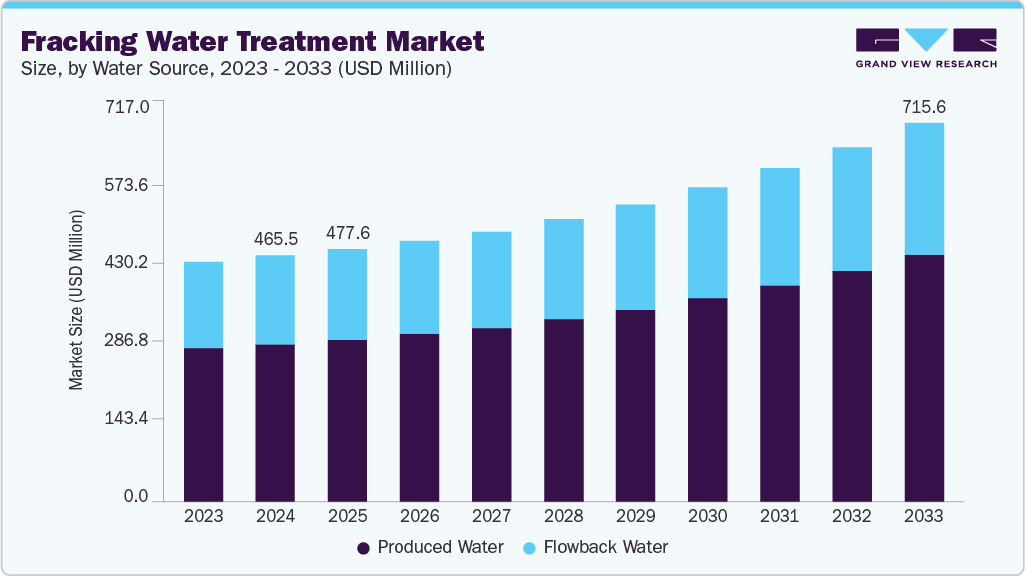

Fracking Water Treatment Market Size, Share & Trends Analysis growing at a CAGR of 5.2% from 2025 to 2033

The global fracking water treatment market size was estimated at USD 465.5 million in 2024 and is projected to reach USD 715.6 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. This growth is largely driven by the substantial volumes of wastewater produced during hydraulic fracturing operations, which pose significant environmental and operational challenges.

Key Market Trends & Insights

- North America dominated the fracking water treatment market with the largest revenue share of 43.7% in 2024.

- The fracking water treatment market in the U.S. is expected to grow at a substantial CAGR of 6.1% from 2025 to 2033.

- By process, the reverse osmosis segment is expected to grow at the fastest CAGR of 6.0% from 2025 to 2033.

- By water source, the produced water segment is expected to grow at the fastest CAGR of 5.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 465.5 Million

- 2033 Projected Market Size: USD 715.6 Million

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

As a result, regulatory bodies are imposing stricter mandates on the treatment and disposal of this wastewater to prevent contamination of surface and groundwater. In turn, these regulatory pressures are prompting oil and gas operators to adopt more advanced and cost-effective water treatment solutions to ensure compliance, reduce environmental liability, and enable water reuse in fracking operations.

In addition, technological advancements in membrane filtration, electrocoagulation, and advanced oxidation processes are enhancing treatment efficiency and scalability. Oil and gas companies are adopting these solutions to reduce operational risk and improve sustainability. Moreover, growing public and stakeholder scrutiny around environmental safety is compelling companies to implement robust water management strategies. These factors collectively accelerate the adoption of water treatment systems in the fracking industry.

Market Concentration & Characteristics

The fracking water treatment industry is moderately concentrated, with a mix of global corporations and specialized technology providers. Major players like Xylem, Veolia, Halliburton, and DuPont hold significant market shares due to their advanced solutions and broad geographic reach. However, regional firms also contribute to the competitive landscape by offering customized services. This balance creates a competitive but not overly fragmented market environment.

The fracking water treatment industry is driven by continuous innovation, particularly in membrane filtration, electrocoagulation, and advanced oxidation technologies. Companies are investing in R&D to enhance efficiency, reduce costs, and enable water reuse. Automation and real-time monitoring tools are also gaining traction. These innovations aim to meet stricter environmental standards and operational demands.

Fracking Water Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 477.6 million |

|

Revenue forecast in 2033 |

USD 715.6 million |

|

Growth rate |

CAGR of 5.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Water source, process, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Norway; Netherlands; Denmark; Russia; Italy; China; Indonesia; India; Australia; Malaysia; Brazil; Argentina; Venezuela; Saudi Arabia; Kuwait; UAE; Nigeria; Algeria |

|

Key companies profiled |

DuPont de Nemours Inc.; Ecologix Environmental Systems LLC; Halliburton Co.; Veolia Environnement SA; Xylem Inc.; Calfrac Well Services Ltd.; Alfa Laval AB; Baker Hughes Co.; Aquatech International LLC; Filtra System Co.; LiqTech International Inc.; Evoqua Water Technologies LLC; Fluence Corporation Ltd.; Ecolab Inc.; OriginClear Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |