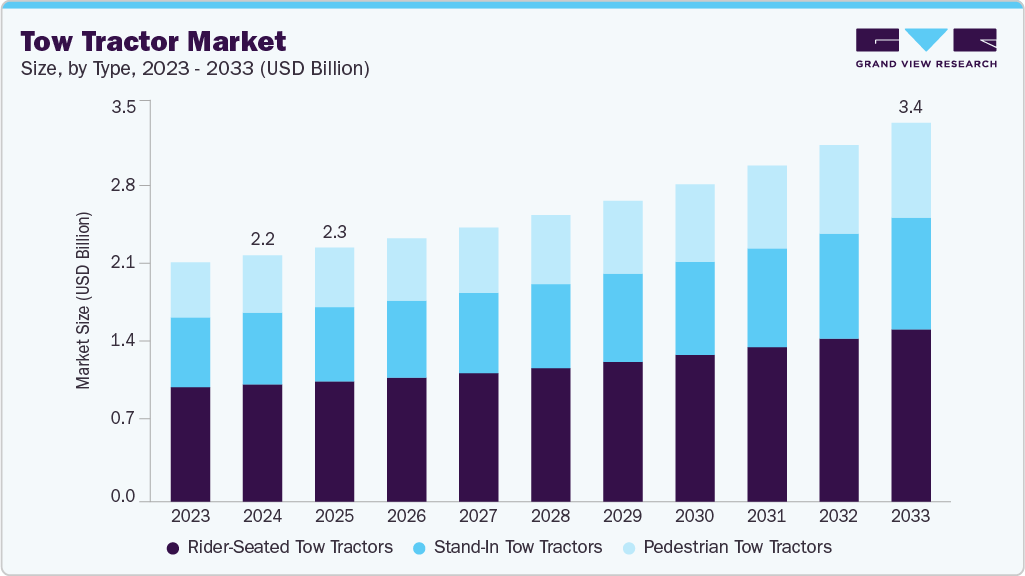

Tow Tractor growing at a CAGR of 5.1% from 2025 to 2033

The global tow tractor market size was estimated at USD 2.24 billion in 2024, and is projected to reach USD 3.45 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The industry is gaining momentum, driven by rapid growth in automated warehousing and e-commerce fulfillment, which require efficient, high-throughput material handling solutions.

Key Market Trends & Insights

- North America tow tractor market accounted for a 32.5% share of the overall market in 2024.

- The tow tractor industry in the U.S. held a dominant position in 2024.

- By type, the rider-seated tow tractors segment accounted for the largest share of 47.6% in 2024.

- By load capacity, the below 5 tons segment accounted for the largest share in 2024.

- By power source, the electric segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.24 Billion

- 2033 Projected Market Size: USD 3.45 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/tow-tractor-market-report/request/rs1

Increasing electrification of ground support equipment (GSE) at airports and transport hubs is fostering sustainable and low-emission operations. Fleet modernization efforts across retail and distribution centers are accelerating the replacement of aging diesel tow tractors with advanced electric and hybrid models that offer improved performance and reduced operational costs. Integration of autonomous driving and telematics technologies presents opportunities to enhance safety, efficiency, and real-time asset management. However, challenges such as limited infrastructure and charging capacity for high-capacity electric tow tractors pose constraints.

The growth of automated stand-in tow tractors is being propelled by the rapid expansion of e-commerce fulfillment operations and the increasing adoption of automation in warehouses and distribution centers. Rising online retail demand requires faster order picking, efficient material movement, and reduced dependency on manual labor. According to the Boston Consulting Group (BCG) and the Retailers Association of India (RAI), India’s retail sector grew from USD 400.9 billion in 2014 to USD 939.8 billion in 2024 at an annual rate of 8.9%. Furthermore, according to the India Brand Equity Foundation (IBEF), the Indian e-commerce market is projected to expand from USD 125 billion in 2024 to USD 345 billion by 2030. Companies are responding to this demand by deploying automated tow tractors to streamline workflows. For instance, in June 2021, Seegrid launched the Palion Tow Tractor Series 8 with Smart Path technology, improving navigation and efficiency in manufacturing, warehousing, and e-commerce logistics.

The electrification of ground support equipment (GSE) at airports and transport hubs is accelerating due to growing environmental mandates, airline sustainability commitments, and the long-term cost advantages of electric systems over diesel models. Electrically driven GSE emits significantly fewer greenhouse gases, up to 48% less CO₂ on average, along with lower noise levels, making them particularly suitable for noise-sensitive and high-traffic areas. Leading ground handling providers, including Swissport, now require that all newly procured GSE must be electric starting from January 2025, aiming for a 55% electric fleet at Zurich by 2025. At Singapore’s Changi Airport, more than 80 electric baggage tractors are already in operation, collectively reducing over 600 tons of CO₂ emissions annually, supported by shared charging facilities. Such initiatives are driving market growth by encouraging investments in electric tow tractors and related infrastructure, fostering innovation in battery technology, and increasing demand for sustainable and efficient airport operations globally.

Tow Tractor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.31 billion |

|

Revenue Forecast in 2033 |

USD 3.45 billion |

|

Growth rate |

CAGR of 5.1% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, load capacity, power source, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Toyota Material Handling, Inc.; Jungheinrich AG; KION Group AG; Crown Equipment Corporation; Taylor-Dunn; Motrec International Inc.; TLD Group (TractEasy Division); Clark Material Handling Company; Alke’ S.r.l.; Hyster-Yale Group, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |