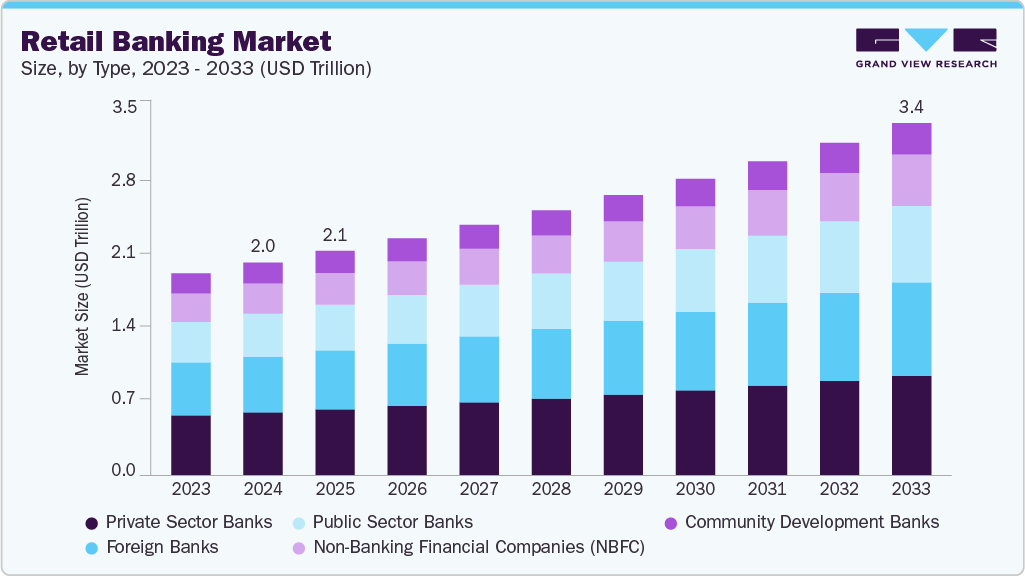

Retail Banking Market Size, Share & Trends Analysis growing at a CAGR of 5.8% from 2025 to 2033

The global retail banking market size was estimated at USD 2,039.25 billion in 2024, and is projected to reach USD 3,373.43 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growth is driven by rapid technological advancements shaping the market’s dynamics and growth potential. The progress in digital technologies has transformed the way customers interact with banks.

Key Market Trends & Insights

- Asia Pacific retail banking market accounted for a 33.7% share of the overall market in 2024.

- The retail banking industry in China held a dominant position in 2024.

- By type, the private sector banks segment accounted for the largest share of 29.7% in 2024.

- By service, the saving and checking account segment held the largest market share in 2024.

- By end use, the residential segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,039.25 Billion

- 2033 Projected Market Size: USD 3,373.43 Billion

- CAGR (2025-2033): 5.8%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest Market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/retail-banking-market/request/rs1

The rise of online and mobile banking has made banking services more accessible and convenient for customers, allowing them to conduct transactions, check balances, and access a wide range of services at their fingertips. Another significant driver is changing customer expectations. Customers nowadays expect personalized and tailored banking experiences. They demand seamless integration across various channels, including online, mobile, and physical branches. Banks that can adapt and provide a superior customer experience through personalized services, innovative products, and efficient processes are likely to thrive in the competitive market. Moreover, demographic shifts are impacting the retail banking industry. The growing middle class in emerging economies creates new opportunities for banks to create customer’s banking requirements.

In addition, competition within the retail banking sector is intensifying. Traditional banks face competition from fintech startups and technology players entering the financial services space. These new players leverage technological innovations, such as deep learning and blockchain, to offer disruptive products and services. Traditional banks are focusing on embracing digital transformation, collaborating with fintech firms, or developing innovative solutions to stay competitive.

Regulatory changes also play a crucial role in shaping the retail banking landscape. Governments and regulatory bodies worldwide impose strict regulations to enhance consumer protection, ensure financial stability, and promote fair practices in the banking industry. Compliance with these regulations requires banks to invest in robust risk management systems, data protection measures, and regulatory reporting capabilities. Moreover, transparency, security, and ethical practices can gain a competitive advantage for the market players and foster long-term customer relationships, driving the market growth further.

However, the market growth is obstructed by the threat of increasing cybersecurity risks. As digitalization expands, banks face a growing number of cyber threats, including data breaches, identity theft, and fraudulent activities. These risks not only harm the customers but also damage the reputation of the banks. To overcome this challenge, banks need to prioritize cybersecurity measures and invest in robust systems to protect customer data. Implementing multi-factor authentication, encryption techniques, and continuous monitoring can help mitigate risks.

Type Insights

The private sector banks segment held the largest share of 29.5% in 2024. The private sector banks have leveraged their agility and flexibility to adapt to changing market conditions and customer preferences. Unlike public sector banks, they are not burdened by bureaucratic processes and enjoy greater autonomy in decision-making, enabling them to respond swiftly to market demands and introduce innovative products and services. Moreover, private sector banks have been successful in creating a customer-centric approach. They prioritize delivering a superior customer experience by offering personalized services, convenient banking channels, and quick turnaround times.