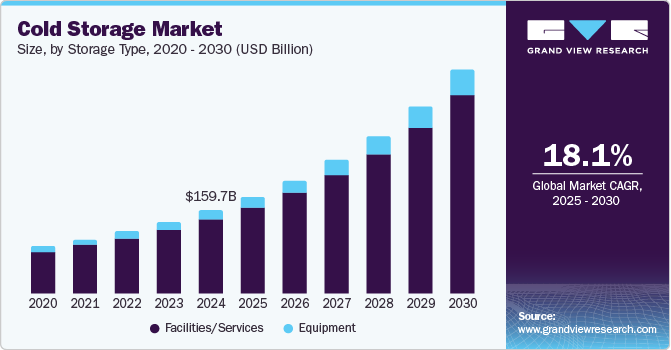

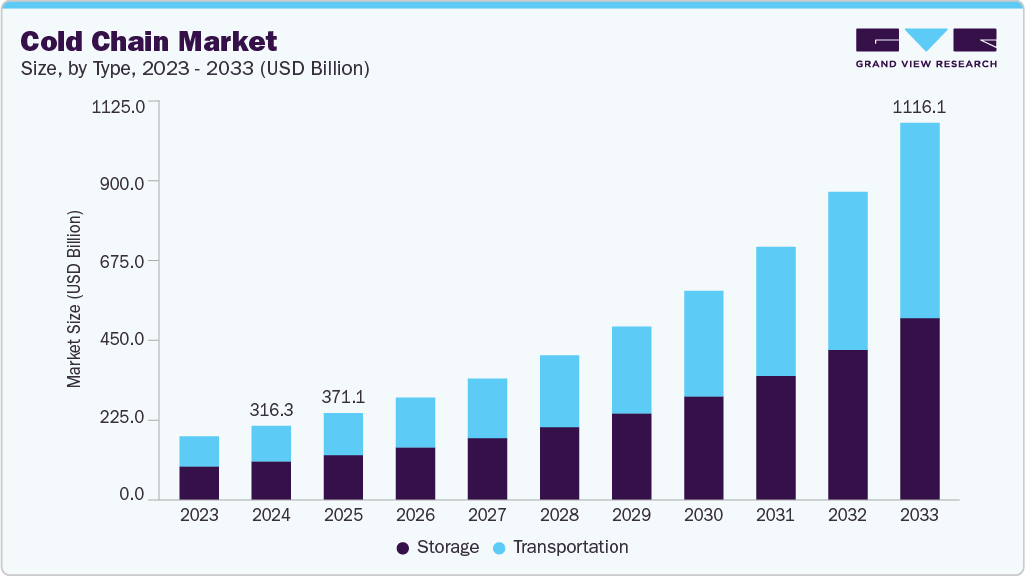

Cold Chain Market Size, Share & Trends Analysis growing at a CAGR of 20.1% from 2025 to 2033

The global cold chain market size was estimated at USD 316.34 billion in 2024 and is projected to reach USD 1,611.0 billion by 2033, growing at a CAGR of 20.1% from 2025 to 2033. Changes in consumer preferences and growing e-commerce sales are expected to drive the market growth.

Key Market Trends & Insights

- The North America cold chain industry held the largest revenue share of more than 33.0% in 2024.

- The U.S. cold chain industry is driven by various factors, including changing consumer preferences, increasing demand for fresh and frozen foods, and the growth of e-commerce.

- Based on type, the storage segment dominated the market with a revenue share of 52.2% in 2024.

- Based on temperature range, the frozen (-18°C to -25°C) segment dominated the overall market in 2024.

- Based on application, the food & beverages segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 316.34 Billion

- 2033 Projected Market Size: USD 1,611.0 Billion

- CAGR (2025-2033): 20.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/cold-chain-market/request/rs1

An increasing number of organized retail stores in developing economies is leading to the growing demand for cold chain solutions. Rising investment in cold chains and government initiatives to minimize food waste are expected to boost market growth. The growing adoption of technologies such as RFID and automation in cold chain applications provides significant growth opportunities for the market. The World Trade Organization (WTO) and bilateral free trade agreements, such as the European Union Free Trade Agreement (FTA) and the North America Free Trade Agreement (NAFTA), have created opportunities for exporters in the U.S. and Europe to increase trade for perishable foods in a manner that is free of import duties.

The refrigerated storage market in developing economies is driven by a shift from carbohydrate-rich diets to protein-rich foods, owing to rising consumer awareness. Countries such as China are expected to portray a significant growth rate over the coming years due to a consumer-led economic transition. With growing technological advancements in warehouse management and refrigerated transportation, the market will likely expand in developing economies.

Increasing IT spending in cold storage logistics drives the growth of the market by facilitating better inventory management and improving the overall efficiency of cold chain supply systems. By investing in advanced technologies such as cloud computing, Internet of Things (IoT), and RFID, cold storage operators can track and monitor their inventory in real time, reducing the risk of food waste, spoilage, and product recalls. The rising demand for temperature-sensitive products has emphasized the need for real-time cold chain monitoring.

Regional Insights

North America cold chain industry held the largest revenue share of more than 33.0% in 2024. It will retain the dominant position throughout the forecast period as the region has significant growth opportunities for companies planning to invest in the long term. Increasing penetration of connected devices and a large consumer base are also expected to fuel market growth over the forecast period.

Cold Chain Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 371.08 billion |

|

Revenue forecast in 2033 |

USD 1,611.0 billion |

|

Growth rate |

CAGR of 20.1% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Actual Data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, temperature range, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Norway; Netherlands; Switzerland; Russia; China; Japan; India; Singapore; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Americold Logistics, Inc.; LINEAGE LOGISTICS HOLDING, LLC; United States Cold Storage; Burris Logistics; Wabash National Corporation; NewCold; Sonoco ThermoSafe (Sonoco Products Company); United Parcel Service of America, Inc.; A.P. Moller – Maersk; NICHIREI CORPORATION; Tippmann Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |