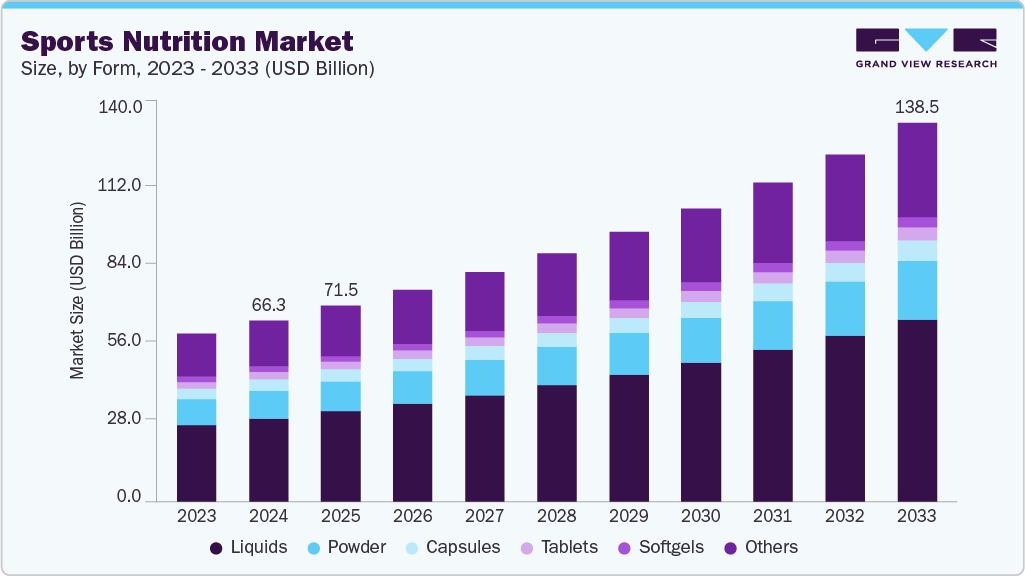

Sports Nutrition Market growing at a CAGR of 8.6% from 2025 to 2033

The global sports nutrition market size was estimated at USD 66.27 billion in 2024 and is projected to reach USD 138.48 billion in 2033, growing at a CAGR of 8.6% from 2025 to 2033. The global market has experienced significant growth over the past decade, driven by the rising adoption of fitness regimes and the increasing awareness of the importance of nutrition in maintaining an active lifestyle.

Key Market Trends & Insights

- North America dominated the global sports nutrition market in 2024 with a revenue share of 48.2%

- Asia Pacific is growing at the fastest CAGR of 10.7% in the forecast period.

- Based on product, the sports drinks segment in the global sports nutrition market accounted for a share of 38.4% in 2024.

- Based on Form, the liquids segment held a share of 45.9% in 2024.

- Based on age group, the adult segment held a share of 88.9% in 2024.

- By distribution channel, the brick & mortar segment dominated the market with a revenue share of 72.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.27 Billion

- 2033 Projected Market Size: USD 138.48 Billion

- CAGR (2025-2033): 8.6%

- Asia Pacific: Significantly growing market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/sports-nutrition-market/request/rs1

This market encompasses a broad range of products, including protein powders, energy bars, dietary supplements, and ready-to-drink (RTD) beverages, designed to enhance athletic performance, support recovery, and improve overall health, driving the overall market during the forecast period. Moreover, athletes and fitness enthusiasts constantly seek products to enhance their performance, improve endurance, and support recovery. This has driven the demand for a wide range of sports nutrition products, including protein powders, energy bars, and recovery drinks. The increasing focus on performance optimization has led to the development of products tailored to specific needs, such as pre-workout supplements for energy, intra-workout products for endurance, and post-workout supplements for recovery.

Technological advancements and innovations in food science have led to developing new and improved sports nutrition products. Companies invest heavily in research and development (R&D) to create effective and appealing products. For instance, introducing plant-based protein powders and bars has opened up new market segments, catering to the growing number of consumers adopting vegetarian and vegan diets, which is further expected to augment market growth during the forecast period.

The rise of e-commerce has significantly impacted the global market by making these products more accessible to a broader audience. Online platforms offer consumers the convenience of purchasing products from the comfort of their homes, often with detailed product descriptions, reviews, and recommendations.

Consumer Insights for the Sports Nutrition Market

Consumers increasingly prioritize overall health, fitness, and well-being, driving demand for products supporting immunity, energy, and mental focus. Products that offer functional benefits, such as immunity-boosting and gut health support, are gaining traction. Prinova Europe Ltd. surveyed 1,277 consumers across five of Europe’s largest markets: France, Germany, Italy, Spain, and the UK, and published the results dated September 2023. The results revealed significant age-related differences in the popularity of strength training versus endurance activities. Over half of the respondents aged 18-24 indicated that strength or gym training was their most frequent exercise. In contrast, consumers aged 55 and older strongly preferred endurance activities.

Weight loss is a prominent goal, with nearly one in four active lifestyle consumers and one in six performance consumers citing it as their primary reason for exercising. Protein is a vital ingredient because it promotes satiety, while innovative options like Prolibra bioactive whey protein and CapsiAtra dihydrocapsiate, marketed for weight loss, are gaining appeal. Overall, 78% of consumers considered supplements important for achieving their goals.

Strength and recovery remained key, particularly for performance consumers who engaged in intense activities like CrossFit and weightlifting. Protein shakes were popular choices in powder (39%) and ready-to-drink (RTD, 35%) formats. Millennials and Gen Z were the largest regular users of these products. Post-workout preferences lean toward dairy-based protein products, with RTDs, powders, and bars being the most favored. The trend towards holistic health is gaining traction, with consumers looking for products that enhance physical performance and support mental and emotional well-being. This has led to the growth of sports product categories that include adaptogens, nootropics, and other supplements aimed at stress management and cognitive enhancement.

Sports Nutrition Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 71.55 billion |

|

Revenue forecast in 2033 |

USD 138.48 billion |

|

Growth rate |

CAGR of 8.6% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, form, age group, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Singapore; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia |

|

Key companies profiled |

BA Sports Nutrition, LLC; Abbott; Quest Nutrition; PepsiCo; Mondelēz International, Inc.; The Coca-Cola Company; FitLife Brands; GNC Holdings, Inc.; Nutra Holdings; Nutrivend |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |