Vendor Neutral Archive Market growing at a CAGR of 13.3% from 2025 to 2033

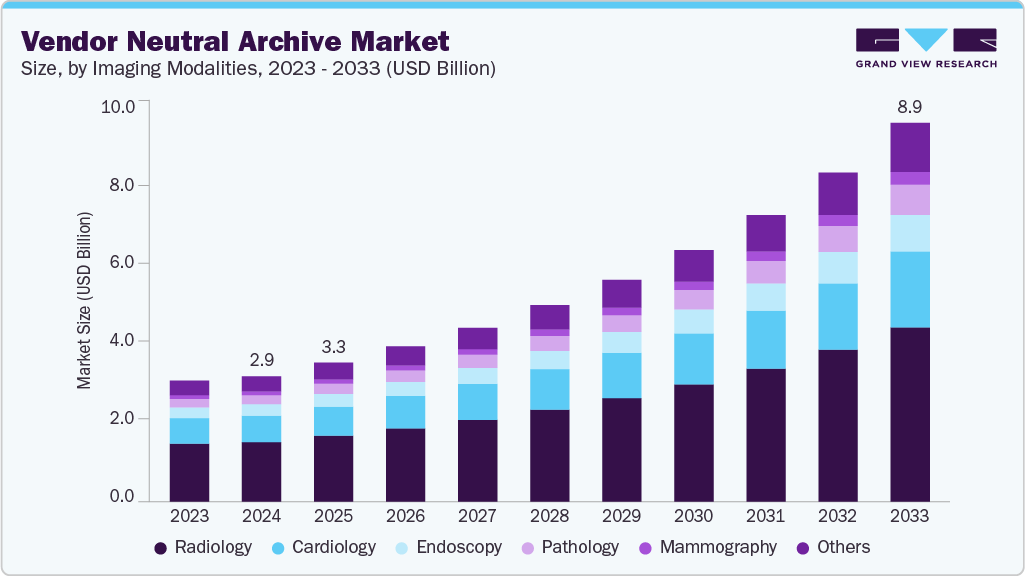

The global vendor neutral archive market size was estimated at USD 2.94 billion in 2024 and is expected to reach USD 8.89 billion, growing at a CAGR of 13.3% from 2025 to 2033. This growth is driven by the increasing imaging volumes across multi-ology workflows (radiology, cardiology, pathology, ophthalmology), and the need to consolidate silos created by legacy PACS during M&A.

Key Market Trends & Insights

- North America dominated the market and accounted for a 38.29% share in 2024.

- The vendor neutral archive market in the U.S. has seen significant growth over the forecast period due to advanced healthcare infrastructure, high imaging volumes, and strong regulatory support for interoperability and data sharing.

- By imaging Modalities, the radiology segment led the market with a share of 47.67% in 2024.

- By deployment mode, cloud based emerged as the leading procedure segment in 2024 and accounted for 45.86% of the market share.

- By end use, the hospitals segment was the leading in 2024 and accounted for 61.10% of the market share.

Market Size & Forecast

- 2024 Market Size: USD 2.94 Billion

- 2033 Projected Market Size: USD 8.89 Billion

- CAGR (2025-2033): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/vendor-neutral-archive-vna-market/request/rs1

CIOs are prioritizing interoperability-DICOM, HL7/FHIR, and IHE-XDS-so images and rich metadata flow seamlessly into EHRs and downstream analytics. Cloud migration and hybrid storage models are reducing the total cost of ownership while improving scalability, disaster recovery, and cyber-resilience, which is a board-level concern after high-profile ransomware events. Long-term retention and tightening data-governance rules (auditability, privacy, data residency) favor vendor neutral archive (VNAs) over application-tied archives.

Recent innovations and strategic initiatives from leading healthcare IT companies further propel the adoption of VNAs. For instance, in February 2024, Fujifilm’s Synapse VNA was named best in KLAS for the fifth consecutive year, recognizing its interoperability and customer satisfaction excellence. Similarly, in March 2024, GE HealthCare announced a collaboration with Tribun Health to advance Vendor Neutral Archive by integrating Vendor Neutral Archive data into GE’s Edison VNA platform. This partnership aims to enhance interoperability and provide clinicians with a more comprehensive view of patient data.

Building on these advancements, the VNA market is witnessing a shift towards greater cloud integration, focusing on enhancing scalability, security, and real-time data access. The growing emphasis on interoperability enables healthcare organizations to seamlessly manage and share imaging data across different systems, improving collaboration and efficiency. As healthcare providers adopt more flexible and integrated solutions, VNAs play a critical role in supporting precision medicine, enhancing clinical decision-making, and streamlining workflows across various healthcare settings.

Vendor Neutral Archive Market Report Scope

|

Report Attribute |

Details |

|

Market Sized in 2025 |

USD 3.26 billion |

|

Revenue forecast in 2033 |

USD 8.89 billion |

|

Growth rate |

CAGR of 13.3% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR in % from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Imaging modalities, deployment mode, component, end use, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

GE HealthCare; Siemens Healthineers International AG; FUJIFILM Corporation; Koninklijke Philips N.V.; IBM Watson Health (Merative); Hyland Healthcare; Sectra AB; Agfa HealthCare; Carestream Health; BridgeHead Software; Canon Medical Systems; Novarad; Dell Technologies; Change Healthcare; Dicom Systems, Inc.; Intelerad; RamSoft |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |