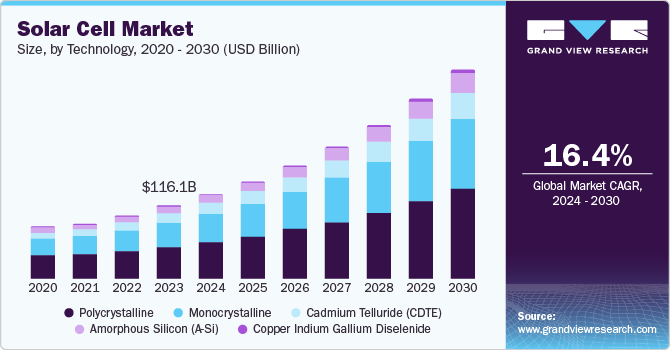

Solar Cell Market Size, Share & Trends Analysis growing at a CAGR of 16.4% from 2024 to 2030

The global solar cell market size was estimated at USD 116.1 billion in 2023 and is anticipated to reach USD 333.8 billion by 2030, growing at a CAGR of 16.4% from 2024 to 2030. The growing environmental awareness and the urgent need to reduce carbon emissions push governments and consumers towards renewable energy sources.

Key Market Trends & Insights

- Asia Pacific dominated the global solar cell market with a revenue share of 60.0% in 2023.

- The U.S. solar cell market is projected to experience significant growth over the forecast period.

- By technology, the polycrystalline segment accounted for 43.7% of the total revenue generated in the global solar cell market in 2023.

- By application, the utility segment dominated the global solar cell market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 116.1 Billion

- 2030 Projected Market Size: USD 333.8 Billion

- CAGR (2024-2030): 16.4%

- Asia Pacific: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/solar-cell-market/request/rs1

Technological advancements in solar cell efficiency and manufacturing processes make solar energy more cost-effective and accessible. In addition, supportive government policies, subsidies, and incentives encourage solar power adoption. The constantly increasing demand for sustainable energy solutions in residential, commercial, and industrial sectors further fuels this growth, as does the growing investment in solar infrastructure and grid integration. Regulatory frameworks significantly influence the solar cell market by fostering an environment conducive to expansion and advancement. Notably, policies such as the Renewable Portfolio Standards (RPS) stipulate a minimum requirement for electricity generation from renewable sources, including solar power, thereby substantially impacting market dynamics and innovation.

In addition, Feed-in Tariffs (FiTs) and Power Purchase Agreements (PPAs) provide financial stability by guaranteeing prices for solar energy producers and encouraging long-term investments. The Investment Tax Credit (ITC) in the U.S. enables homeowners and businesses to offset a significant portion of solar system expenses from their federal taxes, thereby improving cost-effectiveness. Furthermore, tax incentives and subsidies reduce the financial burden on solar projects, making them more attractive to developers and investors.