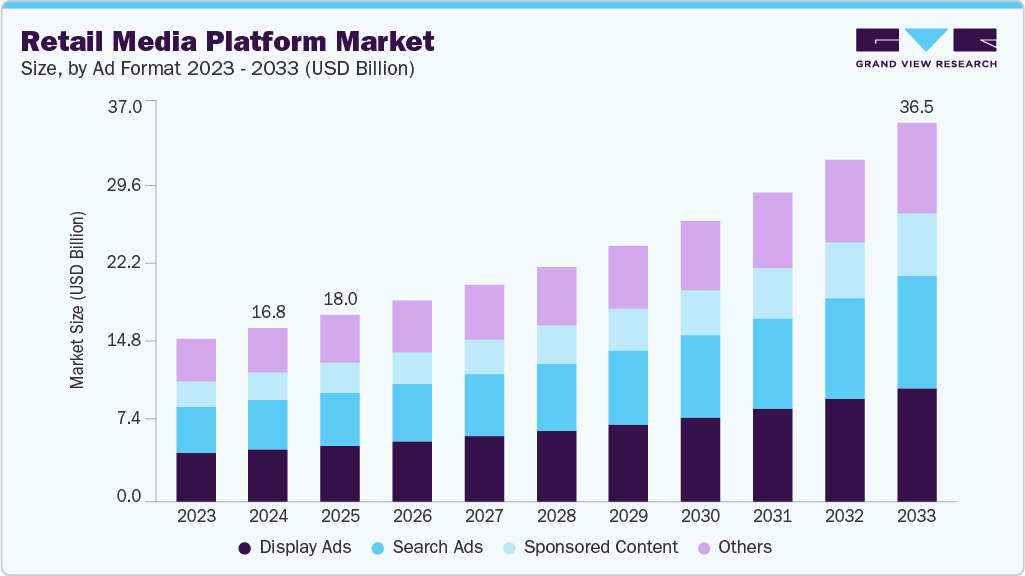

Retail Media Platform Market Size, Share & Trends Analysis growing at a CAGR of 9.3% from 2025 to 2033

The global retail media platform market size was estimated at USD 16.77 billion in 2024 and is projected to reach USD 36.53 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The ongoing digital transformation in retail has led to a surge in e-commerce, creating more digital real estate for advertising opportunities.

Key Market Trends & Insights

- North America held 36.6% revenue share of the global retail media platform market in 2024.

- In the U.S., the growing shift in advertising spend from traditional channels to digital commerce environments is accelerating the demand for the retail media platform market.

- By ad format, display ads segment held the largest revenue share of 30.1% in 2024.

- By platform type, retailer-owned media networks segment held the largest revenue share in 2024.

- By deployment, cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.77 Billion

- 2033 Projected Market Size: USD 36.53 Billion

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/retail-media-platform-market-report/request/rs1

The rise of e-commerce and omnichannel retailing is another major driver of the retail media platform market. As consumers blend online and offline shopping journeys, retailers are investing in digital advertising networks that seamlessly integrate across web, app, and in-store digital screens. These platforms enable advertisers to create unified campaigns that engage customers at multiple touchpoints, increasing the likelihood of brand recall and purchase. Moreover, the surge in mobile shopping and the adoption of retail apps are creating more opportunities for embedded advertising, further fueling demand for advanced retail media solutions.

The retail media platform market is also being driven by the rapid digital transformation across the retail sector, where investments in advanced retail technologies are reshaping how brands connect with consumers. Retailers are integrating sophisticated digital signage, interactive displays, and connected in-store experiences that complement online advertising efforts, creating a seamless consumer journey. This convergence of physical and digital retail experiences increases the effectiveness of retail media campaigns, as shoppers are exposed to consistent messaging across multiple channels. The ability to deliver dynamic, context-aware content based on real-time inventory, promotions, and customer behavior further enhances the appeal of these platforms for advertisers seeking higher engagement rates.

Retail Media Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.99 billion |

|

Revenue forecast in 2033 |

USD 36.53 billion |

|

Growth rate |

CAGR of 9.3% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Ad format, platform type, deployment, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Amazon Advertising; Walmart Connect; Google Ads; Meta Ads; Criteo; The Trade Desk; Kroger Precision Marketing; Instacart Ads; Wayfair LLC; PubMatic, Inc.; Ulta Beauty, Inc.; Target Brands, Inc.; Best Buy; CVS Health; Walgreen Co. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |