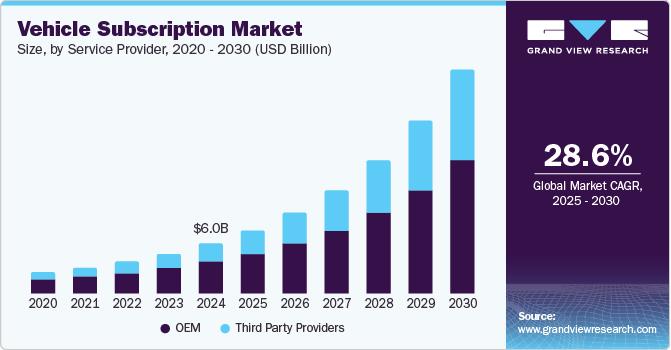

Vehicle Subscription Market Size, Share & Trends Analysis growing at a CAGR of 28.6% from 2025 to 2030

The global vehicle subscription market size was valued at USD 6.04 billion in 2024 and is projected to grow at a CAGR of 28.6% from 2025 to 2030. Vehicle subscription is a flexible alternative to traditional car ownership and leasing, allowing customers to access a vehicle for a monthly recurring fee. This model typically includes insurance, maintenance, roadside assistance, and sometimes even the ability to swap cars based on needs or preferences. Factors such as increased demand for flexible mobility solutions, technology integration and digitalization, sustainability, and the rise of Electric Vehicle (EV) subscriptions can be attributed to the growth of the vehicle subscription market.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/vehicle-subscription-market-report/request/rs1

Consumers are shifting away from traditional vehicle ownership in favor of flexible mobility options that allow them to drive a car without long-term commitments. The growing preference for subscription-based services in various industries, including entertainment and software, drives this trend. Vehicle subscriptions provide users with the ability to swap cars, pause or cancel their plans, and avoid large upfront costs. As urbanization increases and car-sharing services gain popularity, the demand for flexible mobility solutions is expected to continue to grow, attracting more automakers and startups to enter the space, thereby propelling the growth of the vehicle subscription industry.

The rise of digital platforms and artificial intelligence is transforming how vehicle subscription services operate. Advanced telematics, AI-driven pricing models, and seamless mobile apps allow companies to offer personalized experiences, track vehicle usage, and optimize fleet management. Digitalization enhances customer convenience, making it easier to access, manage, and switch between vehicles through a smartphone. Thus, with continuous advancements in technologies, vehicle subscription providers are expected to continue to leverage data analytics to refine their offerings, improving user satisfaction and operational efficiency. This, in turn, is expected to boost the growth of the vehicle subscription market in the coming years.

The global push for sustainability is intensifying, leading to the growing popularity of electric vehicle (EV) subscription services. Consumers looking to transition to EVs without committing to ownership see subscriptions as a low-risk option. These services often include charging solutions, battery maintenance, and software updates, making EV adoption more convenient. Governments worldwide are also supporting this trend with incentives and policies promoting sustainable transportation. Thus, the introduction of more electric vehicle models by automakers is driving rapid expansion of EV subscription programs, accelerating the shift toward greener mobility.

While vehicle subscription services offer enhanced convenience and flexibility, they also present certain drawbacks, which could hamper the growth of the vehicle subscription industry. One notable challenge is the potential for higher costs compared to traditional leasing or purchasing options. The premium charged for the added flexibility and convenience makes it crucial for prospective subscribers to carefully assess their budgets and long-term objectives. In addition, subscription models may not provide the same level of convenience as vehicle ownership. Most subscription plans require the vehicle to be returned at the end of the month, or the subscription must be renewed to continue usage. This limitation can complicate long-distance travel or off-road excursions, as subscribers must plan and consider both the time and financial costs involved.

Vehicle Subscription Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.62 billion |

|

Revenue forecast in 2030 |

USD 26.77 billion |

|

Growth rate |

CAGR of 28.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service provider, subscription type, subscription period, vehicle type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa |

|

Key companies profiled |

Sixt; Carvolution; FINN; ORIX; Mercedes-Benz Mobility; Volkswagen AG; Roam; TeslaRents; MARUTI SUZUKI INDIA LIMITED; and The Hertz System Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |