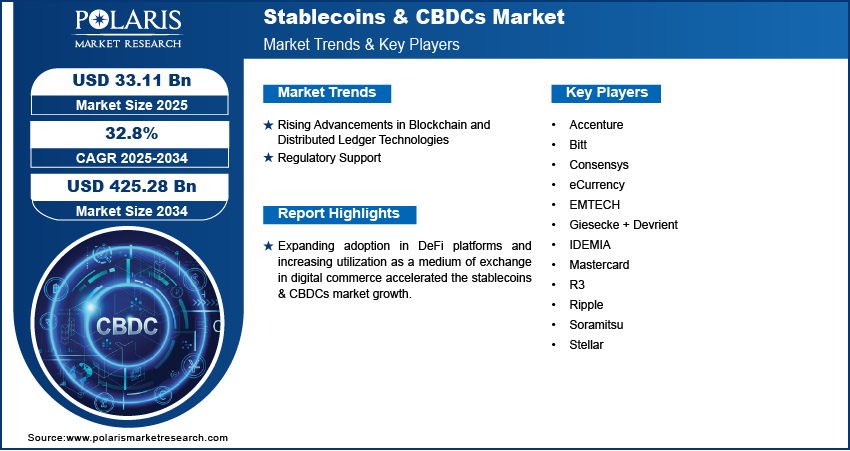

Stablecoins & Central Bank Digital Currencies (CBDCs) Market is forecasted to reach USD 425.28 Billion by 2034, CAGR of 32.8%.

Global Stablecoins & CBDCs Market size and share is currently valued at USD 25.20 billion in 2024 and is anticipated to generate an estimated revenue of USD 425.28 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 32.8% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Market Definition

The Stablecoins & Central Bank Digital Currencies (CBDCs) Market includes blockchain-based digital currencies designed for price stability (stablecoins) and government-issued digital currencies (CBDCs) aimed at modernizing financial systems. Stablecoins are typically pegged to fiat currencies or assets, offering predictable value for digital transactions, while CBDCs represent sovereign digital money issued by central banks. This market supports innovations in digital payments, cross-border remittances, financial inclusion, and monetary policy control. It is driven by the need for secure, transparent, and fast digital currency alternatives in a rapidly digitizing economy. Regulatory frameworks, technological infrastructure, and geopolitical strategies heavily influence the development and adoption of these digital currencies.

Key Report Highlights

- The report highlights the key region that accounts for the highest revenue share in the global Stablecoins & CBDCs market.

- It identifies the leading country within this region that makes a significant contribution to the market’s overall performance.

- The report outlines the dominant segment that holds a major share of the market.

- It also emphasizes the fastest-growing segment projected to gain strong traction during the forecast period.

- Qualitative and quantitative market analysis have been used to provide an in-depth understanding of the market.

Market Overview: Key Figures at a Glance

Market Size Value in 2024 USD 25.20 billion

Market Size Value in 2025 USD 33.11 billion

Revenue Forecast in 2034 USD 425.28 billion

CAGR 32.8% from 2025 to 2034

Get access to the full report or request a complimentary sample for in-depth analysis:

Market Growth Drivers

The stablecoins and central bank digital currencies (CBDCs) market is expanding amid growing demand for secure, low-volatility digital assets and state-backed alternatives to cryptocurrencies. Stablecoins offer price stability through asset backing, facilitating real-time cross-border payments and decentralized finance activities. Simultaneously, governments are exploring CBDCs to enhance financial inclusion, strengthen monetary policy, and modernize payment infrastructures. The digital transformation of banking systems, coupled with increasing interest in cashless economies, supports market growth. Regulatory clarity and public trust in blockchain technology further accelerate adoption. Additionally, interoperability frameworks and pilot programs are enhancing the feasibility and scalability of digital currencies, solidifying their role in the future of global payments and economic transactions.

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. Stablecoins & CBDCs Market Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- Accenture

- Bitt

- Consensys

- eCurrency

- EMTECH

- Giesecke + Devrient

- IDEMIA

- Mastercard

- R3

- Ripple

- Soramitsu

- Stellar