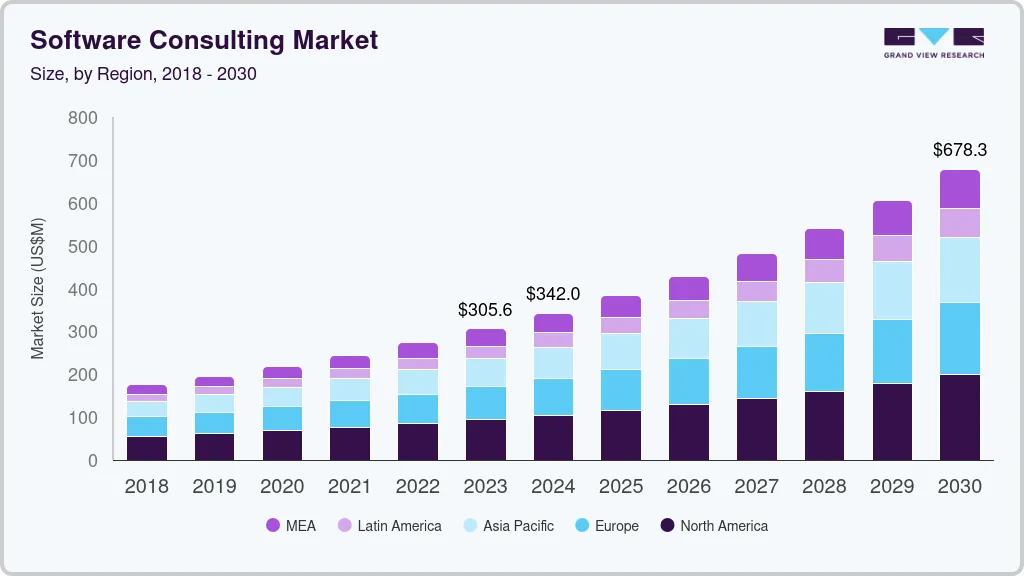

Software Consulting Market growing at a CAGR of 12.1% from 2023 to 2030

The global software consulting market size was estimated at USD 273.13 billion in 2022 and is projected to reach USD 678.32 billion by 2030, growing at a CAGR of 12.1% from 2023 to 2030. The growing preference for the digitalization of business processes across industries and verticals is driving market growth, primarily for the efficient implementation of software into the IT setup of an enterprise.

Key Market Trends & Insights

- North America dominated the market with a revenue share of over 30% in 2022 and will expand further at a steady growth rate from 2023 to 2030.

- The market in Asia Pacific is expected to register a significant growth rate over the forecast period.

- By application, the enterprise solutions segment accounted for the largest market share of over 21% in 2022

- By enterprise size, the large enterprise segment accounted for the largest market share of over 60% in 2022.

- By end-use, the BFSI segment accounted for the largest market share of over 18% of the overall market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 273.13 Billion

- 2030 Projected Market Size: USD 678.32 Billion

- CAGR (2023-2030): 12.1%

- North America: Largest market in 2022

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/software-consulting-market/request/rs1

Moreover, technological developments in cloud computing and data analytics are increasing the demand for new services and encouraging enterprises to adopt novel and innovative solutions. In addition, the growing demand for software consulting services is expected to drive investments in advanced software technologies. These services aid enterprises in decision-making processes vis-à-vis their investment strategy for software adoption.

Organizations benefit from larger revenues and budgets during prosperous economic times, which allows them to spend more on consultants. The demand for software consulting services has expanded with the ever-increasing technological development. Consulting services give the right expertise and software implementation in enterprises to enhance revenue and profitability. The digitization of industries and the evolution of the Enterprise 2.0 concept, which involves combining social software and collaborative technologies for business processes, are the main factors driving market growth. Through software deployment, businesses focus on improving job quality, boosting delivery speed, lowering labor costs, and increasing transparency and accountability. Organizations are finding it challenging to meet end customers’ needs due to the global pandemic; as a result, they are increasingly turning to software consulting solutions and services to speed up service delivery.

Numerous industries face significant ramifications and complications across critical processes due to the COVID-19 pandemic and global economic slowdown. While the market witnessed significant growth over the last few years owing to digitalization and technology penetration, the pandemic has pushed several economies to the edge of recession. This, in turn, leads to numerous consulting clients delaying their projects, reducing project scope to reduce costs, or canceling these projects altogether. The cancellation of multiple client projects has negatively impacted vendors’ revenues and slowed down the market growth for the short term. In the wake of the pandemic, vendors are focusing on adopting a digitally centered approach to provide their services at a lower cost while eliminating expenses, such as the travel costs of consultants. With virtual consulting platforms, vendors can deliver high-impact outcomes similar to physical training but without needing consultants to be physically present. Service providers are also focused on attracting new clients looking to reduce operational spending via automation while opting for innovative solutions to complex business problems.

Application Insights

The enterprise solutions segment accounted for the largest market share of over 21% in 2022 and is projected to remain dominant over the forecast period. The demand for software, such as Enterprise Content Management (ECM), Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM), has been increasing, which is estimated to boost the demand for consulting for enterprise solutions over the coming years. Customer involvement is becoming increasingly important to businesses. As a result, consumer involvement is becoming an increasingly crucial aspect of CRM activity. This encourages companies to develop dedicated solutions for social listening, measurement, management, and monitoring, among other things.

The software security services segment is anticipated to register the highest growth rate over the forecast period. The growth of this segment can be attributed to the increasing use of cloud servers to store information and an increasing number of cyberattacks to gain access to information. Stringent government laws, a boom in trends such as Bring Your Own Device (BYOD) and Bring Your Own Hardware (WFH), and sophisticated assaults across companies are all likely to boost the expansion of software security services. Furthermore, as cloud computing, e-commerce, and social networking become more popular worldwide, the need for enormous amounts of data to be stored in the cloud with increased security is growing. Over the projected period, these factors are expected to enhance demand for software security consulting services.

End-use Insights

The BFSI segment accounted for the largest market share of over 18% of the overall market in 2022. Financial services companies are adopting consulting services to expand their resources, integrate tech into data processes, and increase their businesses. In the forecast period, the widespread usage of digital payments and the increase in fin-tech companies are expected to increase the penetration of blockchain technology in banking. Also, the growing number of digital wallets is expected to propel the market growth. Furthermore, as the usage of cloud-based solutions and services increases for customer information storage, so does the frequency of cyberattacks; thus, organizations in the BFSI industry increasingly demand software security consulting services. Large amounts of data are being hosted in the cloud, necessitating sufficient security and creating an opportunity for software consulting firms to provide security services to BFSI companies.

Software Consulting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 305.55 billion |

|

Revenue forecast in 2030 |

USD 678.32 billion |

|

Growth rate |

CAGR of 12.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 – 2021 |

|

Forecast period |

2023 – 2030 |

|

Report updated |

May 2023 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking/share, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil |

|

Key companies profiled |

Accenture PLC; Atos SE; Capgemini; CGI Group, Inc.; Clearfind; Cognizant; Deloitte Touche Tohmatsu Ltd.; Ernst & Young LLP; International Business Machines Corp.; Oracle Corp.; PricewaterhouseCoopers B.V.; Rapport IT; SAP SE; Trianz |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |