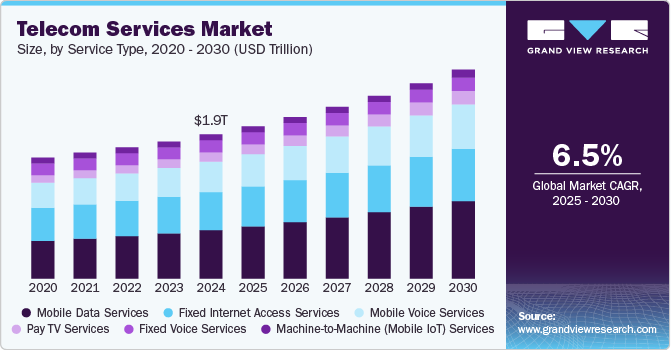

Telecom Services Market Size, Share & Trends Analysis growing at a CAGR of 6.5% from 2025 to 2030

The global telecom services market size was estimated at USD 1,983.08 billion in 2024 and is projected to reach USD 2,874.76 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry.

Key Market Trends & Insights

- Asia Pacific dominated the telecom services market with the largest revenue share of 34.0% in 2024.

- The telecom services market in the U.S. held a dominant position in North America in 2024.

- Based on service type, the mobile data services segment led the market with a share of 40.0% in 2024.

- Based on transmission, the wireless segment led the market with a share of 22.1% in 2024.

- Based on end use, the consumer/residential segment led the market a share of 59.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,983.08 Billion

- 2030 Projected Market Size: USD 2,874.76 Billion

- CAGR (2025-2030): 6.5%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/global-telecom-services-market/request/rs1

An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.

The industry’s product offering evolved in the late 19th century from only voice and visual signals in terms of facsimile or telegraphs over wired infrastructure to the current scenario of exchanging audio, video, and text content over numerous wireless infrastructures. The market for telecom services has also witnessed significant improvements in data speeds, from Global System for Mobile communications (GSM) and Code Division Multiple Access (CDMA) to Third Generation (3G), Fourth Generation (4G), and now the commercialization of Fifth Generation (5G) networks. The advent of data connectivity has made possible the reduction in the duration of transferring large chunks of data from days to hours and now to a few seconds.

In today’s digital age, customers favor Over-The-Top (OTT) channels for a variety of reasons, among which the number of viewing options, and the pricing offered are the most prominent ones. The OTT solution providers offer video, audio, and other media content over the Internet. Usually, they are not bound to price agreements with limited viewing choices to pick from. Common instances of OTT applications are Netflix, Amazon Video, Roku, Hotstar, HBO, and others. Consumers and marketers alike are getting more acquainted with OTT applications and content. Furthermore, smartphone display and sound quality, open-source platforms, and super-fast Internet Protocol (IP) networks, among other innovative services, act as mobilizing factors to draw more consumers to the OTT providers ‘freemium-based’ business models, thus witnessing an ever-growing adoption rate and boosting the market growth.