White Mushroom Market growing at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030

The global white mushroom market size was valued at USD 40.0 billion in 2022 and is expected to reach USD 68.0 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Mushrooms are gaining popularity among consumers owing to their culinary adaptability and nutritional properties.

Key Market Trends & Insights

- The Asia Pacific region held a dominant revenue share of 89.74% in 2022.

- China emerged as a dominant market in the Asia Pacific region with a revenue share of 97.2% in 2022.

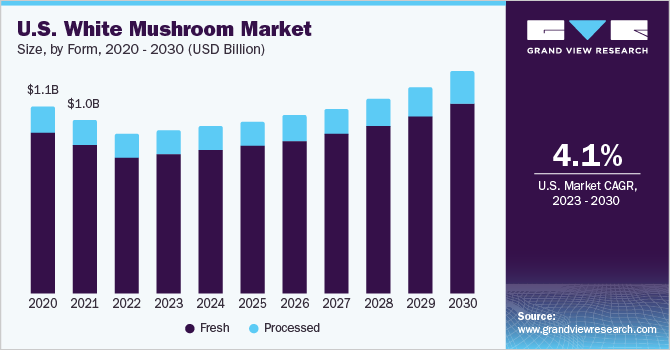

- By form, the fresh white mushrooms segment led the market with a revenue share of 83.1% in 2022.

- By branding, private labels dominated the global processed canned/jarred white mushroom market with a share of 76.5% in 2022.

- By end-use, the retail segment dominated the global processed canned/jarred white mushroom market with a share of 49.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 40.0 Billion

- 2030 Projected Market Size: USD 68.0 Billion

- CAGR (2023-2030): 6.8%

- Asia Pacific: Largest market in 2022

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/white-mushroom-market-report/request/rs1

Furthermore, white mushrooms are easy to grow and harvest in small and local areas. In addition, white mushrooms are a low-calorie, fat-free, and nutrient-rich food option. The rising popularity of plant-based diets has further boosted their market growth, as white mushrooms are often used as a meat substitute. The growing food service sector, improved production efficiency, and enhanced supply chain infrastructure have increased the popularity of white mushrooms.

White mushrooms are popular among consumers worldwide due to their mild flavor, versatile culinary applications, and nutritional benefits. The demand for white mushrooms is expected to continue to grow as they are extensively used in various cuisines and plant-based dishes. According to a February 2023 research article published on ResearchGate, “Exploring Consumer Behavior and Preferences towards Edible Mushrooms in Slovakia,” the most preferred species of mushrooms for consumption are white button mushrooms, followed by oyster mushrooms. Other studies have also confirmed consumers’ high preference for white button mushrooms. The research article indicates that white button mushrooms are the most widespread and popular among consumers, followed by oyster, almond, and shiitake mushrooms.White mushrooms are low in calories, fat-free, and cholesterol-free, and provide essential nutrients, such as vitamins, minerals, and dietary fiber. The increasing focus on healthy eating and the awareness about the nutritional benefits of mushrooms drive the product demand as a healthy ingredient. Mushroomscan be used in a wide range of recipes including soups, salads, stir-fries, and pasta dishes and this has contributed to their popularity and increased consumption. The growing product demand, both in fresh and processed forms, is driven by the recognition of its nutritional value and the ability to enhance the flavor and nutritional profile of meals.There is an increasing emphasis on sustainable and organic cultivation practices in the white mushroom industry.

Form Insights

The fresh white mushrooms segment led the market with a revenue share of 83.1% in 2022. This dominance is attributed to their superior taste and culinary versatility. Many consumers prioritize fresh ingredients in their cooking and dining experiences. Fresh white mushrooms align with this preference, as they are harvested and consumed naturally without any processing or preservation methods. Therefore, fresh mushrooms are highly valued by consumers and favored for their natural and wholesome attributes, making them the top choice in the market.Processed white mushrooms are expected to witness a steady growth rate of 5.5% from 2023 to 2030 owing to factors, such as demand for convenient & time-saving options, increased adoption by food service providers, improved processing technologies, and extended shelf life.Among the processed white mushrooms, frozen white mushrooms are expected to witness a steady growth rate of 6.0% from 2023 to 2030 owing to the increasing demand for ready-to-cook food. Consumers are increasingly seeking convenience in their food choices, and frozen mushrooms offer a time-saving solution with minimal preparation required. Advancements in freezing techniques, such as Individual Quick Freezing (IQF), help preserve the taste, texture, and nutritional value of frozen white mushrooms, enhancing their quality.

White Mushroom Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 41.8 billion |

|

Revenue forecast in 2030 |

USD 68.0 billion |

|

Growth rate |

CAGR of 6.8% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 – 2021 |

|

Forecast period |

2023 – 2030 |

|

Quantitative units |

Volume in metric tons, revenue in USD million, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Form, branding, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Poland; The Netherlands; China; India; Japan; Australia; South Korea; Brazil; Chile; Argentina; Saudi Arabia; South Africa; Israel |

|

Bonduelle Group; Costa Group; Drinkwater Mushrooms; Monterey Mushrooms, Inc.; The Giorgi Companies, Inc.; Phillips Mushroom Farms; Greenyard; GUAN’S MUSHROOM; Shangai Fengke; Metolius Valley Inc.; Okechamp S.A; Eurochamp; Prochamp; Scelta; Fujian Yuxing |

|

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |