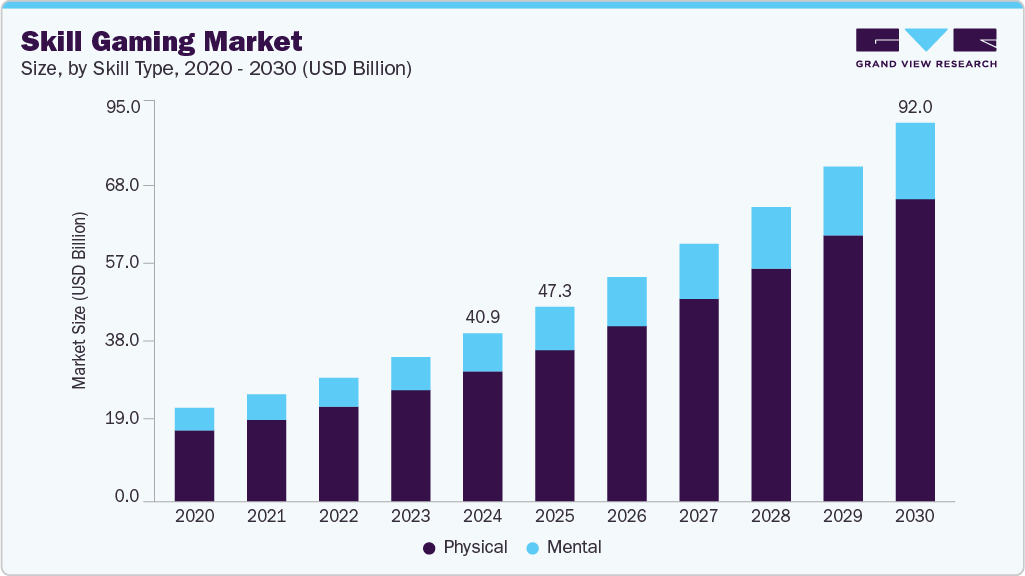

Skill Gaming Market Size, Share & Trends Analysis growing at a CAGR of 14.2% from 2025 to 2030

The global skill gaming market size was estimated at USD 40.85 billion in 2024 and is projected to reach USD 92.03 billion by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The market is witnessing rapid growth, driven by the increasing popularity of mobile-based gaming platforms, rising internet penetration, and the growing demand for real-money competitions that emphasize player skill over chance.

Key Market Trends & Insights

- The Asia Pacific skill gaming market accounted for the largest market share of over 52% in 2024.

- U.S. dominated the North America skill gaming market with a share of over 67% in 2024.

- Based on game genre, the card-based segment dominated the market with a market share of over 34% in 2024.

- Based on skill type, the physical segment accounted for the highest market share in 2024.

- Based on gaming platform, the desktop segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.85 Billion

- 2030 Projected Market Size: USD 92.03 Billion

- CAGR (2025-2030): 14.2%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/skill-gaming-market-report/request/rs1

Key trends shaping the market include the gamification of learning and entertainment, integration of blockchain for secure transactions and transparent gameplay, and the proliferation of esports and skill-based tournaments In addition, technological advancements such as AI-powered matchmaking and real-time analytics are enhancing player experience and engagement across platforms.

The skill gaming Industry is rapidly pivoting toward real-money competitions and entry-fee tournaments as a primary revenue model. Secure payment infrastructure and rigorous compliance frameworks are fostering user trust and facilitating higher conversion rates. This monetization strategy significantly boosts user engagement and drives up average revenue per user (ARPU), minimizing dependency on in-app advertising. Financial incentives are strengthening user retention and broadening the monetizable audience base.

Widespread mobile penetration and the rollout of 5G networks are compelling companies in the skill gaming industry to adopt mobile-first development strategies. To meet the expectations of mobile-centric users, platforms are refining game mechanics, interfaces, and graphics for optimal smartphone performance, particularly in regions where mobile dominates digital consumption. Mobile-native platforms outperform traditional web-based models in user acquisition and session engagement. As a result, mobile optimization is now a strategic priority for scaling and maintaining competitiveness in the global skill gaming ecosystem.