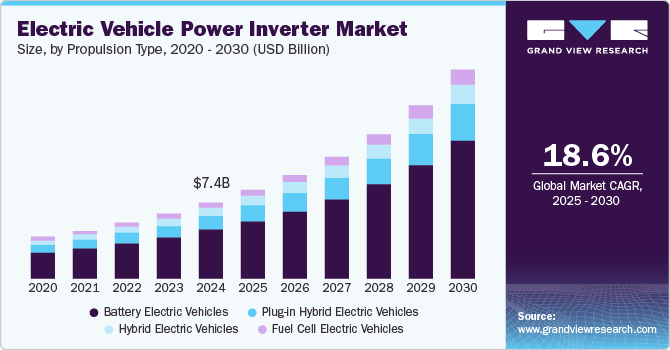

Electric Commercial Vehicle Market Size, Share & Trends Analysis growing at a CAGR of 18.6% from 2025 to 2030

The global electric commercial vehicle market size was estimated at USD 85.26 billion in 2024 and is projected to grow at a CAGR of 18.3% from 2025 to 2030. The electric commercial vehicle industry is undergoing rapid transformation, driven by technological advancements, regulatory pressures, and evolving business models.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/electric-commercial-vehicle-market-report/request/rs1

Factors such as advancements in battery technology and charging infrastructure, government regulations and incentives to promote adoption of EVs, and e-commerce boom and last-mile delivery electrification can be attributed to the market growth. In addition, falling battery prices and strategic investments in charging infrastructure and energy ecosystems further contribute to the growth of the electric commercial vehicle industry.

The electric commercial vehicle industry is heavily reliant on progress in battery technology and charging infrastructure. Ongoing research and development are yielding batteries with higher energy densities, allowing ECVs to travel greater distances on a single charge. Simultaneously, the expansion of charging networks, including the deployment of high-power fast-charging stations, is reducing charging times and improving the overall convenience of ECVs. These improvements are crucial for addressing range anxiety and operational concerns among fleet operators, thereby driving increased adoption of electric commercial vehicles across various sectors.

Government regulations and incentives play a pivotal role in shaping the electric commercial vehicle industry. Concerns about air quality and climate change are intensifying, encouraging governments to enact stricter emission standards, particularly in urban centers. These regulations, coupled with financial incentives such as subsidies, tax exemptions, and grants, are making ECVs a compelling alternative to traditional internal combustion engine vehicles for businesses. This supportive policy landscape is driving significant investment and innovation in the ECV sector, boosting market expansion.

The rapid growth of e-commerce has reshaped the logistics and delivery sector, increasing the need for efficient and sustainable last-mile solutions. Electric vans and light commercial vehicles are becoming the preferred choice due to their zero-emission operation, lower noise levels, and reduced operating costs. These benefits make them well-suited for urban delivery environments. Companies focusing on sustainability and delivery optimization are projected to drive significant growth in demand for electric commercial vehicles in last-mile logistics.

Increasing development and launch of electric commercial vehicles, such as electric buses, is further contributing to the growth of the electric commercial vehicle industry. For instance, in March 2025, Volvo Buses introduced the new Volvo 7800 Electric in Mexico, marking the country’s first locally manufactured electric bi-articulated and articulated bus. Built on the company’s global Volvo BZR electromobility platform, this new model aims to enhance Mexico’s Bus Rapid Transit systems, promoting a more efficient and sustainable public transportation network. Such initiatives are expected to contribute to the growth of the market.

Electric Commercial Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 101.46 billion |

|

Revenue forecast in 2030 |

USD 235.41 billion |

|

Growth rate |

CAGR of 18.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, propulsion type, drive type, vehicle speed, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa |

|

Key companies profiled |

AB Volvo; BYD Company Ltd.; Ford Motor Company; General Motors; Mercedes-Benz Group AG; Mitsubishi Motors Corporation; Nissan Motor Co., Ltd.; Tesla, Inc.; Daimler Truck AG; and Renault Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |