Titanium Dioxide Market growing at a CAGR of 6.9% from 2026 to 2033

The global titanium dioxide market size was estimated at USD 22.96 billion in 2025 and is projected to reach USD 38.97 billion by 2033, growing at a CAGR of 6.9% from 2026 to 2033, driven by robust growth in the paints and coatings industry, supported by rising construction activity, infrastructure development, and increased demand from automotive and industrial maintenance applications. The expanding use of titanium dioxide in plastics, packaging, and consumer goods is driving growth in the titanium dioxide market, supported by its ability to enhance whiteness, opacity, color consistency, and UV resistance.

Key Market Trends & Insights

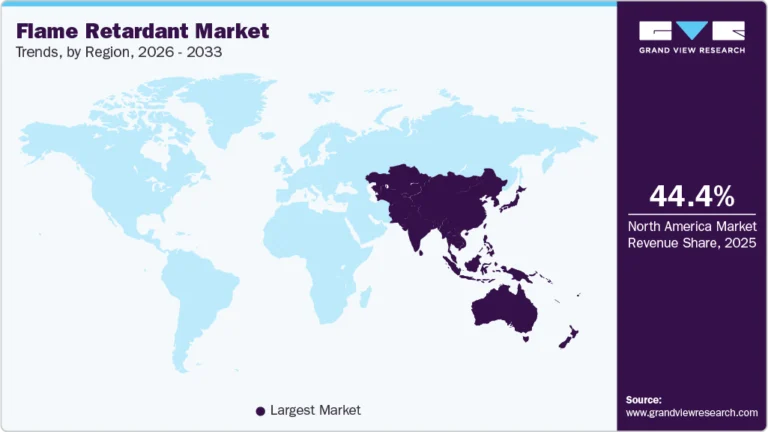

- Asia Pacific dominated the global titanium dioxide market with the largest revenue share of 43.2% in 2025.

- China within Asia Pacific expected to grow at the fastest CAGR of 7.8% from 2026 to 2033.

- By grade, the anatase segment is expected to grow at the fastest CAGR of 7.3% from 2026 to 2033.

- By process, the chloride segment is expected to grow at the fastest CAGR of 7.2% from 2026 to 2033.

- By application, the paints & coatings segment led the market with the largest revenue share of 44.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 22.96 Billion

- 2033 Projected Market Size: USD 38.97 Billion

- CAGR (2026-2033): 6.9%

- Asia Pacific: Largest market share in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/titanium-dioxide-industry/request/rs1

Demand is strengthening across the titanium dioxide color market, while technological advancements are accelerating adoption in the nano titanium dioxide market, titanium dioxide nanoparticles market, and titanium dioxide nanomaterial market. Regionally, rising industrial activity and consumer goods production continue to support growth in the India titanium dioxide market.

A key opportunity in the titanium dioxide market lies in the shift toward sustainable and high-performance materials. Regulatory pressure and evolving customer preferences are encouraging investment in low-carbon and energy-efficient production, particularly for nano and nanoparticle-based solutions, enabling differentiation, premium pricing, and long-term market growth.

Market Concentration & Characteristics

The titanium dioxide market is moderately to highly concentrated, with a limited number of large, vertically integrated global players controlling a significant share of production capacity across the titanium dioxide color market, nano titanium dioxide market, titanium dioxide nanoparticles market, and titanium dioxide nanomaterial market. These players benefit from economies of scale, strong control over raw materials, advanced manufacturing capabilities, and established distribution networks, creating high entry barriers for new participants.

Market competition is primarily driven by product quality, cost efficiency, regulatory compliance, and long-term supply agreements with key end-use industries. The market is characterized by capital-intensive operations, pricing sensitivity to feedstock and energy costs, and increasing focus on sustainable production and value-added grades.

Grade Insights

The rutile grade segment led the market with the largest revenue share of 76.2% in 2025, due to its superior opacity, durability, and UV resistance, making it the preferred choice for paints, coatings, and outdoor applications. Strong demand from construction, automotive, and industrial coatings sustains its leadership position in both volume and value terms.

The anatase grade segment is anticipated to grow at the fastest CAGR of 7.3% in 2025, driven by rising demand from plastics, paper, and cosmetic applications, where high brightness, cost efficiency, and lower abrasiveness are critical. Its suitability for indoor and non-durable applications, combined with increasing consumption in emerging markets, continues to support faster volume growth.

Carrier Production Process Insights

The sulfate carrier production process segment led the market with the largest revenue share of 77.9% in 2025, due to its ability to use a wide range of raw materials and its established, cost-effective production infrastructure. Its strong presence in Asia and emerging markets, along with flexibility in producing anatase and rutile grades, supports its continued dominance.

The chloride process segment is anticipated to grow at the fastest CAGR 7.2% during the forecast period, driven by increasing demand for high-purity rutile TiO₂ used in premium paints, coatings, and plastics. Lower waste generation, higher production efficiency, and better environmental performance compared to the sulfate route are accelerating investments in chloride-based capacity.

Application Insights

The paints & coatings segment led the market with the largest revenue share of 44.6% in 2025, due to TiO₂’s critical role in providing opacity, brightness, and durability in architectural, industrial, and automotive coatings. Sustained demand from construction, infrastructure, and maintenance activities continues to anchor this segment’s leading market share.

The plastics segment is anticipated to grow at the fastest CAGR of 7.1% during the forecast period, supported by rising demand from packaging, consumer goods, and automotive components. Titanium dioxide enhances color consistency, UV resistance, and mechanical performance, making it a key additive as plastic consumption expands across both developed and emerging markets.

Titanium Dioxide Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 24.41 billion |

|

Revenue forecast in 2033 |

USD 38.97 billion |

|

Growth rate |

CAGR of 6.9% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2018 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Grade, carried production process, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

The Chemours Company; The Tronox Holdings plc; LB Group; Venator Materials PLC; KRONOS Worldwide Inc.; Evonik Industries AG; Ishihara Sangyo Kaisha, Ltd.; CNNC HUAN YUAN Titanium Dioxide Co., Ltd.; The Kerala Minerals & Metals Limited; CATHAY INDUSTRIES; TOR Minerals International, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |