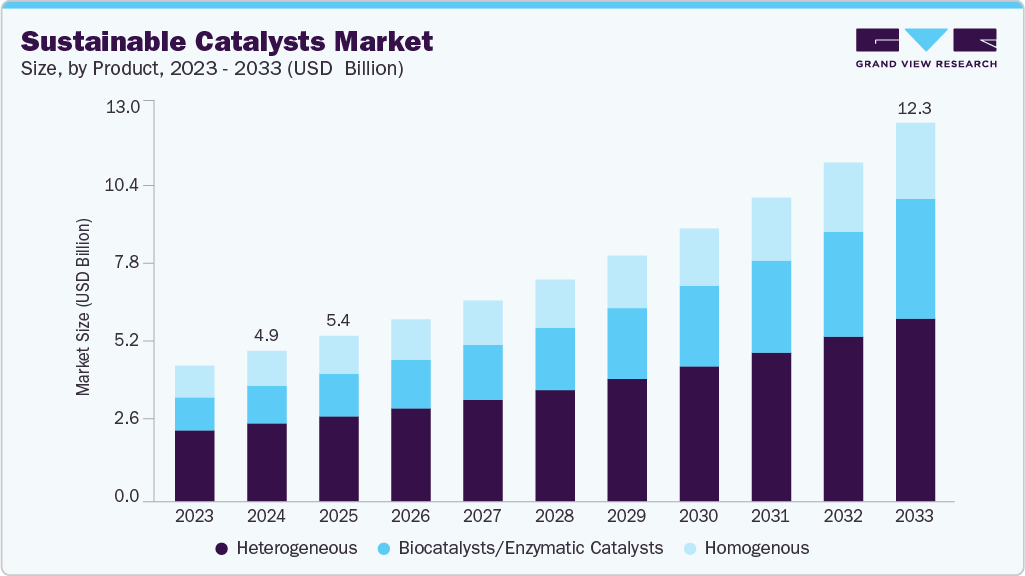

Sustainable Catalysts Market growing at a CAGR of 10.9% from 2025 to 2033

The global sustainable catalysts market size was estimated at USD 4.88 billion in 2024 and is projected to reach USD 12.29 billion by 2033, growing at a CAGR of 10.9% from 2025 to 2033. The industry is driven by the accelerating global shift toward green chemistry and decarbonization.

Key Market Trends & Insights

- Asia Pacific dominated the global sustainable catalysts market with the largest revenue share of 40.6% in 2024.

- China represents the largest market for sustainable catalysts, driven by its vast petrochemical base, renewable energy expansion, and government-led sustainability initiatives.

- By product, the heterogeneous segment held the highest market share of 51.8% in 2024 in terms of revenue.

- By application, the petrochemicals & refining segment led the sustainable catalysts industry with the largest revenue share of 26.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.88 Billion

- 2033 Projected Market Size: USD 12.29 Billion

- CAGR (2025-2033): 10.9%

- Asia Pacific: Largest Market in 2024

- Latin America: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/sustainable-catalysts-market-report/request/rs1

Stringent environmental regulations and the transition to low-carbon industrial operations are pushing manufacturers to adopt eco-friendly catalyst solutions that minimize waste, energy consumption, and hazardous by-products. Industries such as chemicals, refining, and polymers are actively integrating sustainable catalysts to meet emission targets and improve process efficiency. Another major driver is the rising demand for renewable and bio-based feedstocks, which require specialized catalytic systems. Sustainable catalysts, such as biocatalysts, recyclable metals, and non-toxic materials, enable the production of green fuels, bio-based polymers, and sustainable chemicals, aligning with the circular economy model. This shift is supported by government initiatives and R&D investments promoting carbon neutrality and sustainable manufacturing.

Additionally, advancements in nanocatalysis, single-atom catalysts, and hybrid catalyst systems are expanding the performance capabilities of sustainable catalysts. These technologies enhance activity, selectivity, and reusability, enabling industries to achieve higher output with reduced environmental impact. The combination of technological innovation and regulatory momentum continues to propel market growth globally.

Furthermore, the increasing focus on sustainability and green chemistry is reshaping adhesive formulations, creating new opportunities for silane-modified polymers (Biocatalysts/Enzymatic Catalysts), water-based polyurethane, and silicone-based systems. Manufacturers are investing in the development of low-VOC, solvent-free, and bio-based adhesives to comply with tightening environmental regulations across Europe and North America. In addition, the growth of chemical synthesis automation and advanced manufacturing technologies has driven the use of sustainable catalysts in electronic assemblies, consumer goods, and renewable energy components. Collectively, these factors underscore a structural shift in material joining solutions, positioning sustainable catalysts as a key enabler of innovation and performance in high-growth end-use industries.

Market Concentration & Characteristics

The industry is characterized by strong innovation intensity and rapid technological evolution. It integrates multiple disciplines such as material science, biotechnology, and nanotechnology, leading to a diverse product landscape. Market participants are focusing on developing low-toxicity, recyclable, and high-efficiency catalysts that meet both industrial performance and environmental compliance requirements.

In terms of concentration, the market is moderately consolidated, dominated by leading global catalyst producers such as BASF SE, Johnson Matthey, Clariant, and Evonik Industries. These players invest heavily in R&D and sustainability-driven projects, often forming partnerships with biotechnology firms and renewable energy companies. However, smaller startups and academic collaborations are also emerging as important innovators, especially in the biocatalyst and nanocatalyst domains.

Sustainable Catalysts Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.37 billion |

|

Revenue forecast in 2033 |

USD 12.29 billion |

|

Growth rate |

CAGR of 10.9% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Volume & revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific: Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

BASF SE; Topsoe; Evonik Industries AG; Clariant; Ecovyst; Johnson Matthey; Albemarle Corporation; Honeywell; W.R. Grace; Dow; Umicore |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |