Data Center Insulation growing at a CAGR of 15.2% from 2025 to 2033

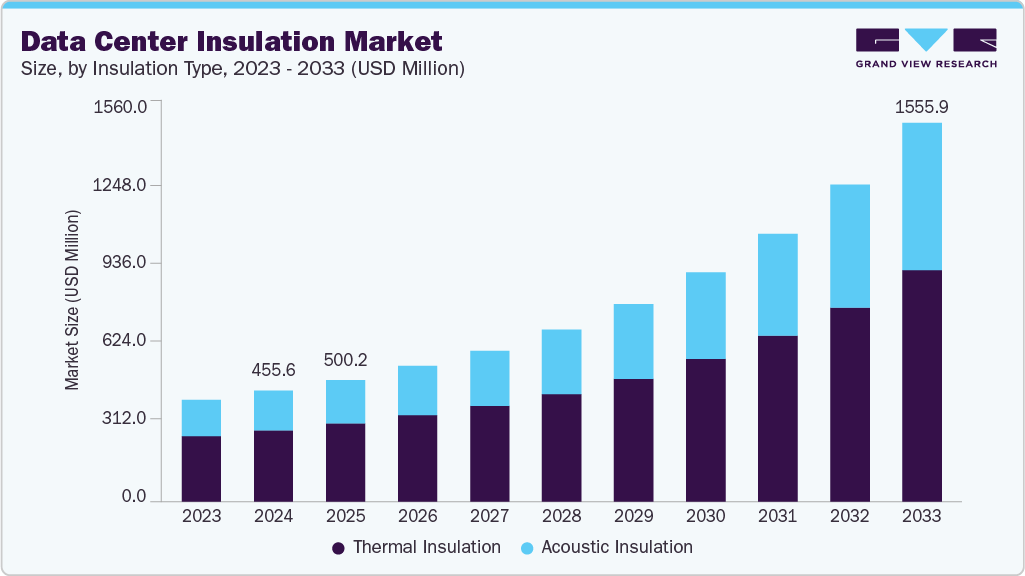

The global data center insulation market size was valued at USD 455.6 million in 2024 and is projected to reach USD 1,555.9 million by 2033, growing at a CAGR of 15.2% from 2025 to 2033. The growth is primarily driven by the increasing demand for insulation solutions in data centers, spurred by the global expansion of data center infrastructure.

Key Market Trends & Insights

- North America data center insulation dominated the global market with the largest revenue share of over 43% in 2024.

- The data center insulation Market in the U.S. led the North America market and held the largest revenue share in 2024.

- By material type, the mineral wool segment accounted for a market share of over 29.0% in 2024.

- By insulation type, thermal insulation led the market and held the largest revenue share in 2024.

- By application, the raised floors segment is expected to grow at the fastest CAGR of over 15.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 455.6 Million

- 2033 Projected Market Size: USD 1,555.9 Million

- CAGR (2025-2033): 15.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/data-center-insulation-market-report/request/rs1

This surge is largely due to rising energy consumption and the need for cost-effective cooling strategies. Effective insulation helps regulate and maintain temperatures, minimizing heat loss and improving a building’s Power Usage Effectiveness (PUE).The rapid increase in global data traffic driven by cloud computing, IoT devices, video streaming, and AI workloads has significantly boosted the demand for high-performance data center infrastructure. As businesses and consumers rely more heavily on digital services, hyperscale, enterprise, and edge data centers are being constructed at an accelerated pace across the globe. This expansion has created a parallel demand for efficient thermal management systems to support continuous, high-density computing operations. Insulation plays a critical role in maintaining stable internal temperatures, reducing energy consumption, and enhancing equipment reliability. Without effective insulation, cooling systems must work harder, resulting in higher operational costs and environmental impact. As a result, data center operators are prioritizing advanced insulation materials that contribute to better thermal control, improved Power Usage Effectiveness (PUE), and compliance with green building standards. This trend is expected to intensify as data volumes continue to grow exponentially in the coming years.

The global push toward sustainability has made environmental regulations and green certifications key drivers in the data center insulation market. Governments and regulatory bodies are increasingly enforcing stricter carbon emission norms, while organizations seek certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) to demonstrate their commitment to sustainability. These standards require data centers to meet rigorous energy efficiency and environmental performance benchmarks. In response, data center operators are adopting high-performance insulation materials that minimize thermal losses, reduce HVAC energy demand, and support overall operational efficiency. Materials like mineral wool, spray foam, and elastomeric foam are favored for their low environmental impact, high R-values, and long-term performance. Additionally, many insulation solutions now feature recyclable content or low-emission formulations, aligning with circular economy goals. As environmental accountability becomes a core aspect of digital infrastructure, sustainable insulation will remain a priority for future-ready data centers.

As major technology companies commit to carbon-neutral and net-zero goals, green data centers are becoming the industry standard. Achieving these targets requires a comprehensive approach to energy efficiency, where insulation plays a critical role. By minimizing heat loss and reducing the burden on cooling systems, insulation directly lowers a data center’s energy consumption and carbon footprint. As a result, demand is rising for sustainable insulation materials such as recyclable foams, low-VOC (volatile organic compound) products, and bio-based alternatives. These eco-friendly solutions not only improve thermal performance but also support compliance with environmental standards and corporate sustainability strategies, making them essential in future-focused data center designs.

Data Center Insulation Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 500.2 million |

|

Market Size forecast in 2033 |

USD 1,555.9 million |

|

Growth rate |

CAGR of 15.2% from 2025 to 2033 |

|

Actual data |

2021 – 2023 |

|

Base year |

2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Insulation type, material, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Armacell; Kingspan Group; Rockwool International; Johns Manville; Owens Corning; Sika AG; Kaimann GmbH; Saint-Gobain; IAC Acoustics; Aeroflex Co. Ltd.; Knauf Insulation; Aspen Aerogels; Recticel Insulation; Ventac; Boyd Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |