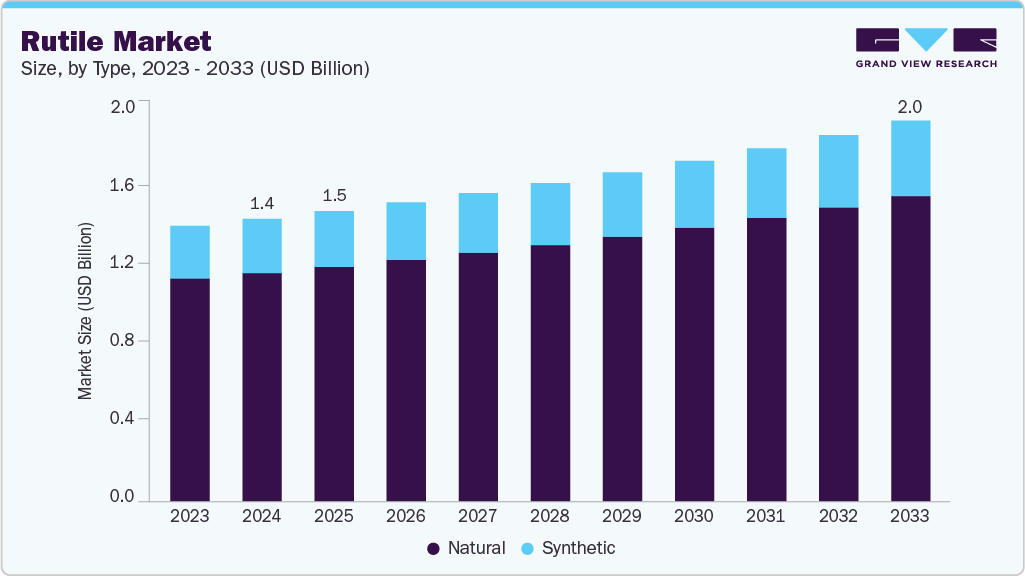

Rutile Market growing at a CAGR of 3.4% from 2025 to 2033

The global rutile market size was estimated at USD 1.49 billion in 2024 and is projected to reach USD 2.01 billion by 2033, growing at a CAGR of 3.4% from 2025 to 2033. The rutile industry is gaining momentum due to the rising production of titanium dioxide pigments, which remain indispensable in coatings, plastics, and paper industries.

Key Market Trends & Insights

- Asia Pacific dominated the rutile market with the largest market revenue share of 53.3% in 2024.

- By type, the natural segment led the market with the largest revenue share of 80.9% in 2024.

- By application, the titanium metals & alloys segment is anticipated to register at the fastest CAGR of 6.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.49 Billion

- 2033 Projected Market Size: USD 2.01 Billion

- CAGR (2025-2033): 3.4%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/rutile-market/request/rs1

Increasing infrastructure development across emerging economies is creating steady demand for high-performance coatings that rely heavily on rutile-based TiO₂ for durability, opacity, and brightness. This trend aligns with rapid urban expansion, which continues to elevate pigment consumption across architectural and industrial applications.

Titanium metal, extracted from rutile through advanced processing routes, offers exceptional strength-to-weight advantages and corrosion resistance. As manufacturers seek to enhance fuel efficiency and achieve stringent environmental targets, the adoption of titanium alloys is rising, accelerating the need for high-grade rutile feedstock.

Advances in additive manufacturing and precision engineering are giving the rutile industry further traction. Titanium powders used in 3D printing require consistent, high-purity input materials that many rutile-based processes can deliver. The expansion of metal additive manufacturing for medical implants, automotive components, and aerospace parts is pushing producers to scale up rutile supply chains to meet evolving quality standards.

The shift toward renewable energy technologies present another significant growth avenue. Rutile is increasingly used in photocatalysts, dye-sensitized solar cells, and other energy-conversion materials where its crystalline structure enhances performance. As nations accelerate clean energy deployment to meet climate goals, the requirement for advanced materials with strong optical and electronic characteristics is widening, strengthening rutile consumption in these emerging applications.

Rising mining investments across Australia, South Africa, and African coastal regions are also supporting market growth. Expanded exploration activities, improved beneficiation technologies, and the development of new mineral sands projects are boosting rutile output. This supply-side expansion is helping stabilize availability while enabling downstream industries to plan long-term production strategies, creating a favorable environment for sustained market growth.

Drivers, Opportunities & Restraints

The rutile industry is driven by the expanding consumption of titanium dioxide pigments across coatings, plastics, and paper industries. Strong construction activity across Asia Pacific, the Middle East, and Africa is strengthening the need for high-opacity and weather-resistant coatings, which rely heavily on rutile for superior brightness and performance. Rising demand for titanium metal in aerospace, automotive, and medical applications is adding to this momentum as manufacturers focus on lightweight materials that improve efficiency and durability.

Opportunities are emerging through the growing use of rutile in advanced technologies such as additive manufacturing, photocatalysts, and next-generation solar cells. High-purity grades are gaining prominence as industries seek materials with excellent optical, thermal, and electronic properties. The development of new mineral sands projects in Australia and Africa, along with improvements in beneficiation techniques, is creating room for capacity expansion and supply diversification. Increasing research in nanostructured TiO₂ is also opening potential avenues for high-value applications.

The rutile industry faces restraints due to fluctuations in mineral sands production, resource depletion in mature mines, and inconsistent supply from certain regions. Growing environmental regulations related to mining activities are adding operational challenges for producers, especially in regions with stricter land restoration and water-use rules.

Type Insights

The natural segment led the market with the largest revenue share of 80.9% in 2024, due to rising demand from titanium dioxide producers seeking high-grade feedstock with stable mineralogical properties. Natural rutile offers superior TiO₂ content, which enhances pigment brightness and opacity, making it a preferred raw material for premium coatings and plastics. As construction, automotive, and packaging industries scale up production, manufacturers are increasingly relying on natural rutile to achieve consistent product quality while reducing processing costs associated with upgrading lower-grade alternatives.

The synthetic segment is anticipated to register at the fastest CAGR over the forecast period. Synthetic rutile provides controlled TiO₂ content and reduced impurities, which helps pigment producers optimize production efficiency and achieve consistent optical performance in coatings, plastics, and paper. As downstream manufacturers focus on uniformity in pigment batches for architectural and industrial applications, the reliability of synthetic grades is becoming a key advantage that fuels market adoption.

Application Insights

The paints and coatings segment led the market with the largest revenue share of 58.1% in 2024, as manufacturers increasingly prioritize high-performance formulations that deliver strong opacity, UV resistance, and long-term durability. Rutile-based titanium dioxide remains central to achieving these attributes because its crystal structure and high refractive index enhance brightness and coverage. As residential, commercial, and industrial construction accelerates across Asia Pacific, the Middle East, and Africa, demand for architectural coatings with consistent color retention and weather protection continues to rise, supporting steady uptake of rutile in this application.

Rutile Market Report Scope

|

Report Attribute |

Details |

|

Market Definition |

The market size represents the annual sales value of rutile sold for end-use purposes. |

|

Market size value in 2025 |

USD 1.53 billion |

|

Revenue forecast in 2033 |

USD 2.01 billion |

|

Growth rate |

CAGR of 3.4% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative Units |

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue & volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

Iluka Resources Limited; Tronox Holdings plc; Rio Tinto Group; Kenmare Resources plc; TiZir Limited; Sierra Rutile Limited; Base Resources Limited; Cochin Minerals and Rutile Limited; Kerala Minerals and Metals Ltd; V V Mineral |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |