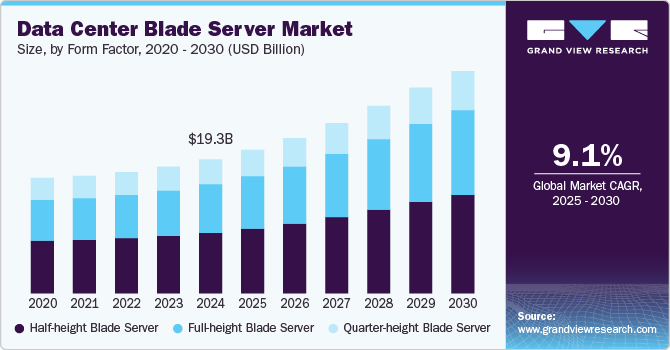

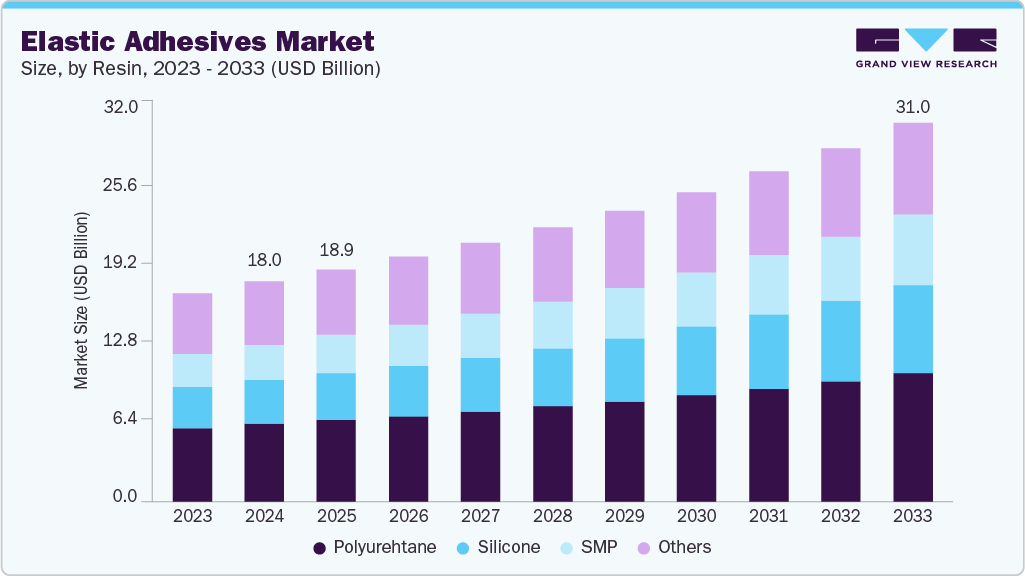

Elastic Adhesives growing at a CAGR of 6.3% from 2025 to 2033

The global elastic adhesives market size was estimated at USD 18,037.3 million in 2024 and is projected to reach USD 31,020.3 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The rising demand for elastic adhesives across construction, automotive, and industrial manufacturing sectors is driven by their superior bonding strength, flexibility, and vibration resistance.

Key Market Trends & Insights

- Asia Pacific dominated the global elastic adhesives market with the largest revenue share of 45.3% in 2024.

- The U.S. elastic adhesives industry is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By resin, the polyurethane segment held the highest market share of 35.2% in 2024 in terms of revenue.

- By end use, the automotive & transportation segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 18,037.3 Million

- 2033 Projected Market Size: USD 31,020.3 Million

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/elastic-adhesives-market-report/request/rs1

In construction, they are increasingly used in structural glazing, flooring, sealing, and façade applications, replacing traditional mechanical fasteners and rigid adhesives. Their ability to accommodate substrate movement, thermal expansion, and environmental stress makes them ideal for modern architectural designs emphasizing sustainability and aesthetics. The ongoing expansion of residential and commercial infrastructure, particularly in emerging economies across Asia Pacific and the Middle East, continues to bolster the market growth.

Another major driver is the growing adoption of lightweight materials in the automotive and transportation industries. Automakers are using elastic adhesives for bonding dissimilar materials such as composites, plastics, and metals to achieve weight reduction, noise damping, and improved crash performance. With the rapid transition toward electric vehicles (EVs), demand for adhesives that can withstand heat, vibration, and electrical insulation requirements has surged. Elastic adhesives also support cleaner assembly processes, lower volatile organic compound (VOC) emissions, and better design flexibility, aligning with the automotive industry’s sustainability goals and regulatory standards for energy efficiency and emissions.

Furthermore, the increasing focus on sustainability and green chemistry is reshaping adhesive formulations, creating new opportunities for silane-modified polymers (SMPs), water-based polyurethane, and silicone-based systems. Manufacturers are investing in the development of low-VOC, solvent-free, and bio-based adhesives to comply with tightening environmental regulations across Europe and North America. In addition, the growth of industrial automation and advanced manufacturing technologies has driven the use of elastic adhesives in electronic assemblies, consumer goods, and renewable energy components. Collectively, these factors underscore a structural shift in material joining solutions, positioning elastic adhesives as a key enabler of innovation and performance in high-growth end-use industries.

Market Concentration & Characteristics

The elastic adhesives market is characterized by its diverse material base and application versatility, spanning multiple industries such as construction, automotive, industrial manufacturing, and electronics. These adhesives are defined by their high flexibility, elongation, and strong bonding capabilities, allowing them to absorb stress, vibration, and movement without compromising structural integrity. The market is broadly segmented by resin type, primarily polyurethane (PU), silicone, and silane-modified polymers (SMP), each catering to specific performance requirements and end-use conditions. Continuous advancements in formulation chemistry have enhanced properties like adhesion strength, weather resistance, and curing speed, enabling greater adoption in complex assembly and sealing applications.

From a structural perspective, the market is moderately consolidated, with major global players such as Henkel, Sika, 3M, H.B. Fuller, and Arkema dominating through extensive product portfolios and R&D capabilities. However, regional manufacturers also hold strong positions in niche applications and cost-sensitive markets, particularly in Asia Pacific. The industry exhibits steady technological innovation, driven by regulatory pressure to reduce volatile organic compound (VOC) emissions and improve sustainability. As a result, there is a noticeable shift toward water-based and solvent-free formulations, as well as bio-based and hybrid adhesive technologies. This combination of strong industrial demand, ongoing material innovation, and sustainability-driven reformulation defines the key characteristics of the global elastic adhesives market.

Elastic Adhesives Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 18,998.5 million |

|

Revenue forecast in 2033 |

USD 31,020.3 million |

|

Growth rate |

CAGR of 6.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific: Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

BASF SE; Henkel AG & Co. KGaA; H.B. Fuller Company; 3M; Dow; DuPont, Inc.; Sika AG; Arkema; The Sherwin-Williams Company; Huntsman International LLC; PPG Industries; Sika AG; Wacker Chemie AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |