Viscosity Index Improvers Market growing at a CAGR of 4.7% from 2025 to 2033

The global viscosity index improvers market size was estimated at USD 2,847.6 million in 2024 and is projected to reach USD 4,282.7 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The viscosity modifiers and viscosity index improvers are same.

Key Market Trends & Insights

- Asia Pacific dominated the global viscosity index improvers market with the largest revenue share of 46.2% in 2024.

- The China viscosity index improvers market is driven by massive automotive production, industrial manufacturing, and lubricant consumption.

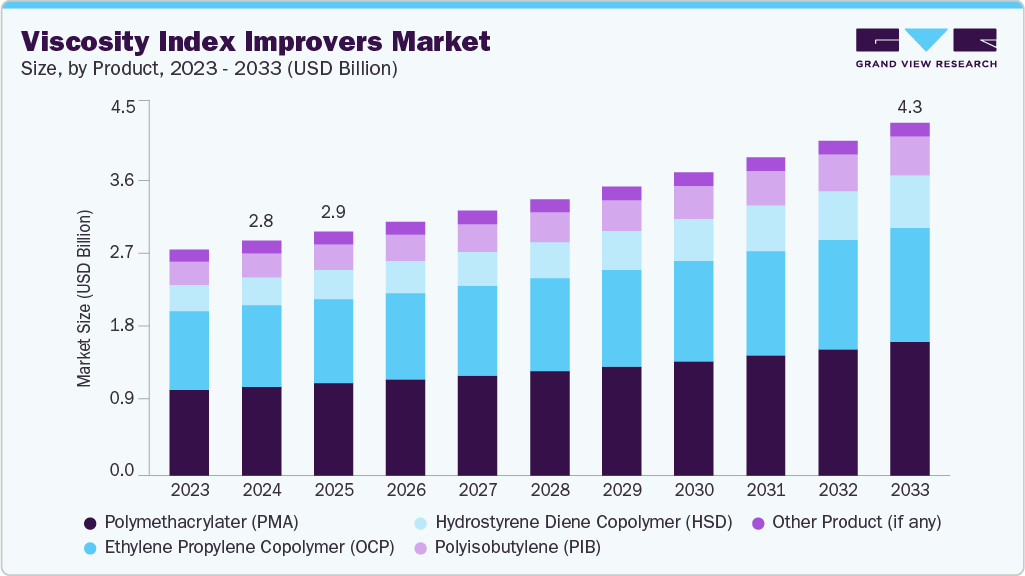

- By product, the polymethacrylater (PMA) segment held the highest market share of 37.7% in 2024 in terms of revenue.

- By application, the engine oils segment led the viscosity index improvers industry with the largest revenue share of 50.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,847.6 Million

- 2033 Projected Market Size: USD 4,282.7 Million

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest Market in 2024

- North America: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/viscosity-index-improvers-market-report/request/rs1

The viscosity modifiers (also known as viscosity index improvers) are key polymeric additives used to enhance the temperature-dependent behavior of lubricants and oils, ensuring consistent performance across varying thermal conditions. The market growth is primarily driven by the expanding automotive and industrial lubricant sectors, where the demand for high-performance, fuel-efficient, and low-viscosity lubricants continues to rise.

Increasing production of passenger and commercial vehicles, coupled with stricter emission norms, has accelerated the adoption of viscosity index improvers in engine oils, transmission fluids, and hydraulic lubricants.

Another major growth driver is the increasing emphasis on fuel efficiency and emission reduction. Modern engine designs operate under higher temperatures and pressures, requiring lubricants that maintain optimal viscosity and film strength. Viscosity index improvers help achieve better energy efficiency by reducing frictional losses, improving cold-start performance, and extending oil drain intervals. The development of advanced hydrogenated styrene-diene and polymethacrylate-based VIIs is enabling the formulation of next-generation lubricants with superior shear stability and oxidation resistance. Additionally, the growing adoption of synthetic and semi-synthetic lubricants in both automotive and industrial sectors is further strengthening market demand for high-quality viscosity modifiers.

Furthermore, the rapid emergence of electric and hybrid vehicles presents new opportunities for viscosity index improver manufacturers. Electric vehicle (EV) drivetrains and e-transmissions require specialized lubricants with controlled thermal and rheological properties, creating demand for tailor-made VIIs compatible with low-viscosity fluids. The increasing industrial automation and expansion of heavy machinery, construction, and marine sectors also support lubricant consumption, reinforcing the market’s long-term growth outlook. Overall, ongoing product innovation, evolving engine technologies, and the global shift toward sustainability are expected to drive steady expansion in the viscosity index improvers market through 2033.

Market Concentration & Characteristics

The viscosity index improvers (VII) market is moderately consolidated, with a few global chemical and lubricant additive manufacturers dominating overall supply. Major players such as Lubrizol Corporation, Infineum International, Afton Chemical Corporation, and BASF SE hold significant market shares due to their strong product portfolios, global distribution networks, and long-standing relationships with lubricant formulators and OEMs. These companies invest heavily in R&D to develop advanced polymer chemistries, such as hydrogenated styrene-diene copolymers (HSDs) and polymethacrylates (PMAs), that offer superior shear stability and thermal performance for high-end lubricants. Entry barriers are relatively high, given the capital-intensive production process, the need for technical expertise in polymer synthesis, and stringent quality and performance validation standards required by end users.

At the same time, the market is witnessing a gradual shift toward regional diversification and strategic partnerships. Emerging Asian producers, particularly in China, India, and South Korea, are expanding capacity to cater to growing domestic lubricant demand, leading to increased competition at the regional level. However, the formulation of OEM-approved lubricant additives remains largely controlled by established multinational companies that possess proprietary technologies and testing capabilities. This dynamic results in a moderately concentrated but technologically differentiated market, where innovation, long-term supply contracts, and customized formulation capabilities are the key competitive advantages.

Viscosity Index Improvers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2,961.0 million |

|

Revenue forecast in 2033 |

USD 4,282.7 million |

|

Growth rate |

CAGR of 4.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

BASF SE; Chevron Oronite Company LLC; Evonik Industries AG; Afton Chemical Corporation; The Lubrizol Corporation; Sanyo Chemical Industries; Akzo Nobel N.V.; LANXESS AG; Mitsui Chemicals, Inc.; Petronas; Para Lubricants Ltd.; Sika AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |