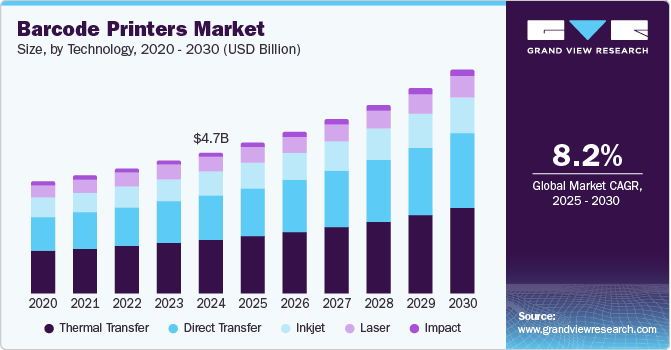

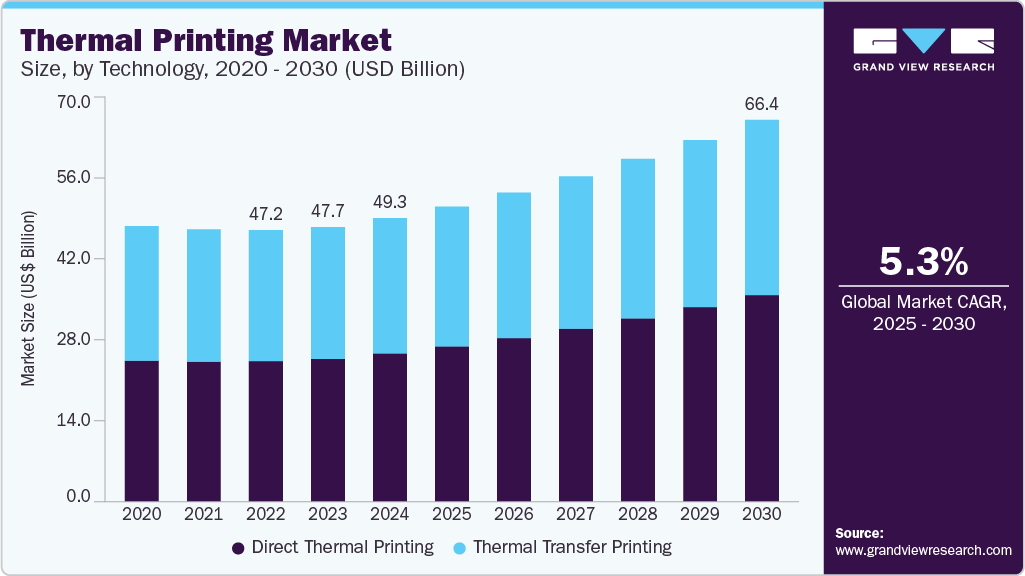

Thermal Printing Market Size, Share & Trends Analysis growing at a CAGR of 5.3% from 2025 to 2030

The global thermal printing market size was estimated at USD 49.3 billion in 2024 and is projected to reach USD 66.4 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The thermal printing industry is gaining momentum, driven by the rapid growth of e-commerce and retail industries andincreased use of thermal printers in healthcare and logistics.

Key Market Trends & Insights

- North America dominated the thermal printing market with the largest revenue share of 35.8% in 2024g.

- The thermal printing market in U.S. held a dominant position in 2024.

- By technology, the direct thermal printing segment led the market with the largest revenue share of 52.3% in 2024.

- In terms of product type segment, the desktop printers segment accounted for the largest market revenue share in 2024.

- In terms of application segment, the barcode and label printing segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 49.3 Billion

- 2030 Projected Market Size: USD 66.4 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/thermal-printing-market-report/request/rs1

The increasing adoption of RFID technology is further fueling the market, as it enhances tracking and inventory management capabilities across various sectors. However, high initial investment costs associated with industrial-grade printers remain a key challenge. The increasing demand for mobile printers presents a major growth opportunity for the market. These compact and portable devices are gaining traction among businesses for on-the-go printing needs, further expanding the market.

The rapid growth of e-commerce and retail industries is significantly driving demand for printing and labeling solutions. According to the Census Bureau of the Department of Commerce, in 2024, U.S. e-commerce sales reached USD 1.19 trillion, up 8.1% year-over-year, comprising 16.1% of total retail sales, according to the U.S. Census Bureau. Similarly, India’s e-commerce sector is projected to grow from USD 123 billion in 2024 to USD 292.3 billion by 2028 at a CAGR of 18.7%, as per the India Brand Equity Foundation. This surge increases the need for efficient shipping, inventory, and packaging labels, boosting adoption of thermal and mobile printers.

The rising adoption of RFID technology is significantly boosting demand for RFID-compatible label printers. RFID enables real-time tracking and inventory visibility, reducing human error and improving operational efficiency across retail, logistics, and healthcare sectors. For instance, Walmart has expanded its RFID mandate beyond apparel to include home goods, electronics, and toys, requiring suppliers to tag these products. This push for standardized RFID implementation is prompting businesses to invest in printers capable of encoding RFID labels, driving sustained growth in the RFID printer segment.