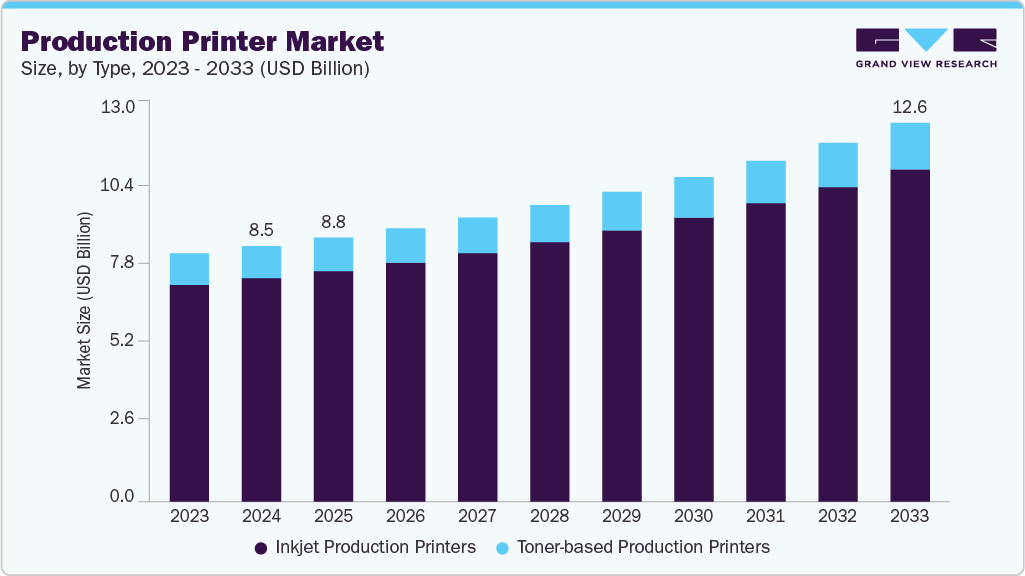

Production Printer Market Size, Share & Trends Analysis growing at a CAGR of 4.6% from 2025 to 2033

The global production printer market size was estimated at USD 8.49 billion in 2024 and is projected to reach USD 12.59 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The integration of high-speed inkjet technology and automation in print workflows has emerged as a significant trend in the global production printer market, driven by the growing demand for personalized print solutions,

Key Market Trends & Insights

- The Asia Pacific Production Printer market accounted for a 38.4% share of the overall market in 2024.

- The production printer industry in China held a dominant position in 2024.

- By type, the inkjet production printers segment accounted for the largest share of 87.3% in 2024.

- By color output type, the color production printers segment held the largest market share in 2024.

- By production method, the cut fed (sheet-fed) segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.49 Billion

- 2033 Projected Market Size: USD 12.59 Billion

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/production-printer-market-report/request/rs1

The rise of short-run printing in commercial sectors, and the increasing need for cost-effective and efficient high-volume printing in packaging and publishing applications. Stricter environmental compliance standards are propelling the market growth for sustainable production printers. In 2023, the U.S. Environmental Protection Agency (EPA) reinforced its enforcement of the Resource Conservation and Recovery Act (RCRA), mandating safer chemical alternatives and enhanced hazardous waste management across printing facilities. Regulations such as the National Emissions Standards for Hazardous Air Pollutants (NESHAP) have limited VOC emissions, directly boosting the market for water-based inks and energy-efficient UV curing systems, especially in the packaging and label segments. Furthermore, the EPA’s 2023 guidelines aimed at screen printing facilities advocated a 15-20% reduction in solvent use through advanced drying systems, influencing technology upgrades and sustainable workflow adoption.

digital packaging solutions. During the same period, the wood products subsector grew by 31.3%, partly driven by innovations in digitally printed corrugated boxes. By 2023, over 68% of packaging converters had integrated inkjet systems to accommodate retailers’ needs for variable-data printing on shipping materials, directly propelling market growth.

Industrial sectors have increasingly adopted advanced inkjet systems since 2021, boosting the production printer market. For instance, the computer and electronics subsector saw a 13.5% growth in shipment values by the end of 2021, driven by applications in circuit printing and component labeling. Simultaneously, the transportation equipment sector grew by 12.1%, utilizing UV-curable inkjet printers for durable, high-resolution markings. These printers, which often exceed 1,200 dpi, meet rigorous safety standards and align with EPA reports from 2022-2023 that show a 30-40% reduction in VOC emissions compared to analog systems, reinforcing their value in regulatory-compliant production environments.

Between 2021 and 2023, the shift toward personalized, on-demand print jobs gained momentum, bolstering the demand for digital production printers. U.S. Census data shows the miscellaneous manufacturing subsector, home to many custom printing operations, expanded by 9.4% in 2021. Concurrently, the printing and related support activities subsector posted a 9.0% increase in shipment value, reflecting growth in quick-turn, low-volume print services. Government surveys conducted in 2022 revealed that 42% of commercial printers had already adopted on-demand capabilities for books, brochures, and promo items, significantly boosting market demand for flexible, high-efficiency digital presses.