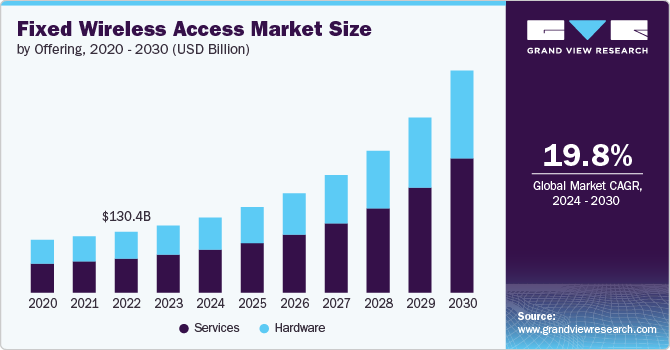

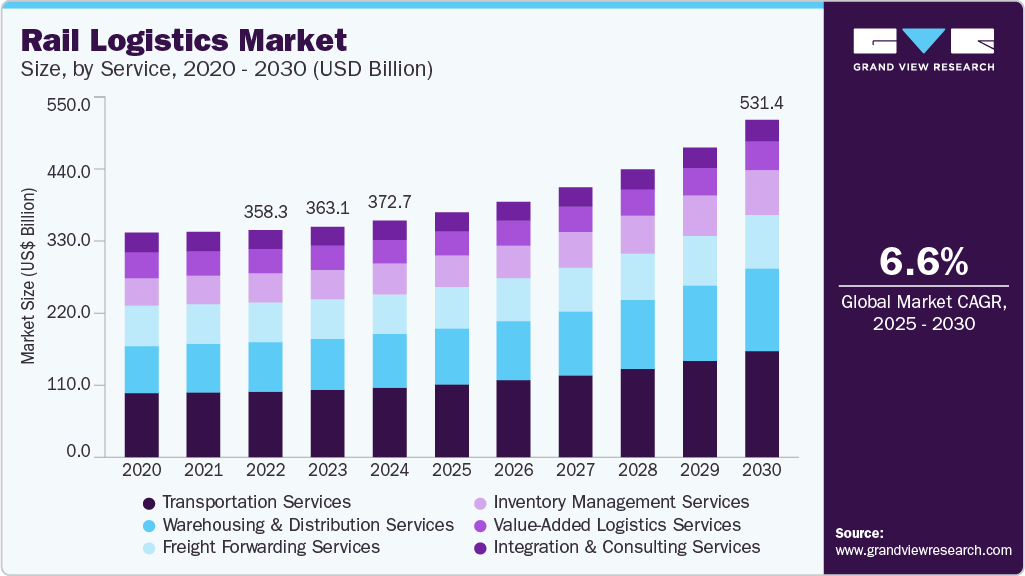

Rail Logistics Market Size, Share & Trends Analysis grow at a CAGR of 6.6% from 2025 to 2030

The global rail logistics market size was estimated at USD 372.77 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The rail logistics industry’s growth is driven by several underlying drivers, most notably the growing demand for cost-efficient, bulk transportation solutions amid rising global trade volumes.

Key Highlights:

- The Asia Pacific led the global rail logistics market with a revenue share of 43.56% in 2024.

- The rail logistics market in India is expected to grow at a fastest CAGR over the forecast period.

- By service, the transportation services segment accounted for the largest share of 29.6% in 2024.

- Based on cargo type, the bulk segment held the largest market share in 2024.

- By end-use industry, the mining and metals segment dominated the market in 2024.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/rail-logistics-market-report/request/rs1

Increasing urbanization and industrialization have necessitated more reliable freight corridors, while concerns around reducing carbon emissions have further positioned rail as a preferred mode over road transport. In addition, government initiatives supporting infrastructure development and intermodal connectivity have played a significant role in enhancing the market potential.

Environmental regulations and corporate sustainability goals are encouraging shippers and logistics providers to shift more freight from road to rail. Rail transport offers significant reductions in greenhouse gas emissions per ton-kilometer compared to trucking, making it an attractive option in the global push to decarbonize supply chains. In Europe, green freight initiatives and emissions trading schemes are actively encouraging modal shifts, while in North America and Asia Pacific, rail is being positioned as a cleaner alternative to highway transport for both bulk and intermodal cargo. This sustainability trend is expected to increase as more governments set net-zero targets and impose stricter carbon pricing mechanisms.

Substantial public and private sector investments in upgrading rail infrastructure are opening new capacity and improving service reliability. Projects such as India’s Dedicated Freight Corridors, China’s Belt and Road rail links, and North America’s network upgrades are expanding the operational footprint of rail logistics. In addition, digital technologies such as real-time tracking, predictive maintenance, and automated train operations are enhancing efficiency and reducing costs. Smart rail freight solutions powered by IoT and AI are enabling better asset utilization and cargo visibility, which is critical to attracting high-value and time-sensitive freight segments. Thus, investment in rail infrastructure and increasing digitalization in the rail industry is propelling the growth of the rail logistics industry.