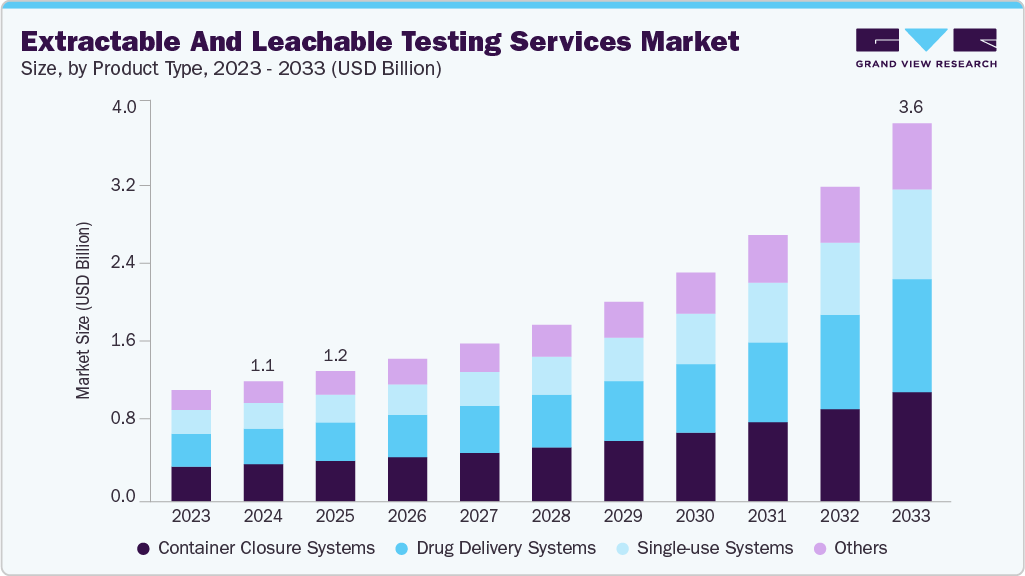

Extractable And Leachable Testing Services growing at a CAGR of 14.3% from 2025 to 2033

The global extractable and leachable testing services market size was estimated at USD 1.13 billion in 2024 and is expected to reach USD 3.57 billion by 2033, growing at a CAGR of 14.3% from 2025 to 2033. The expanding pharmaceutical and biotechnology sectors across the world are fueling the demand for E&L testing services.

Key Market Trends & Insights

- The North America extractable and leachable testing servicesmarket held the largest share of 37.73% of the global market in 2024.

- The extractable and leachable testing services industry in the U.S. is expected to grow significantly over the forecast period.

- By product type, the container closure systems segment held the largest market share of 31.17% in 2024.

- By application, the orally inhaled and nasal drug products (OINDP) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 3.57 Billion

- CAGR (2025-2033): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/extractable-leachable-testing-services-market-report/request/rs1

Moreover, increasing regulatory scrutiny on the quality of healthcare products, the rise of complex drug formulations, such as biologics and combination products, and rising emphasis on product safety are further anticipated to propel the market growth. The COVID-19 pandemic had positively impacted extractable and leachable testing services. With the heightened focus on healthcare and pharmaceuticals during the pandemic, there has been an increased awareness of the importance of rigorous testing to ensure the safety and efficacy of medical products. As a result, extractable and leachable testing services have gained more recognition and investment, leading to advancements in testing methodologies, equipment, and expertise. The pharmaceutical and medical device industries have been able to accelerate their research and development efforts to deliver innovative products while maintaining a strong commitment to safety and compliance. According to a WHO article, nearly 16 billion vaccine doses worth USD 141 billion were supplied in 2021, nearly thrice the market volume of 2019 (5.8 billion) and nearly three-and-a-half times the market value of 2019 (USD 38 billion). Thus, the increased demand for vaccines during the pandemic boosted the demand for extractable and leachable testing services.

The pharmaceutical and biotechnology industry has been rapidly growing in recent years due to advancements in technology, increased demand for novel drugs, and a growing incidence & prevalence of chronic diseases. This has also led to increased R&D activities for the creation of novel therapeutics. For instance, in 2022, the U.S. FDA’s Center for Drug Evaluation and Research (CDER) approved 37 new drugs, either as new molecular entities or as new therapeutic biological products. Thus, high product development and commercialization by pharmaceutical industries created a higher demand for extractable and leachable testing services.

Furthermore, patient safety is the top priority for medical devices and pharmaceutical industries and they are making significant efforts to safeguard the final product. Pharmaceutical companies are investing largely to develop robust methods for leachable and extractable testing. According to Merck KGaA, leachable and extractable are compounds that can migrate from the container to the formulation and can produce serious adverse effects such as toxicity and adverse drug reactions. To mitigate this, the company developed its pre-qualified secondary Certified Reference Materials (CRMs) and ready-to-use CRM mixtures. This reference material is certified ISO 17025 and 17034. This guidance material from the company can act as SOP for analytical laboratories providing extractable & leachable testing services. Thereby increasing the demand for extractable and leachable testing services over the forecast period.

Market Concentration & Characteristics

E&L testing is being driven hard by analytical innovation: high-resolution LC-MS/HRMS workflows, advanced GC-MS, ICP-MS for elemental impurities, and better sample-prep automations are pushing detection limits down and turning previously “unknowns” into identifiable, reportable signals, which in turn expands the types of studies sponsors need and the value labs can charge for. These technical gains are also being paired with informatics (automated data pipelines, spectral libraries, AET-based decision tools) so labs can deliver faster, more defensible risk assessments to clients.

Extractable And Leachable Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.23 billion |

|

Revenue forecast in 2033 |

USD 3.57 billion |

|

Growth rate |

CAGR of 14.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Eurofins Scientific; Intertek Group plc; SGS Société Générale de Surveillance SA; WuXi AppTec; Merck KGaA; West Pharmaceutical Services; Pacific Biolabs; Medical Engineering Technologies Ltd.; Boston Analytical; Sotera Health (Nelson Laboratories, LLC) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |