Protein Chip growing at a CAGR of 7.74% from 2025 to 2033

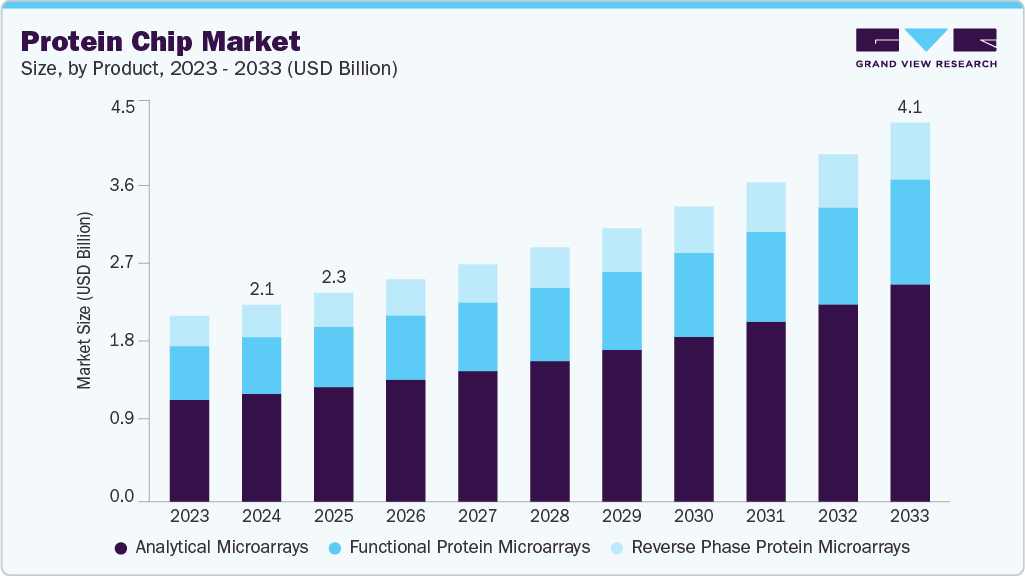

The global protein chip market size was estimated at USD 2.15 billion in 2024 and is projected to reach USD 4.14 billion by 2033, growing at a CAGR of 7.74% from 2025 to 2033, owing to the growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, increasing diagnostic applications, and ongoing technological advancements. Moreover, the growing investment in proteomics research & technology development is anticipated to fuel the market growth over the forecast period.

Key Market Trends & Insights

- The North America protein chip market held the largest share of 40.15% of the global market in 2024.

- The protein chip industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the analytical microarrays segment held the highest market share of 54.81% in 2024.

- By application, the antibody characterization segment led the market with the largest revenue share of 56.88% in 2024.

- By end-use, the academic & research institutes segment led the market with the largest revenue share of 51.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.15 Billion

- 2033 Projected Market Size: USD 4.14 Billion

- CAGR (2025-2033): 7.74%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/protein-chip-market-report/request/rs1

Biomarker Discovery

One of the main factors driving the market expansion for protein chips is the discovery of biomarkers. Protein chips provide comprehensive insights into protein expression, post-translational modifications, and protein-protein interactions while facilitating high-throughput screening and the identification of disease-specific biomarkers. Because of these capabilities, they are essential for comprehending disease mechanisms at the molecular level. The need for trustworthy biomarkers to support early disease detection, patient stratification, and treatment monitoring has increased due to the increased emphasis on precision and personalized medicine on a global scale. Pharmaceutical and biotechnology companies and academic research institutions increasingly implement protein chip technologies to speed up biomarker validation and reduce discovery timelines.

Market Concentration & Characteristics

The degree of innovation in the protein chip industry is exceptionally high because of ongoing developments in array design, detection technologies, and data integration. Modern protein chips have evolved from simple planar arrays to high-density, miniaturized formats capable of analyzing thousands of proteins simultaneously with enhanced sensitivity and specificity. Because of their unrelenting innovation, protein chips are essential in clinical and industrial biotechnology settings, speeding up research and diagnostics and placing them at the forefront of next-generation proteomics.

The protein chip industry has seen a moderate but steady increase in M&A activity, indicative of growing interest from established life sciences companies and up-and-coming biotechnology firms. The main goals of strategic acquisitions are to increase geographic presence, acquire cutting-edge technologies, and diversify product portfolios. For example, larger players frequently purchase niche protein chip developers to incorporate high-throughput proteomic solutions into their more comprehensive genomics, diagnostics, or drug discovery offerings. This trend indicates that consolidation and strategic alliances are important tactics to spur innovation, broaden market reach, and preserve a competitive edge in this maturing market. For instance, in February 2022, MRM Proteomics, Inc. (MRMP) and Agilent Technologies Inc. announced a new co-marketing agreement. This partnership aims to enhance the capabilities of quantitative proteomic applications, facilitating significant scientific discoveries within the research community.

Protein Chip Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.28 billion |

|

Revenue forecast in 2033 |

USD 4.14 billion |

|

Growth rate |

CAGR of 7.74% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; Thermo Fisher Scientific; Sigma-Aldrich Corporation; Illumina; Shimadzu Corporation; Roche Diagnostics; RayBiotech; Danaher |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |