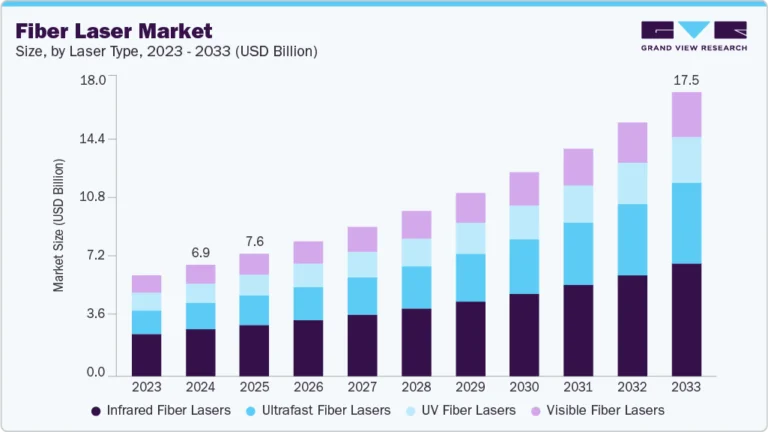

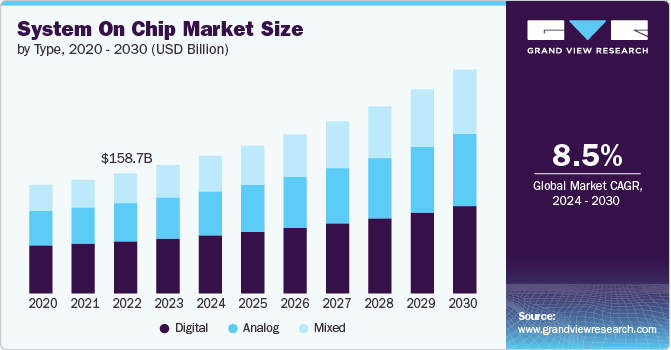

System On Chip Market Size, Share & Trends Analysis growing at a CAGR of 8.3% from 2024 to 2030

The global system on chip market size was estimated at USD 169,540.0 million in 2023 and is projected to reach USD 295,493.8 million by 2030, growing at a CAGR of 8.3% from 2024 to 2030. The proliferation of mobile devices is a major driver of the market growth as smartphones, tablets, and wearable devices require compact, powerful chips that can handle multiple functions, such as processing, graphics, and connectivity, within a single, integrated package.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, digital accounted for a revenue of USD 169,540.0 million in 2023.

- Digital is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 169,540.0 Million

- 2030 Projected Market Size: USD 295,493.8 Million

- CAGR (2024-2030): 8.5%

- Asia Pacific: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/system-on-chip-market-report/request/rs1

This demand for smaller, faster, and more energy-efficient components pushes manufacturers to innovate continuously, leading to significant advancements in system on chip (SoC) technology, which is further boosting market growth.

Technological advancements are driving the growth of the system on chip industry, with continuous innovations in semiconductor manufacturing processes, including smaller node sizes and enhanced design architectures. The shift towards multi-core processors and the integration of AI and machine learning capabilities within SoCs is propelling the market growth. These advancements enable SoCs to offer improved processing power, energy efficiency, and versatility, making them suitable for a wider range of applications, from consumer electronics to industrial automation.

Governments worldwide are pivotal in boosting the sales of SoC products by supporting semiconductor research and development, providing subsidies for local manufacturing, and implementing favorable trade policies. In regions such as North America, Europe, and Asia Pacific, governments are investing heavily in semiconductor infrastructure to reduce dependency on imports and enhance domestic capabilities. These initiatives include funding for R&D, tax incentives for companies investing in semiconductor technologies, and collaborations with academic institutions to foster innovation.

Manufacturers operating in system on chip market are increasingly focusing on the development of highly specialized and application-specific SoCs to cater to the growing demands of various sectors, including consumer electronics, automotive, healthcare, and telecommunications. They are investing in innovative research to enhance chip performance, reduce power consumption, and improve integration capabilities. In addition, they are also forming strategic collaborations with technology firms, startups, and research institutions to accelerate innovation and stay competitive in the rapidly evolving market.

The market presents several key opportunities, particularly in emerging technologies such as AI, 5G, and autonomous vehicles. The growing need for edge computing solutions and the integration of SoCs in industrial automation and smart city projects offer vast potential for market expansion. In addition, the increasing focus on energy-efficient and sustainable electronics opens opportunities for developing green SoCs that cater to environmentally conscious consumers and industries. The expansion of the global semiconductor ecosystem, driven by geopolitical shifts and the push for localization, also provides new avenues for market growth.

Type Insights

The digital segment held the largest market share in 2023 due to the high demand for smartphones, tablets, and other consumer electronics that rely heavily on digital SoCs for their processing power and functionality. Digital SoCs are essential for running complex algorithms, supporting high-speed data processing, and enabling connectivity features such as 5G. In addition, advancements in artificial intelligence (AI) and machine learning (ML) technologies have further fueled segmental growth, as these applications require powerful processing capabilities that digital SoCs are well-equipped to provide. The shift towards more connected and smart devices in both consumer and industrial sectors continues to bolster the high share of digital SoCs in the overall market.

The mixed segment is expected to witness the fastest CAGR from 2024 to 2030 due to the increasing integration of both analog and digital functionalities within a single chip. Mixed SoCs have applications such as the Internet of Things (IoT), automotive electronics, and telecommunications, where devices require both analog signals for interfacing with the physical world and digital processing for data manipulation. Mixed SoCs offer the advantage of reducing the overall system size, power consumption, and cost by combining these functions into one chip. The growing demand for advanced driver-assistance systems (ADAS) in vehicles, smart home devices, and wearable technology is significantly contributing to the expansion of the mixed SoC segment.