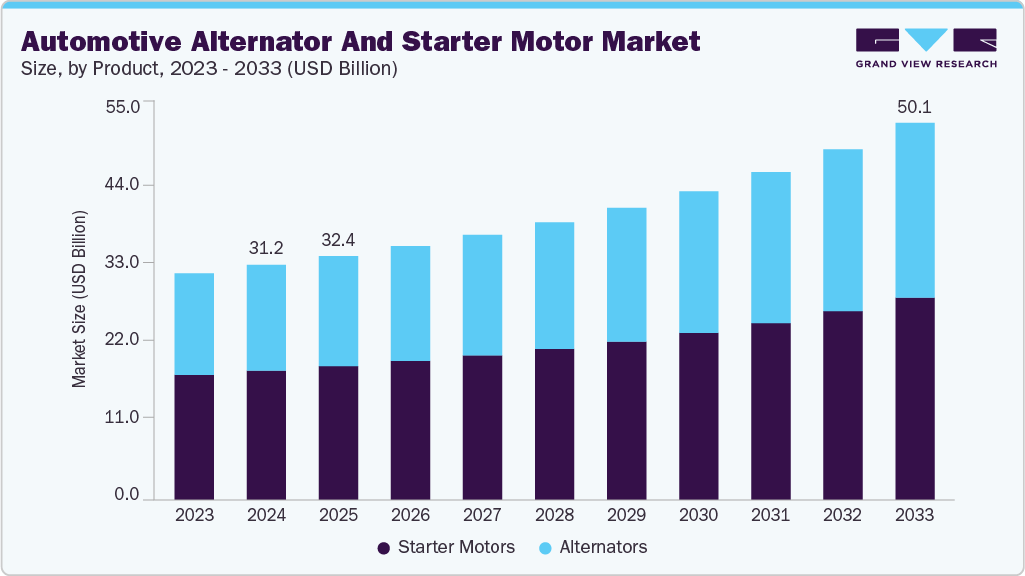

Automotive Alternator And Starter Motor Market Size, Share & Trends Analysis growing at a CAGR of 5.6% from 2025 to 2033

The global automotive alternator and starter motor market size was estimated at USD 31.18 billion in 2024 and is projected to reach USD 50.05 billion in 2033, growing at a CAGR of 5.6% from 2025 to 2033. The growth of the industry is largely fueled by the rising global automotive production and sales.

Key Market Trends & Insights

- Asia Pacific dominated the automotive alternator and starter motor industry with the largest revenue share of 39.41% in 2024.

- The automotive alternator and starter motor market in China led Asia Pacific, primarily due to the country’s dominant automotive manufacturing base, high domestic vehicle sales, and extensive export activity.

- By product, the starter motors segment held the largest revenue share of 54.98% in 2024.

- By sales channel, the OEMs held the largest revenue share of 65.66% in 2024.

- By vehicle type, the passenger vehicles segment held the largest revenue share of 59.78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.18 Billion

- 2033 Projected Market Size: USD 50.05 Billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-alternator-starter-motor-market-report/request/rs1

Increasing demand for passenger cars, commercial vehicles, and off-road vehicles, particularly in emerging economies such as India, China, and Brazil, is driving the need for reliable starting and charging systems. The expansion of the e-commerce and logistics sectors has boosted the sales of light commercial vehicles (LCVs) and heavy trucks, directly increasing the consumption of starter motors and alternators. This surge in vehicle production and fleet expansion forms a strong foundation for market growth.

Another key driver is the rising demand for replacement and aftermarket components. Alternators and starter motors are wear-prone parts that require periodic replacement, creating consistent aftermarket opportunities. Regions such as North America and Europe, where the average vehicle age exceeds 12 years, are seeing a steady increase in component replacements. Additionally, the expansion of organized aftermarket networks and the rapid growth of online automotive parts sales platforms have improved the accessibility of these components, boosting market penetration.

The industry is also benefiting from advancements in automotive electrical systems and electrification trends. Modern vehicles require higher electrical output to power advanced features like ADAS, infotainment systems, electronic power steering, and comfort functions, necessitating high-efficiency alternators. The increasing adoption of start-stop technology and mild hybrid (48V) systems has further accelerated the demand for high-performance starter motors and integrated starter-generator solutions. At the same time, stringent emission norms and fuel efficiency requirements are pushing automakers to adopt energy-efficient and lightweight alternators to reduce engine load and improve overall vehicle performance.

Automotive Alternator And Starter Motor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 32.37 billion |

|

Revenue forecast in 2033 |

USD 50.05 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sales channel, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Denso Corporation; Valeo Group; Bosch Mobility (Robert Bosch GmbH); Mitsubishi Electric Corporation; Hitachi Astemo, Ltd.; Prestolite Electric (Broad-Ocean); SEG Automotive; Delco Remy (BorgWarner Inc.); MAHLE Group; Lucas TVS Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |