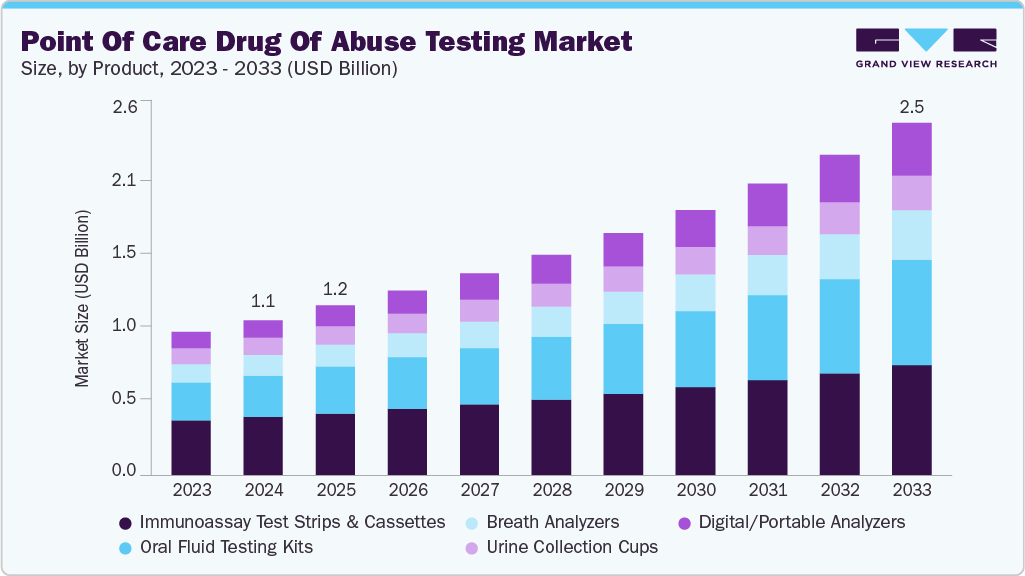

Point Of Care Drug Of Abuse Testing Market Size, Share & Trends Analysis growing at a CAGR of 9.62% from 2025 to 2033

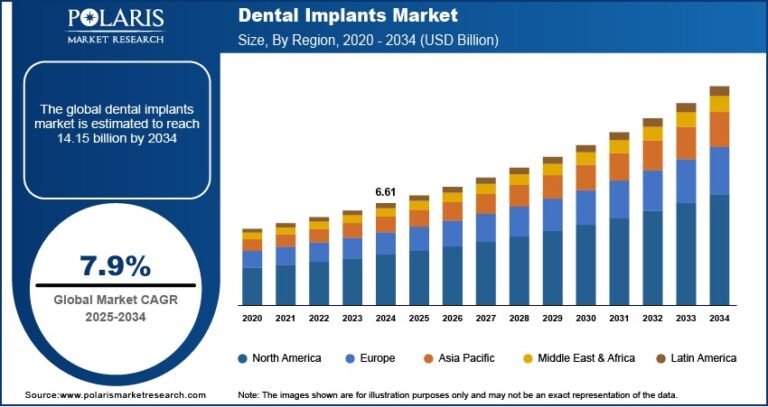

The global point of care drug of abuse testing market size was estimated at USD 1.08 billion in 2024 and is projected to reach USD 2.45 billion by 2033, growing at a CAGR of 9.62% from 2025 to 2033, due to increasing substance misuse worldwide and the urgent need for rapid, decentralized drug testing solutions. POC testing, which includes urine, saliva, breath, and sweat-based kits, provides rapid results at the site of sample collection, eliminating the need for complex lab infrastructure.

Key Market Trends & Insights

- North America point-of-care drug of abuse (DOA) testing market held the largest share of 39.42% of the global market in 2024.

- The point of care drug of abuse (DOA) testing market in the U.S. is expected to grow significantly over the forecast period.

- By immunoassay test strips and cassettes, the reagents & kits segment held the highest market share of 37.25% in 2024.

- Based on sample type, the urine segment held the highest market share in 2024.

- By technology, the lateral flow assay (LFA) segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.08 Billion

- 2033 Projected Market Size: USD 2.45 Billion

- CAGR (2025-2033): 9.62%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/point-of-care-drug-of-abuse-testing-market-report/request/rs1

These tools are increasingly being adopted in clinical settings, roadside enforcement, schools, and even at home, making them a key component in public health and safety strategies globally. Technological advancements are significantly enhancing the accuracy, speed, and usability of POC DOA testing devices. The development of immunoassay-based test strips, portable analyzers, and digital readers enables fast results with minimal sample handling. AI and machine learning are beginning to integrate into some testing platforms, assisting in result interpretation and reducing operator error. Non-invasive sampling methods, such as oral fluid and sweat-based testing, are improving user compliance and privacy. In addition, newer devices now support multi-panel drug testing, enabling simultaneous detection of multiple substances such as opioids, cannabis, cocaine, amphetamines, and benzodiazepines. These innovations are crucial in settings where quick decision-making is essential-such as emergency departments, law enforcement operations, and rehabilitation centers. The miniaturization of diagnostic technology and improved connectivity features, including smartphone integration and Bluetooth-enabled data logging, are making these tools more accessible and user-friendly, driving adoption in both professional and consumer markets.

Government regulations and workplace safety initiatives are key drivers in the expansion of the POC DOA testing market. In countries such as the U.S., federal mandates require drug screening for safety-sensitive industries such as transportation, aviation, and healthcare. This has led to widespread use of on-site testing kits that provide rapid screening without needing laboratory confirmation unless a positive result arises. Roadside drug testing programs, particularly in jurisdictions with legalized cannabis use, are also boosting demand for accurate and mobile POC devices. Moreover, school drug prevention programs and military recruitment processes increasingly incorporate quick screening methods to deter and identify drug use early. In Europe and parts of Asia, evolving workplace safety laws and anti-doping initiatives are supporting broader implementation. These frameworks not only promote public safety but also create a steady demand for reliable, cost-effective, and easy-to-use testing solutions that can be deployed in a range of decentralized environments.