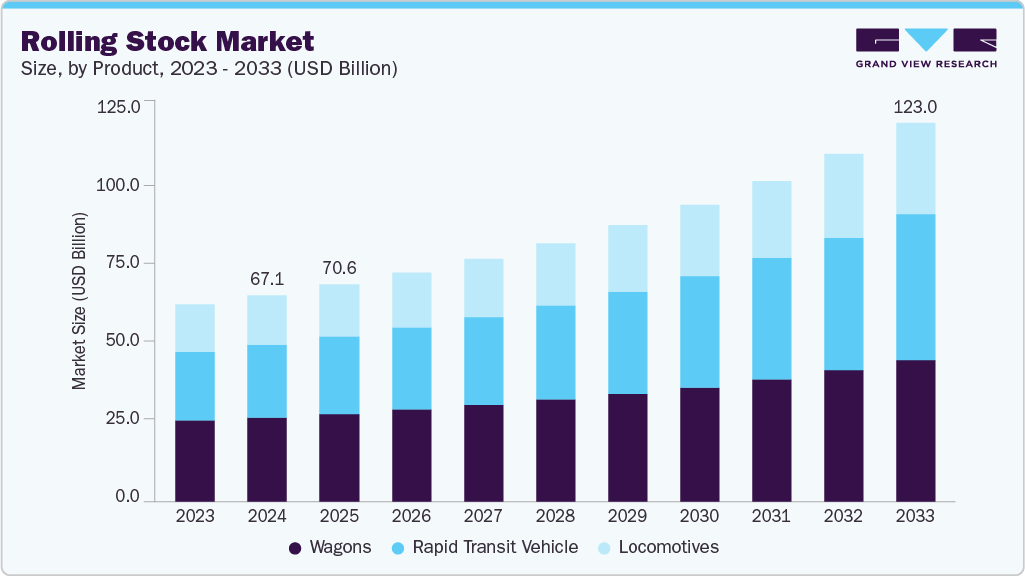

Rolling Stock growing at a CAGR of 7.2% from 2025 to 2033

The global rolling stock market size was estimated at USD 67.12 billion in 2024, and is projected to reach USD 123.01 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Increasing investments in railway infrastructure, growing adoption of advanced digital solutions, and rising demand for energy-efficient and sustainable transportation systems are key factors driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the rolling stock market with the largest revenue share of 44.0% in 2024.

- By product, the wagons segment led market with the largest revenue share of 40.9% in 2024.

- By type, the diesel segment accounted for the largest market revenue share in 2024.

- By train type, the rail freight segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 67.12 Billion

- 2033 Projected Market Size: USD 123.01 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The global rolling stock market size was estimated at USD 67.12 billion in 2024, and is projected to reach USD 123.01 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Increasing investments in railway infrastructure, growing adoption of advanced digital solutions, and rising demand for energy-efficient and sustainable transportation systems are key factors driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the rolling stock market with the largest revenue share of 44.0% in 2024.

- By product, the wagons segment led market with the largest revenue share of 40.9% in 2024.

- By type, the diesel segment accounted for the largest market revenue share in 2024.

- By train type, the rail freight segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 67.12 Billion

- 2033 Projected Market Size: USD 123.01 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/rolling-stock-market/request/rs1

An emerging opportunity lies in the expansion of high-speed rail networks in developing regions, which could significantly boost rolling stock demand. However, the market faces challenges such as high capital expenditure and long project lead times. A notable trend is the integration of Internet of Things (IoT) and predictive maintenance technologies, enhancing operational efficiency and reducing downtime in railway operations.

Several government agencies and private entities are focusing on enhancing their transportation infrastructure while deploying a large number of rolling stock vehicles that can carry considerable loads of freight, ultimately contributing to market growth. For instance, as per Global Railway Review, as of January 2023, the Indian railways contribute approximately 27% of India’s freight transport. Thus, the government of India is aiming to enhance the current share of railway freight transport to almost 40 – 45% in the coming years. As a result, the government is focusing on various strategic initiatives, including collaborations and partnerships with the major players in the rolling stock industry, to be undertaken in order to achieve its target. These initiatives involve high investments in the deployment of advanced rolling stock vehicles and advancements in the associated railway infrastructure.

Increasing investments in railway infrastructure are significantly impacting the rolling stock market growth. With increased investments in railway infrastructure, the focus on modernizing rolling stock is increasing. This involves upgrading locomotives with more powerful engines, installing better braking systems, and improving passenger comfort in coaches. Furthermore, it includes the use of environmentally friendly rolling stock, such as electric trains or trains powered by alternative fuels. Increased investments in railway infrastructure also lead to the expansion of railway networks, which can subsequently drive the demand for rolling stock.

This involves the purchase of new locomotives, coaches, and wagons to meet the needs of an expanded network. Infrastructure upgrades such as improvements to the tracks, which include reducing the number of curves or installing modern signaling systems, are also contributing to the market growth. For instance, in March 2023, Siemens announced an investment of USD 220 million to build advanced manufacturing and rail services facilities in North Carolina, U.S. These new facilities are expected to improve rail technology to aid passenger’s smooth journey within the country

Advances in technology have made it possible to design and produce energy-efficient rolling stock. For instance, modern electric locomotives use regenerative braking, which captures the energy lost during braking and stores it in onboard batteries. This energy can be used later to power the train, which reduces the overall energy consumption and costs. New technologies such as computer vision, and artificial intelligence are also making rail transportation safer. These technologies can be used to detect obstacles on the tracks, monitor train performance, and prevent collisions. For instance, Positive Train Control (PTC) technology uses GPS, wireless communication, and onboard computers to slow down or stop trains and prevent accidents automatically.

Rolling Stock Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 70.62 billion |

|

Revenue Forecast in 2033 |

USD 123.01 billion |

|

Growth rate |

CAGR of 7.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, train type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Alstom Transport; CRRC Corporation Limited; GE Transportation; Hitachi Rail System; Hyundai Rotem; Kawasaki Heavy Industries, Ltd.; Siemens Mobility; Stadler Rail AG; The Greenbrier Co.; Trinity Rail; CAF, Construction and Railway Auxiliary, SA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |