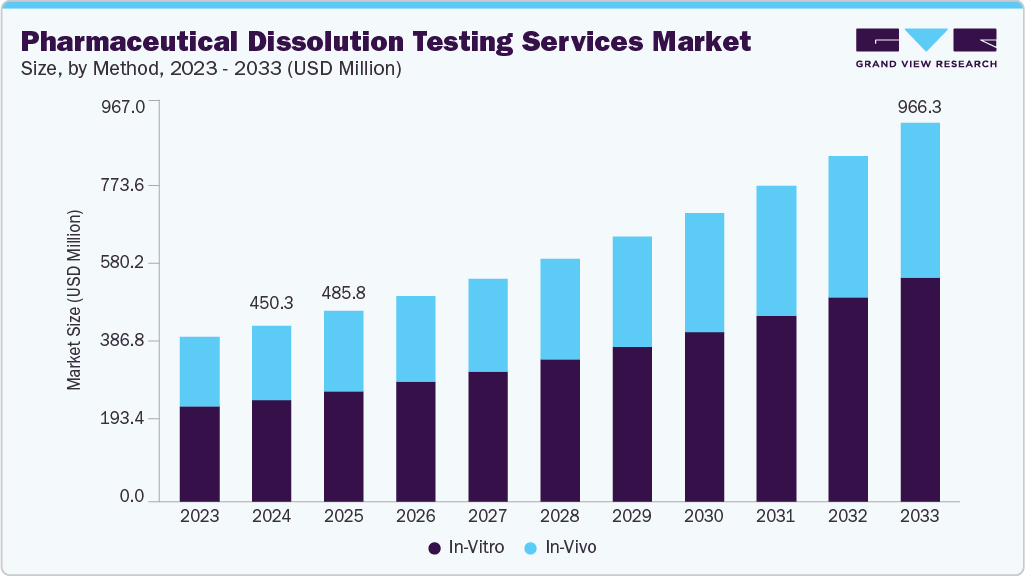

Pharmaceutical Dissolution Testing Services Market Size, Share & Trends Analysis growing at a CAGR of 8.98% from 2025 to 2033

The global pharmaceutical dissolution testing services market size was estimated at USD 450.3 million in 2024 and is projected to reach USD 966.3 million by 2033, growing at a CAGR of 8.98% from 2025 to 2033. Rising demand for generic drugs and bioequivalence studies, constant regulatory emphasis on consistent drug release profiles and quality control, and growing outsourcing activities are driving the growth of the market.

Key Market Trends & Insights

- North America pharmaceutical dissolution testing services market held the largest share of 53.14% of the global market in 2024.

- The pharmaceutical dissolution testing services industry in the U.S. is expected to grow significantly over the forecast period.

- By method, the in vitro segment led the market with the largest revenue share of 57.8% in 2024.

- Based on dosage form, the tablets segment led the market with the largest revenue share in 2024.

- By dissolution apparatus, the paddle segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 450.3 Million

- 2030 Projected Market Size: USD 966.3 Million

- CAGR (2025-2030): 8.98%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/pharmaceutical-dissolution-testing-services-market-report/request/rs1

The market is being driven by the increasing regulatory stringency surrounding drug quality, safety, and bioavailability. Health authorities such as the U.S. FDA, EMA, and CDSCO mandate dissolution testing as a core requirement in the approval process for both branded and generic pharmaceuticals. This has led to a growing need for advanced, reliable, and standardized dissolution testing to ensure consistent drug release profiles. The rising volume of generic drug approvals globally has intensified the demand for comparative dissolution testing in bioequivalence studies, making it essential for companies to outsource these services for faster and cost-effective regulatory compliance. Moreover, the complexity of modern drug formulations, such as sustained-release and poorly soluble drugs, necessitates customized and high-precision testing protocols, prompting pharma firms to rely on specialized contract service providers with technical expertise and instrumentation capabilities.

Furthermore, the rapid expansion of pharmaceutical R&D pipelines, especially in emerging markets, creates heightened demand for dissolution testing across early- and late-phase development. Small and mid-sized pharmaceutical and biotech firms, often operating with limited in-house infrastructure, are increasingly turning to third-party service providers for dissolution testing to accelerate timelines and reduce operational burdens. Furthermore, the rise in personalized medicine and novel drug delivery systems, including nanotechnology and 3D-printed tablets, reshapes dissolution testing needs. Advances in automation, real-time analytics, and integration of dissolution testing with other quality control technologies are streamlining workflows and improving data accuracy, further incentivizing outsourcing.