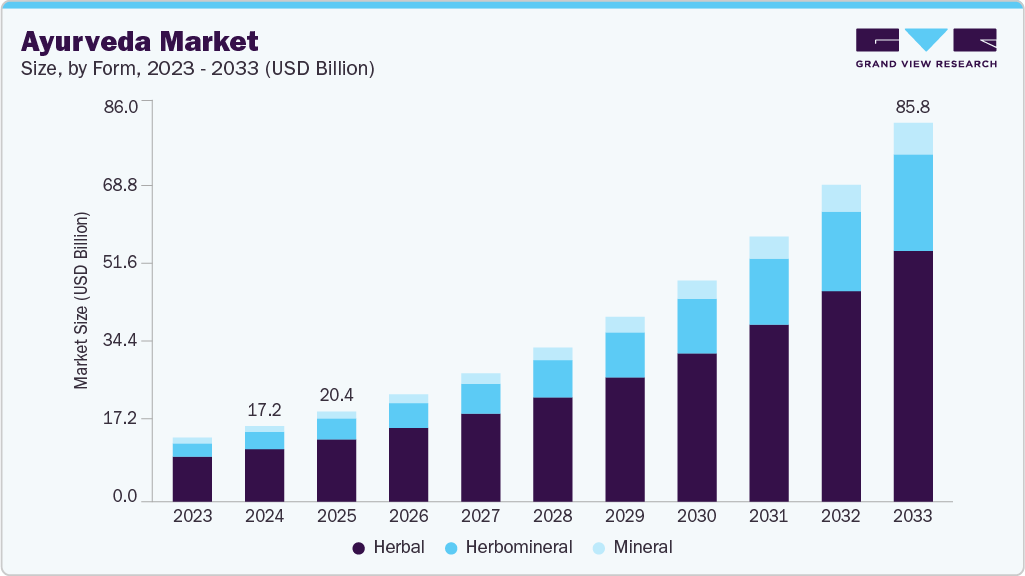

Ayurveda Market growing at a CAGR of 19.66% from 2025 to 2033

The global ayurveda market size was estimated at USD 17.15 billion in 2024 and is expected to reach USD 85.83 billion by 2033, growing at a CAGR of 19.66% from 2025 to 2033. This growth is majorly anticipated due to the rising prevalence of chronic diseases, increasing awareness of the benefits of Ayurvedic products, and high adoption & acceptance of Ayurveda.

Key Market Trends & Insights

- The Asia Pacific ayurveda market held the largest share of 78.26% of the global market in 2024.

- The ayurveda market in India is expected to grow significantly over the forecast period.

- By form, the herbal dominated the market in 2024 with a 69.51% share.

- By application, medical/therapy dominated the market in 2024 with a 60.38% share and is projected to grow at the fastest CAGR from 2025 to 2033.

- By indication, the skin/hair segment held the largest market share of 25.65% in 2024.

- By distribution channel, the retail & institutional sales segment held the largest market share of 65.69% in 2024.

- By end use, the home settings segment held the largest market share of 63.70% in 2024 and is anticipated to grow significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 17.15 Billion

- 2033 Projected Market Size: USD 85.83 Billion

- CAGR (2025-2033): 19.66%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/ayurveda-market-report/request/rs1

Moreover, rising demand for organic and natural personal care products, including Ayurvedic ingredients such as neem, turmeric, and sandalwood, is driving industry growth. The market is being shaped by a primary trend of clinical studies demonstrating the health benefits of Ayurvedic supplements. This trend has led to a spike in scientific validation, which has increased customer trust and fueled market growth. Ayurvedic medicines and treatments are known to have fewer side effects compared to allopathic medicines.

For instance, Turmeric is widely used in various supplements due to its anti-inflammatory properties, which have been validated by research. The market witnessed a surge in demand due to the increasing consumer focus on preventive healthcare and immunity-boosting products during the COVID-19 pandemic. The lockdowns and social distancing measures led to a shift in consumer behavior towards natural and organic products, including Ayurvedic supplements and medicines. Moreover, the growing awareness about the benefits of Ayurveda in managing stress and anxiety levels also contributed to the market growth during COVID-19. Governments worldwide recognize the potential benefits of Ayurveda and are taking steps to regulate and promote its use.

Market Concentration & Characteristics

The Ayurveda industry is experiencing moderate to high innovation, driven by advancements in product formulations, standardization of manufacturing processes, and integration with modern wellness trends. Companies focus on developing personalized Ayurvedic solutions and expanding their product lines to cater to diverse consumer needs.

The Ayurveda industry has witnessed a moderate level of merger and acquisition (M&A) activity, driven by the need for brand expansion, product portfolio diversification, and entry into new geographies. Established players are acquiring smaller specialized firms to enhance product innovation and raw material sourcing capabilities. Cross-border acquisitions increase as companies target global expansion and access to emerging markets. M&A activity is expected to grow as competition intensifies and consumer demand for authentic Ayurvedic solutions rises.

Ayurveda Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.15 billion |

|

Revenue forecast in 2033 |

USD 85.83 billion |

|

Growth rate |

CAGR of 19.66% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Form, application, indications, distribution channel, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; South Arabia; UAE; Kuwait |

|

Key companies profiled |

Kerala Ayurveda Ltd.; Patanjali Ayurved Ltd.; Dabur Ltd.; Kerry Group (Natreon Inc.); Vicco Laboratories; Himalaya Global Holdings Ltd. (Himalaya Wellness Company); Emami Group of Companies Pvt Ltd.; Bio Veda Action Research Co.; Amrutanjan Health Care Ltd.; Baidyanath |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |