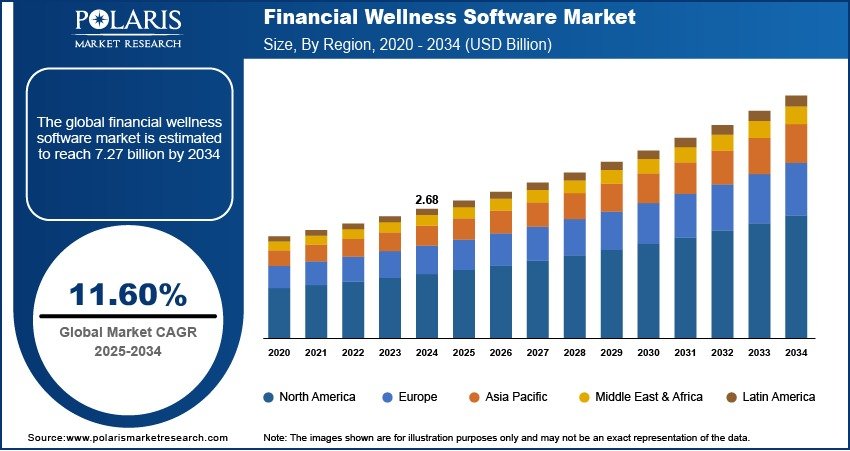

Financial Wellness Software Market Size Projected to Reach USD 7.27 Billion by 2034 | CAGR: 11.60%

The Financial Wellness Software Market was valued at USD 2.68 billion in 2024 and is expected to grow at a CAGR of 11.60% from 2025 to 2034. Key factors fueling this growth include a rising emphasis by employers on employee well-being and growing awareness around financial literacy.

Key Market Trends

AI & ML‑Powered Personalization

Platforms increasingly harness artificial intelligence and machine learning to deliver tailored financial guidance, predictive insights, and automated savings plans—enhancing budgeting, debt management, and investment strategies for users .

Mobile‑First & On‑the‑Go Access

With over 70% of users preferring mobile interactions, mobile-first apps featuring real-time notifications, expense tracking, and wallet integrations are becoming essential.

Holistic Wellness Integration

Financial tools are now incorporating mental health and stress-reduction features—such as mindfulness exercises and holistic content—recognizing the link between financial health and overall well‑being .

Gamification & Behavioral Motivation

Incorporating rewards, challenges, and progress tracking boosts user engagement, retention, and positive financial behavior—seen in gamified learning modules used by thousands of employers .

API & Open‑Finance Integration

The rise of open finance and APIs enables seamless aggregation across banking, payroll, investments, insurance, and more—giving users a unified financial snapshot

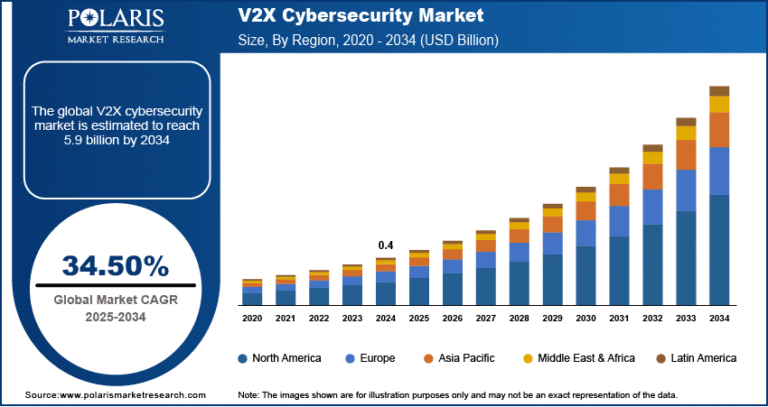

Market Size & Forecast

Market size value in 2025 USD – 2.99 billion

Revenue forecast in 2034 USD – 7.27 billion

CAGR – 11.60% from 2025 – 2034

Request for Free Sample:

Industry Overview:

The financial wellness software market is a rapidly growing sector focused on providing digital tools and platforms that help individuals manage personal finances, reduce debt, plan for retirement, and improve overall financial health. These solutions are increasingly adopted by employers as part of employee benefits programs to enhance workplace satisfaction, productivity, and retention. Financial wellness platforms typically offer features such as budgeting tools, credit score tracking, personalized financial advice, and educational resources. As financial stress becomes a major concern globally, businesses, financial institutions, and HR tech providers are investing in integrated solutions that support holistic employee well-being.

Key Market Drivers & Barriers:

A major driver of this market is the rising awareness of mental and financial health linkages, prompting organizations to invest in employee support systems. Increasing adoption of fintech solutions, along with advancements in AI, data analytics, and mobile banking, further fuels growth. Additionally, government initiatives promoting financial literacy and employer-sponsored wellness programs contribute to market expansion. However, challenges such as data privacy concerns, integration complexities with existing HR and payroll systems, and limited awareness among small and medium-sized enterprises (SMEs) act as barriers to widespread adoption.

Market Opportunity:

The financial wellness software market presents significant opportunities in expanding beyond corporate settings to include banks, credit unions, insurance companies, and government agencies seeking to offer inclusive financial education. The rise of remote work and gig economy jobs has created demand for accessible, self-managed financial tools tailored to diverse user needs. Moreover, emerging markets offer untapped potential due to increasing smartphone penetration and digital banking adoption. With continued innovation in AI-driven insights, gamification, and behavioral finance, the industry is well-positioned for scalable growth across both B2B and B2C segments.