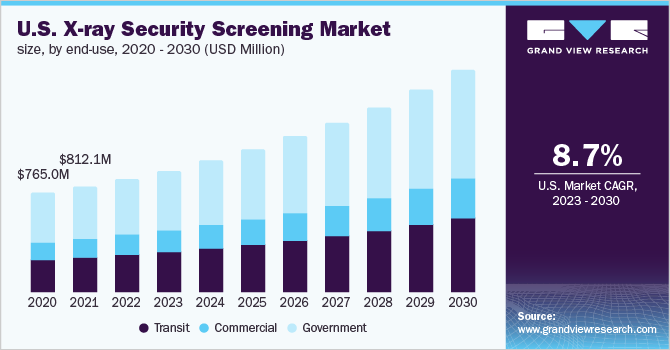

X-ray Security Screening Market Size, Share, & Trends Analysis growing rate (CAGR) of 8.9% from 2023 to 2030

The global X-ray security screening market size was valued at USD 3,208.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. The market growth can be attributed to the increasing threats such as criminal activities and the growing adoption of screening techniques for inspecting people and products for the detection of weapons. Furthermore, rising commercial construction activities, particularly the establishment of large shopping centers, also propel the demand for advanced security screenings. The industry witnessed a major upheaval due to the outbreak of COVID-19. Major countries across the globe scaled back airport and other shopping mall operations. Furthermore, after the reopening, security across the globe was revamped to implement non-contact methods to screen passengers and baggage.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/x-ray-security-screening/request/rs1

The COVID-19 outbreak became a blessing in disguise for players in the security screening industry. Soon, as lockdowns were lifted in a staggered manner, several airports and shopping malls implemented X-ray screening, automated checkpoints, and baggage inspection to implement non-contact methods. These factors are expected to further propel the growth of the X-ray security screening industry during the forecast period.

Several organizations have implemented biometrics technology for physical and logistic access to mitigate the risks associated with data. These technologies are deployed to provide access control, prevent theft or leakage control, and register the attendance of employees. For biometrics, employees do not have to remember passwords or carry anything to validate their identity. This makes the deployment of biometrics technologies much easier and quicker as compared to other security solutions. These benefits are expected to further supplement the market growth.

The X-ray security screening industry has evolved rapidly, and the integration of new technologies has made X-ray security screening easy to use, fast, and safe. The aforementioned factors have broadened the scope of X-ray security screening systems beyond industrial applications. Technological advancements in hardware such as detectors, sources, and tubes as well as software upgrades have contributed significantly towards enhancing the efficiency of X-ray security systems. Presently, upgrading existing security screening installations provides avenues for the industry’s growth.

To improve security owing to several terrorism-related threats, X-ray security screening devices have been developed to complement existing manual searches and technologies such as metal detectors and X-ray security scanners. However, ionizing radiation is known to be carcinogenic and side effects such as skin cancers may hamper the market. Each time a passenger receives the backscatter scan, he or she may be exposed to a low dose of radiation. Such drawbacks could hinder the growth of the X-ray security screening industry during the forecast period.

The expansion of airports along with other commercial infrastructure and the growing threats such as terrorism are key factors driving the growth of the X-ray security scanning industry. Due to weak security systems at railway stations, seaports, hotels, and airports, illegal and terrorist activities continue to be on the rise. Body scanning and other end-use technologies are required to prevent terrorist attacks and other illegal activities. In March 2016, 30 citizens were killed in the departure hall of Maelbeek metro station and Brussels Zaventem International Airport. As a result, there will be a high demand for X-ray security screening systems during the forecast period.

End-use Insights

The government segment accounted for a market share of 45.9% in 2022. The widespread use of security screenings by governments and law enforcement agencies to improve security drives the growth of the X-ray screening security industry. Governments and private organizations are aggressively investing in security solutions owing to rising incidences of terrorist activities.

Security checks and surveillance are major areas of government buildings, such as courthouses, parliament houses, and public banks, among others. Furthermore, government agencies continue to install several security devices, such as X-ray security scanner, handheld detectors, metal detectors, and biometrics systems. These factors have created robust demand for X-ray screening security systems in securing public infrastructure during the forecast period.

The transit segment is anticipated to expand at a CAGR of 8.9% during the forecast period. The segment growth can be attributed to an increase in the number of passengers worldwide and continuous efforts to adopt security measures to ensure complete safety for citizens and global travelers. This is expected to drive the demand for X-ray security screening in the transit sector over the next few years.