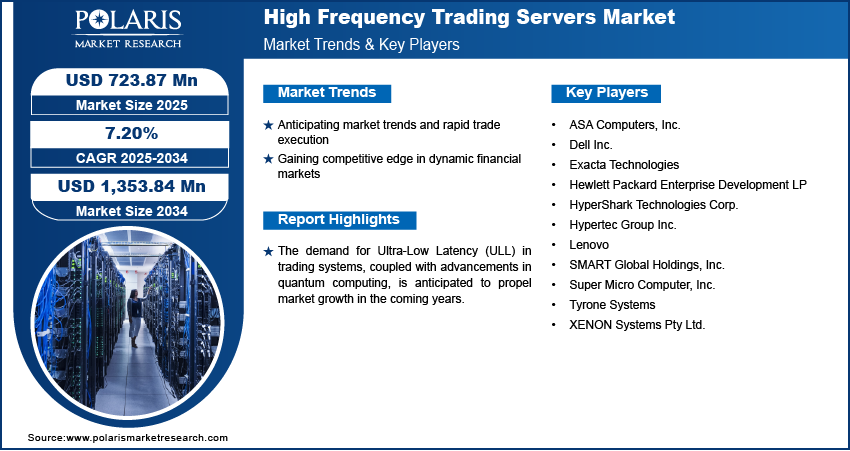

High Frequency Trading Servers Market Projected to Reach USD 1,353.84 Million by 2034, Growing at a CAGR of 7.20%

The global High Frequency Trading Servers Market was valued at USD 675.25 million in 2024 and is expected to reach USD 1,353.84 million by 2034, growing at a CAGR of 7.20% from 2025 to 2034. This growth is fueled by the financial sector’s increasing dependence on ultra-low latency trading platforms and real-time data analytics, which are essential for gaining a competitive edge in fast-paced trading environments.

Key Market Trends & Insights:

Increasing Demand for Ultra-Low Latency

Financial institutions are prioritizing servers that deliver microsecond-level latency, as speed is crucial for executing large volumes of trades in milliseconds, especially in volatile markets.

Rising Adoption of FPGA and GPU-Based Servers

HFT firms are increasingly leveraging field-programmable gate arrays (FPGAs) and GPUs to accelerate data processing and algorithm execution, enhancing performance in complex trading strategies.

Expansion of Algorithmic and Quantitative Trading

The growth of algorithmic trading and quant-based investment models is driving demand for high-performance servers that can handle large-scale, real-time computations.

Growing Importance of Edge Computing

To reduce data transmission delays, firms are deploying edge computing infrastructure closer to trading exchanges, improving execution speed and operational efficiency.

Integration of AI and Machine Learning

Advanced AI and ML algorithms are being used in high-frequency trading to detect market patterns, which requires powerful servers capable of high-speed computation and data analysis.

Market Size & Forecast

- Market size value in 2025 – USD 723.87 million

- Revenue forecast in 2034 – USD 1,353.84 million

- CAGR – 7.20% from 2025 – 2034

Request for Free Sample: https://www.polarismarketresearch.com/industry-analysis/high-frequency-trading-servers-market/request-for-sample

Key Market Growth Drivers – High Frequency Trading Servers Market

- Demand for Ultra-Low Latency Trading – Financial firms require servers with extremely low latency to gain a competitive advantage in executing trades within microseconds.

- Growth of Algorithmic and Quantitative Trading – Increasing adoption of automated and data-driven trading strategies is boosting the need for powerful and reliable HFT servers.

- Rising Investments in Financial Technologies – Continuous investments in fintech and trading infrastructure are driving upgrades to high-performance computing systems.

- Global Expansion of Stock Exchanges and Trading Volumes – Growing participation in global financial markets is fueling demand for scalable and efficient trading server infrastructure.

- Technological Advancements in Server Hardware – Innovations in CPU, GPU, and FPGA technologies are enabling faster data processing and improved trading speeds, further supporting market growth.

Market Challenges – High Frequency Trading Servers Market

- High Infrastructure Costs – Implementing and maintaining ultra-low latency servers and data centers involves significant capital investment, limiting adoption among smaller firms.

- Regulatory and Compliance Issues – Global financial regulators are increasingly scrutinizing HFT practices, introducing stricter compliance requirements that may slow down deployment.

- Technological Complexity – Integrating advanced hardware like FPGAs and customizing trading algorithms require high technical expertise and ongoing maintenance.

- Market Saturation in Developed Economies – In mature markets like North America and Europe, most major players already operate optimized HFT infrastructure, slowing new growth opportunities.

- Security and Data Integrity Risks – The high-speed, high-volume nature of HFT makes it vulnerable to cyberattacks, requiring constant investment in security technologies.