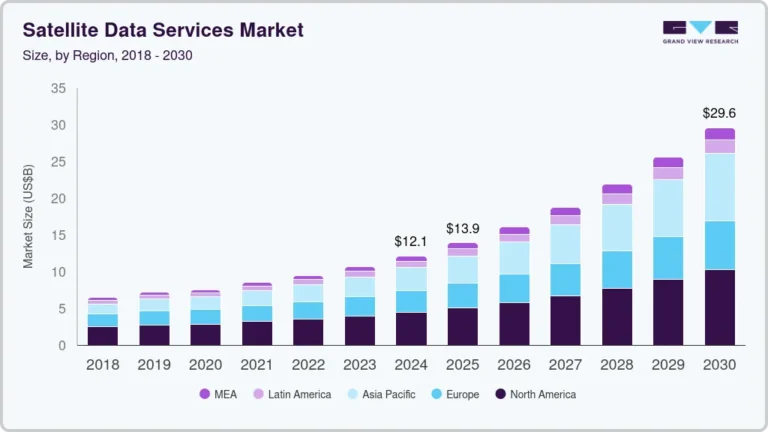

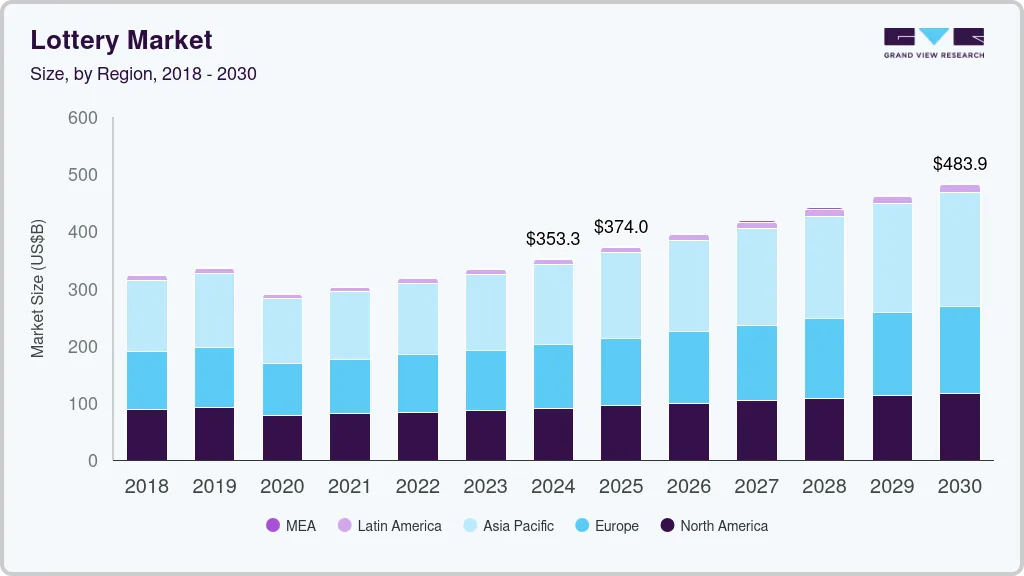

Lottery Market Size, Share & Trends Analysis growing at a CAGR of 5.3% from 2025 to 2030

The global lottery market size was estimated at USD 353.29 billion in 2024 and is expected to reach USD 483.93 billion in 2030, growing at a CAGR of 5.3% from 2025 to 2030. The lottery industry is experiencing dynamic trends driven by technological advancements, changing consumer behaviors, and evolving regulatory environments.

Key Market Trends & Insights

- The Asia Pacific lottery industry dominated with a revenue share of over 38% in 2024.

- The U.S. lottery industry accounted for the largest market share of 70% in 2024.

- Based on category, the draw-based lottery game category segment accounted for the largest market share of over 45% in 2024.

- Based on application, the offline lottery segment accounted for the largest share of the lottery industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 353.29 Billion

- 2030 Projected Market Size: USD 483.93 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/lottery-market-report/request/rs1

One of the key factors driving growth is the rising popularity of online lotteries, which have revolutionized the way people interact with lottery games. The widespread use of smartphones, along with enhanced internet access, has significantly simplified the process for users to buy tickets and join games from virtually any location, at any time This shift towards online platforms is also backed by better security, including encryption and digital tools, which help protect transactions and build trust among users, which is expected to drive the lottery industry expansion in the coming years.

The growing shift towards digital platforms is transforming how lottery services are delivered, as operators embrace online and mobile solutions to meet the changing preferences of modern consumers. Traditional paper-based lotteries are being replaced with digital alternatives that offer greater accessibility, especially for tech-savvy users and younger audiences. Online lottery platforms are integrating user-friendly interfaces, secure payment options, and real-time result updates to enhance the user experience. This digital evolution is making participation more convenient while simultaneously expanding the reach of the lottery industry, fueled by growing internet access and widespread smartphone usage across global markets.

Additionally, evolving government regulations are significantly influencing the lottery market’s growth, as many countries are moving towards legalizing and formalizing lottery systems, especially in the digital space. This shift is creating new revenue opportunities for authorities while bringing more structure and transparency to the industry. The increasing recognition by governments of the benefits of controlled lottery systems, including tax revenue and reduced illegal gambling, is driving regulatory efforts that fuel the expansion of the global market.

There is a clear shift in lottery participation patterns, driven by evolving consumer preferences across different age groups. Younger generations are increasingly drawn to digital and mobile-friendly lottery formats, such as instant-win games and gamified experiences. Meanwhile, older consumers still prefer traditional methods, such as in-store ticket purchases. This generational shift is influencing the types of games offered and how they are delivered, leading to a more diverse and dynamic lottery industry landscape.

Application Insights

The offline lottery segment accounted for the largest share of the lottery industry in 2024, owing to the strong level of consumer trust in traditional lottery systems. The strong consumer trust in traditional lottery systems, particularly among older demographics, who value the security of in-person transactions, is driving the segmental growth. Government regulations and licensing provide a structured and secure environment, further enhancing consumer confidence. In regions with limited digital access, offline lotteries continue to be the primary mode of participation, which is expected to present lucrative growth opportunities for the segment.

Lottery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 374.01 billion |

|

Revenue forecast in 2030 |

USD 483.93 billion |

|

Growth rate |

CAGR of 5.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report Product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Category, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil |

|

Key companies profiled |

International Game Technology (IGT); Scientific Games Corporation; Française des Jeux (FDJ); Lottomatica S.p.A.; Camelot Group; China Welfare Lottery; China Sports Lottery; Hong Kong Jockey Club; New York State Lottery; California Lottery; Florida Lottery; Singapore Pools; Ontario Lottery and Gaming Corporation (OLG); Mizuho Bank Ltd.; The Government Lottery Office; Sazka Group; INTRALOT; BCLC (British Columbia Lottery Corporation); Loto-Quebec; Lotto.com |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |