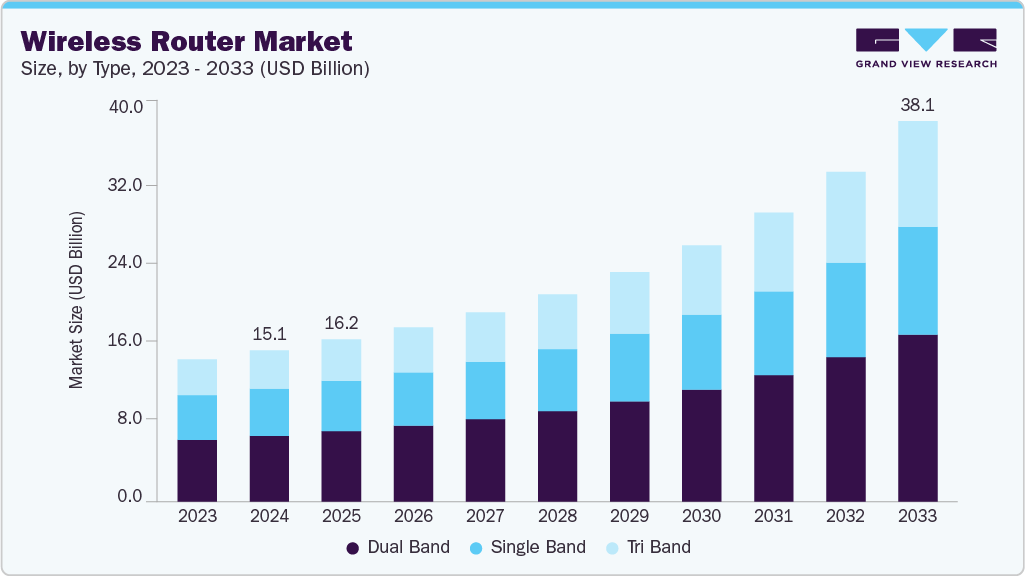

Wireless Router growing at a CAGR of 11.3% from 2025 to 2033

The global wireless router market size was estimated at USD 15.15 billion in 2024 and is projected to reach USD 38.10 billion in 2033, growing at a CAGR of 11.3% from 2025 to 2033. The market is experiencing significant growth, driven primarily by the rising demand for high-speed internet connectivity.

Key Market Trends & Insights

- North America dominated the wireless router industry with the largest revenue share of 33.74% in 2024.

- The wireless router market in the U.S. is the largest in North America.

- By type, the dual band segment held the largest revenue share of 43.43% in 2024.

- By bandwidth, the 300 Mbps to 1000 Mbps (1 Gbps) segment held the largest revenue share of 45.12% in 2024.

- By application, the residential segment held the largest life science market revenue share of 52.64% in 2024

Market Size & Forecast

- 2024 Market Size: USD 15.15 Billion

- 2033 Projected Market Size: USD 38.10 Billion

- CAGR (2025-2033): 11.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/wireless-router-market-report/request/rs1

With the increasing popularity of bandwidth-intensive applications such as 4K/8K video streaming, cloud gaming, and video conferencing, consumers and businesses alike require routers that can deliver faster speeds and lower latency.

Another key driver is the rapid growth of smart homes and IoT devices, which rely on stable and efficient Wi-Fi connections. The proliferation of smart speakers, security cameras, thermostats, and other connected devices has increased the need for routers that can manage multiple connections simultaneously without performance degradation. This has led to a surge in demand for Wi-Fi 6 and Wi-Fi 6E routers, which offer improved bandwidth, reduced congestion, and better power efficiency compared to older Wi-Fi 5 models. Furthermore, the upcoming Wi-Fi 7 standard is expected to revolutionize the market with even faster speeds and enhanced reliability, particularly for applications like augmented reality (AR), virtual reality (VR), and real-time cloud computing.

The shift to remote and hybrid work models has also played a crucial role in boosting the wireless router market. With more employees working from home, there is a growing need for reliable home networking solutions that can support video calls, large file transfers, and seamless connectivity across multiple devices. Mesh Wi-Fi systems have gained popularity as they eliminate dead zones in larger homes, ensuring consistent coverage. Enterprises, too, are investing in high-performance routers to support SD-WAN, VoIP, and other business-critical applications. Security concerns are another factor influencing purchasing decisions, with consumers and businesses opting for routers equipped with advanced features like built-in VPNs, AI-based threat detection, and parental controls.

The wireless router market is undergoing a transformative phase, driven by cutting-edge technological advancements that are redefining connectivity standards. One of the most significant developments is the emergence of Wi-Fi 7 (802.11be), which promises to revolutionize wireless networking with unprecedented speeds of up to 46 Gbps and ultra-low latency. This next-generation standard introduces innovative features such as 320 MHz channel bandwidth and Multi-Link Operation (MLO), enabling devices to simultaneously transmit data across multiple frequency bands for more stable and efficient connections. Early adopters, particularly in the gaming and enterprise sectors, are already leveraging Wi-Fi 7 routers, such as the ASUS ROG Rapture GT-BE98 and TP-Link Archer BE800, to support bandwidth-intensive applications like 8K streaming, virtual reality, and real-time cloud computing. These routers are not just faster but also smarter, capable of dynamically allocating bandwidth to prioritize critical tasks.

One significant restraint in the wireless router market is the high cost of next-generation routers, particularly those supporting Wi-Fi 6E and Wi-Fi 7 standards. While these advanced routers offer substantial improvements in speed, latency, and multi-device performance, their premium pricing creates a barrier to widespread adoption, especially among budget-conscious consumers and small businesses. Furthermore, the lack of widespread infrastructure to fully utilize Wi-Fi 6E/7 capabilities in certain areas reduces the perceived value of these high-end routers, creating a mismatch between their technological potential and real-world applicability for some users.

Wireless Router Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.24 billion |

|

Revenue forecast in 2033 |

USD 38.10 billion |

|

Growth rate |

CAGR of 11.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, bandwidth, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

TP-Link Systems Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; ZTE; AVM Computersysteme Vertriebs GmbH; NETGEAR; ASUSTeK Computer Inc.; D-Link Corporation; RUCKUS Networks; Shenzhen Tenda Technology Co.,Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |