Pump Market growing at a CAGR of 4.8% from 2026 to 2033

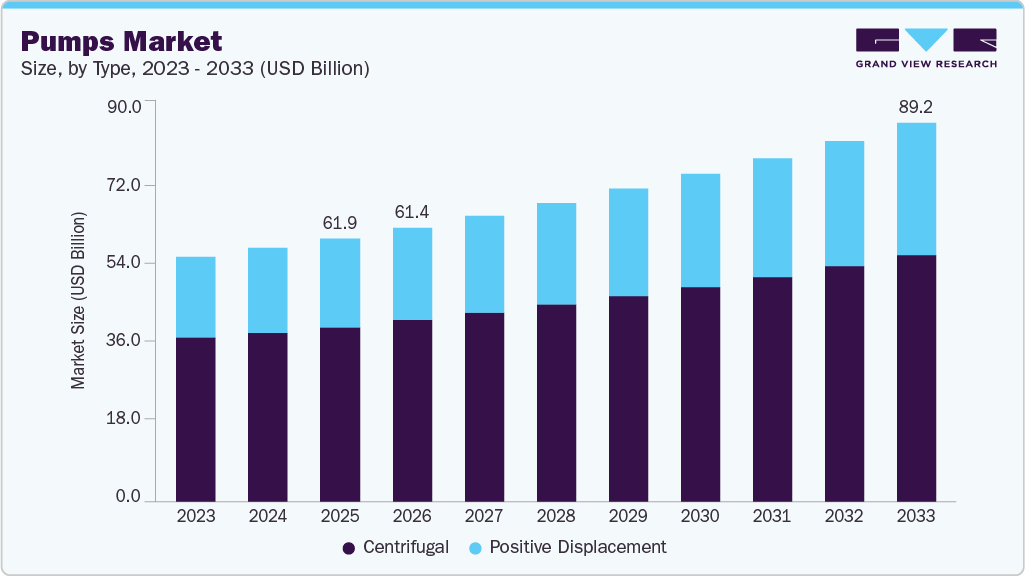

The global pumps market size was estimated at USD 61,876.6 million in 2025 and is projected to reach USD 89,175.3 million by 2033, growing at a CAGR of 4.8% from 2026 to 2033. The pump market is witnessing growth driven by their essential dual functions, enhancing fluid pressure and increasing flow rates.

Key Market Trends & Insights

- Asia Pacific dominated the pump market with the largest revenue share of 45.4% in 2025.

- The pump market in the India is expected to grow at a substantial CAGR of 6.4% from 2026 to 2033.

- By type, the positive displacement segment is expected to grow at a considerable CAGR of 5.3% from 2026 to 2033 in terms of revenue.

- By end use, the water and wastewater segment is expected to grow at a considerable CAGR of 5.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 61,876.6 Million

- 2033 Projected Market Size: USD 89,175.3 Million

- CAGR (2026-2033): 4.8%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/pump-market/request/rs1

In industries such as oil & gas exploration and mining, pumps are vital for maintaining optimal pressure and ensuring accurate dosing of reagents during complex synthesis operations.

The demand for pumps is on the rise due to expanding fluid management needs in sectors like power generation and construction. Furthermore, growth in the agricultural investments, urban development, and the necessity for wastewater treatment are anticipated to boost the market further. Moreover, advancements in technology along with the expansion of key industries such as water & wastewater treatment, chemical, power generation, and agriculture are expected to propel the market’s growth.

Market Concentration & Characteristics

The pump market is fragmented, with several global and regional players competing across various segments. While major companies hold significant market shares in specific applications like oil & gas or water treatment, numerous smaller firms cater to niche and localized demands. This competitive landscape fosters innovation and pricing pressure. Ongoing mergers and acquisitions may gradually increase consolidation in certain high-growth areas.

The pump industry is experiencing steady innovation, driven by the integration of smart technologies, IoT, and energy-efficient designs. Manufacturers are focusing on automation, remote monitoring, and predictive maintenance to enhance performance. Innovations also target reduced environmental impact and operational costs. This evolution is reshaping both product development and end user expectations.

The industry has seen a consistent level of mergers and acquisitions, especially among companies aiming to expand geographic presence or enter niche markets. Strategic acquisitions are enabling firms to strengthen their technological capabilities and diversify offerings. Bolt-on deals are common for accelerating growth and achieving economies of scale. This trend supports market consolidation and competitive positioning.

Regulatory frameworks heavily influence the pump market, especially in sectors like water treatment, oil & gas, and chemicals. Compliance with energy efficiency standards and environmental guidelines shapes product design and adoption. Regulations often drive the need for upgrades or replacements of legacy systems. As sustainability concerns grow, regulatory pressure is expected to intensify.

Pumps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 64,375.1 million |

|

Revenue forecast in 2033 |

USD 89,175.3 million |

|

Growth rate |

CAGR of 4.8% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, and region. |

|

Region Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia |

|

Key companies profiled |

SLB; Ingersoll Rand; The Weir Group PLC; Vaughan Company; KSB SE & Co. KGaA; Pentair; Grundfos Holding A/S; Xylem; Flowserve Corporation.; ITT INC.; EBARA CORPORATION.; IWAKI CO., LTD.; Sulzer Ltd; SPX FLOW, Inc.; Titan Manufacturing Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |