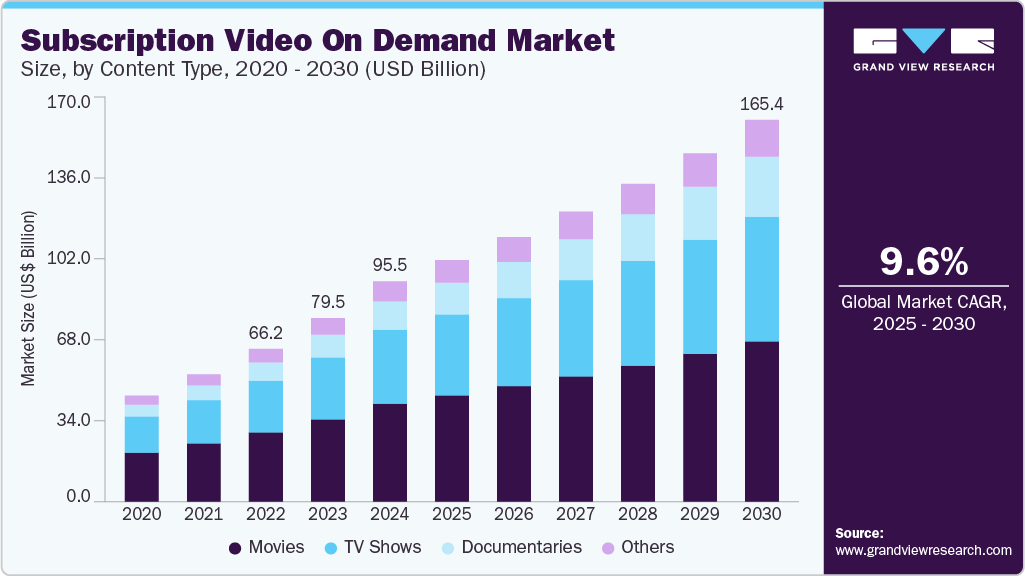

Subscription Video On Demand grow at a CAGR of 9.6% from 2025 to 2030

The global subscription video on demand market size was estimated at USD 95.50 billion in 2024 and is expected to grow at a CAGR of 9.6% from 2025 to 2030. The growing influence of social media is driving significant changes in the subscription video-on-demand (SVOD) industry.

Key Highlights:

- The North America subscription video on demand market accounted for a significant share of over 44% in 2024

- The U.S. subscription video on demand industry dominated with a share of over 67% in 2024, driven by increasing demand for viewing flexibility.

- By content type, the movies segment dominated the SVOD market with a share of over 44% in 2024.

- By device type, the smartphones segment is expected to witness the fastest CAGR from 2025 to 2030.

- By revenue model, the subscription-based segment accounted for the largest market share in 2024.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/subscription-video-on-demand-svod-market-report/request/rs1

Streaming platforms are leveraging social media to spotlight trending content, share exclusive behind-the-scenes insights, and engage directly with audiences in real time. This real-time interaction is crucial for staying relevant, sparking conversations, and building deeper connections with viewers. By increasing content visibility and creating buzz via social media platforms, SVOD providers are enhancing user engagement and loyalty, establishing social media as a crucial growth driver for the market.

The integration of subscription video on demand services with smart TVs, streaming devices, and voice assistants is becoming increasingly seamless, significantly enhancing the user experience. This frictionless connectivity allows consumers to access content effortlessly across multiple platforms, aligning with the growing expectation for consistent performance and usability. Consequently, the subscription video on demand industry is expanding its reach by catering to a broader, tech-savvy audience. This trend is a key enabler of the market growth, as convenience and accessibility drive higher engagement and subscriber acquisition.

The rising global appetite for animated content is emerging as a key growth catalyst within the subscription video on demand industry, appealing to both younger audiences and adults. SVOD platforms are strategically investing in premium animated series and films that address diverse age groups, including family-friendly titles and more sophisticated animated offerings. As animation gains recognition as a genre with wide-ranging appeal, it is strengthening viewer engagement and retention. This dynamic is accelerating the expansion of the SVOD market by tapping into a versatile content segment with cross-generational relevance.

Subscription Video On Demand Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 104.66 billion |

|

Revenue forecast in 2030 |

USD 165.45 billion |

|

Growth rate |

CAGR of 9.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Segments covered |

Content type, device type, revenue model, end-use, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Amazon Prime Video; Apple TV+; DAZN; Discovery+; Disney+; HBO Max; Hulu; Netflix; Paramount+; Peacock; Sony Crackle; YouTube Premium |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |