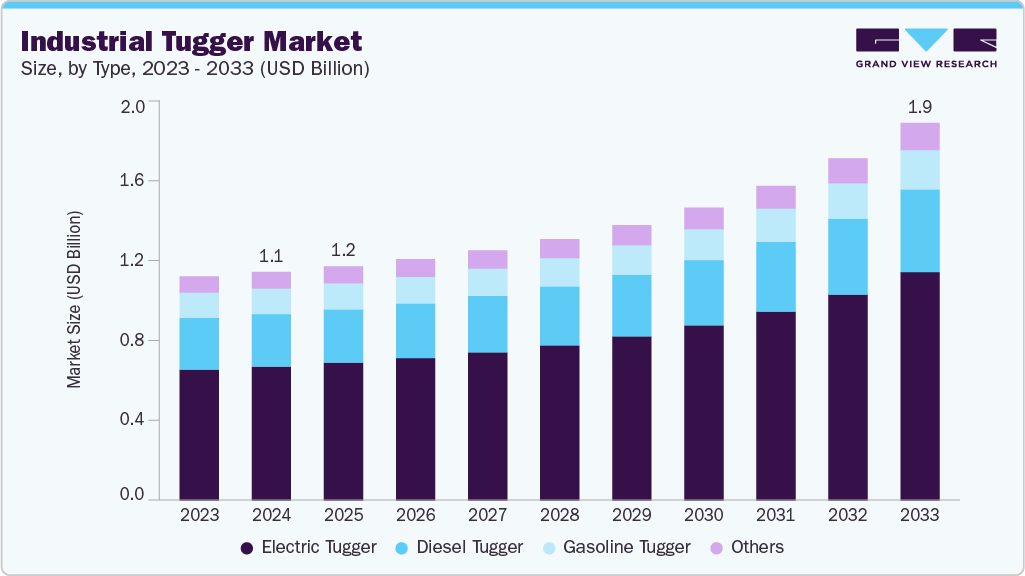

Industrial Tugger growing at a CAGR of 6.2% from 2025 to 2033

The global industrial tugger market size was estimated at USD 1.13 billion in 2024, and is projected to reach USD 1.87 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market is primarily driven by the growing demand for efficient and safe material handling solutions across industries such as automotive, e-commerce, aerospace, and manufacturing.

Key Market Trends & Insights

- Asia Pacific industrial tugger market accounted for a 43.2% share of the overall market in 2024.

- The industrial tugger industry in the China held a dominant position in the Asia Pacific region in 2024.

- By type, the electric tugger segment accounted for the largest share of 58.6% in 2024.

- By load capacity, the upto 5000 lbs segment held the largest market share in 2024.

- By application, the warehouse segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 1.87 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/industrial-tugger-market-report/request/rs1

The rise of lean manufacturing, just-in-time logistics, and high-volume order fulfillment has made tuggers an essential alternative to forklifts, as they allow for safer, more streamlined movement of goods. Technological innovation is reshaping the market, with the emergence of electric, lithium-ion battery-powered, and autonomous tugger solutions. Automation and integration with Industry 4.0 technologies are enabling tuggers to operate within smart factories and logistics hubs, reducing labor dependency and improving efficiency. Advancements in autonomous mobile robots (AMRs) and vision-guided navigation systems are transforming conventional tuggers into intelligent machines that can adapt to dynamic environments.

Regulatory policies play a significant role in shaping the market for industrial tugger. Emission control standards in Europe and North America are driving the transition from diesel-powered tuggers to electric and hybrid models. Safety regulations in workplaces are also encouraging companies to replace traditional forklifts with tuggers, as they reduce traffic congestion and accident risks on shop floors. Moreover, government incentives for the adoption of green and sustainable material handling equipment are accelerating the deployment of electric and autonomous tuggers in developed and emerging economies alike.

Despite strong growth prospects, the market faces restraints such as high initial investment costs for advanced electric and autonomous tugger systems, which can be a barrier for small and medium-sized enterprises (SMEs). The lack of charging infrastructure and power limitations in certain regions continue to hinder the adoption of electric tuggers, especially in heavy-duty operations. Diesel tuggers, while powerful, face challenges from stringent environmental regulations and rising fuel costs, which may reduce their long-term viability.

Industrial Tugger Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.16 billion |

|

Revenue forecast in 2033 |

USD 1.87 billion |

|

Growth rate |

CAGR of 6.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Actual data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, load capacity, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Toyota Material Handling; Crown Equipment Corporation; Hyster-Yale Materials Handling, Inc.; MITSUBISHI LOGISNEXT CO.,LTD.; Lift Truck Center, Inc.; CLARK; The Raymond Corporation; Global Equipment Company Inc.; MasterMover, Inc.; Cyngn Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |