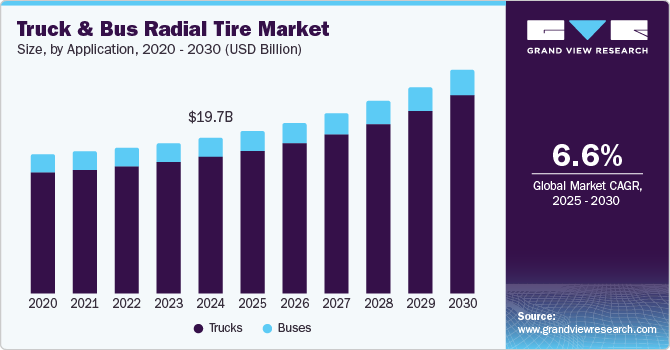

Truck & Bus Radial Tire growing at a CAGR of 6.6% from 2025 to 2030

The global truck & bus radial tire market size was valued at USD 19.75 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The growing demand for trucks and buses across various industries is a major factor driving the truck & bus radial (TBR) tire market. The rapid expansion of e-commerce, urbanization, and globalization has significantly increased the need for efficient transportation and logistics services. With more goods being transported across cities and countries, fleet operators are investing in new commercial vehicles to meet the rising freight demand.

In addition, the public transportation sector is witnessing substantial growth due to increased urban population and government initiatives promoting mass transit systems to reduce traffic congestion and pollution. Many cities are expanding their bus fleets to improve public transport accessibility, further boosting demand for TBR tires. Since radial tires offer benefits like enhanced fuel efficiency, longer lifespan, and better load-carrying capacity, they have become the preferred choice for fleet owners and transportation companies.

The expansion of the aftermarket and retreading services also drives growth of the market. The aftermarket for TBR tires is witnessing steady growth, driven by the increasing preference for tire retreading services among fleet operators. Radial tires have a longer tread life and can be retreaded multiple times, making them a cost-effective solution for commercial vehicle owners. The expanding network of tire retreading services and the growing availability of high-quality aftermarket TBR tires are contributing to overall market expansion.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/truck-bus-radial-tire-market-report/request/rs1

Furthermore, many countries are investing in large-scale infrastructure projects, including road construction, highway expansion, and transportation networks. Improved road connectivity increases the demand for heavy-duty commercial vehicles, directly boosting the need for durable and high-performance radial tires. In developing economies such as India, China, and Brazil, government-led initiatives to modernize transport infrastructure are accelerating the adoption of TBR tires for long-haul and intercity transportation.

However, the high initial cost of radial tires restrains the growth of the market. Radial tires are more expensive due to their advanced construction, superior materials, and enhanced durability. For small fleet operators and budget-conscious businesses, the upfront investment in radial tires can be a deterrent, leading them to opt for lower-cost alternatives. This price sensitivity is particularly evident in developing economies, where cost considerations often outweigh long-term benefits.

Application Insights

The trucks segment accounted for the largest share of 87.57% in 2024. The enhanced durability and longevity offered by radial tires drive its adoption in trucks. Radial tires offer significantly higher durability and longevity compared to bias-ply tires, making them an attractive choice for truck operators. The radial construction allows for better heat dissipation, reducing the risk of blowouts and excessive wear. This extended lifespan translates to lower replacement frequency, reducing overall operating costs for fleet operators.

The bus segment is expected to grow at a significant CAGR over the forecast period. Improved ride comfort and passenger safety offered by radial tires drive its adoption in buses. Radial tires are designed with a flexible sidewall and independent tread, which results in better shock absorption and reduced vibrations. This leads to a smoother and more comfortable ride for passengers, which is especially important for long-distance and public transit buses.

Truck & Bus Radial Tire Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 20.59 billion |

|

Revenue forecast in 2030 |

USD 28.30 billion |

|

Growth Rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, sales channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa |

|

Key companies profiled |

MICHELIN; Apollo Tires; Yokohoma Rubber Corporation; Bridgestone Corporation; Sumitomo Rubber Industries, Ltd.; Continental AG; Balkrishna Industries Limited (BKT); Giti Tire; The Goodyear Tire & Rubber Company; Kumho Tir |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |