Virtual Customer Premises Equipment Market Size, Share & Trends Analysis growing at a CAGR of 18.4% from 2025 to 2033

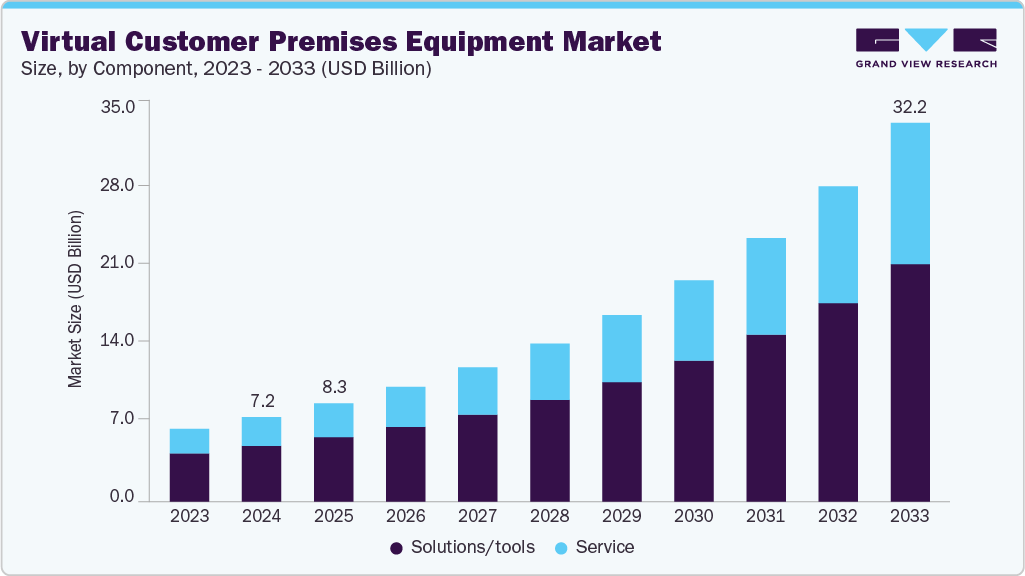

The global virtual customer premises equipment market size was estimated at USD 7.19 billion in 2024 and is projected to reach USD 32.18 billion by 2033, growing at a CAGR of 18.4% from 2025 to 2033. The virtual customer premises equipment (vCPE) market is being driven by the growing demand for flexible, scalable, and cost-efficient network solutions across various industries.

Key Market Trends & Insights

- North America dominated the virtual customer premises equipment industry and accounted for a share of 36.7% in 2024.

- The virtual customer premises equipment industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solutions/tools segment dominated the market in 2024 and accounted for the largest share of 65.9%.

- By deployment type, the cloud-based virtual customer premises equipment segment held the largest market in 2024.

- By enterprise size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.19 Billion

- 2033 Projected Market Size: USD 32.18 Billion

- CAGR (2025-2033): 18.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/virtual-customer-premises-equipment-vcpe-market/request/rs1

The need for enhanced IT service mobility and virtual networking infrastructure has been a major driver, as businesses seek to reduce capital expenditure by replacing traditional hardware with software-based solutions.

Technological advancements have played a pivotal role in reshaping the vCPE landscape. Key innovations, such as software-defined networking (SDN), edge computing, and AI-driven network orchestration have been increasingly integrated into vCPE platforms to enhance performance and manageability. The shift from proprietary hardware to white-box solutions has been enabled by open standards, thereby fostering vendor interoperability and lowering deployment costs. Furthermore, 5G rollouts have catalyzed the development of more dynamic and responsive vCPE solutions, allowing telecom operators to deliver high-speed and low-latency services at the network edge.

The rise of Software-Defined Wide Area Networking (SD-WAN) is one of the most influential trends driving the vCPE market. Enterprises are increasingly deploying SD-WAN to gain better network agility, centralized control, and cost efficiency, especially for multi-site operations. vCPE enables SD-WAN solutions by virtualizing network functions such as routing, firewalling, and WAN optimization at the edge. This trend is particularly strong among large enterprises and service providers seeking to eliminate the complexity of legacy hardware-based CPE. The ongoing shift from MPLS to internet-based WAN connectivity further boosts this transformation.

The growing demand for network function virtualization (NFV), along with the need for cost-effective and agile network infrastructure, has significantly contributed to the market’s growth. Enterprises and service providers are increasingly shifting towards cloud-based network functions to reduce hardware dependencies and improve scalability. In addition, the rise in remote work and the proliferation of IoT devices have accelerated the adoption of vCPE solutions as businesses seek to enhance network flexibility and streamline service delivery. Thus, the virtual customer premises equipment market is growing rapidly with the adoption of cloud-native network functions and broader NFV frameworks.