Procurement As A Service growing at a CAGR of 14.4% from 2025 to 2033

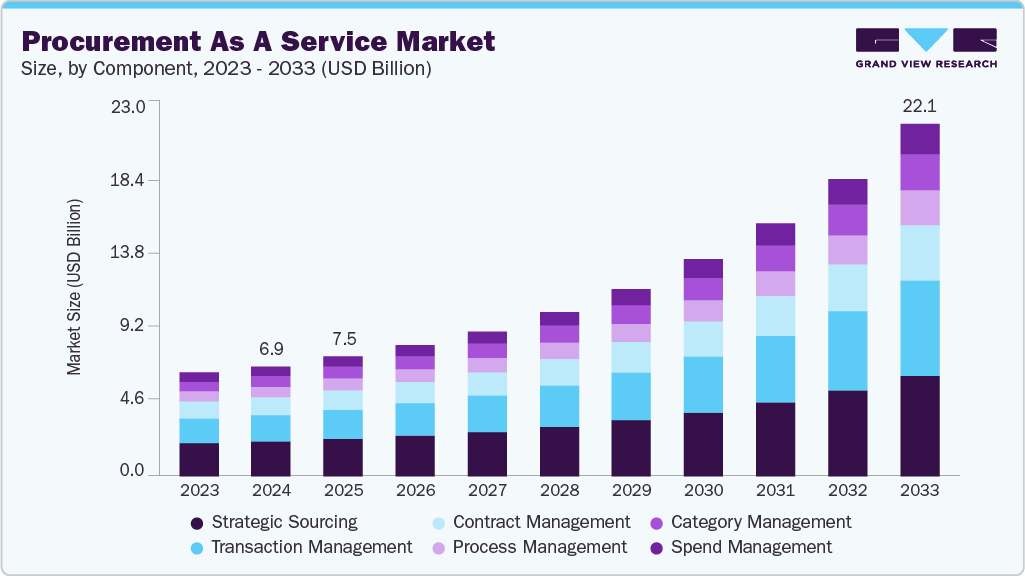

The global procurement as a service market size was estimated at USD 6.89 billion in 2024 and is projected to reach USD 22.10 billion by 2033, growing at a CAGR of 14.4% from 2025 to 2033 due to increasing demand for cost optimization, operational efficiency, and strategic sourcing among businesses across industries. Organizations increasingly recognize the need to outsource procurement functions to expert third-party providers to reduce procurement costs, streamline operations, and gain access to advanced procurement technologies.

Key Market Trends & Insights

- North America procurement as a service dominated the global market with the largest revenue share of 44.6% in 2024.

- The procurement as a service market in the U.S. led North America and held the largest revenue share in 2024.

- By component, strategic sourcing led the market and held the largest revenue share of 31.9% in 2024.

- By deployment, the SMEs segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the IT & telecom segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6.89 Billion

- 2033 Projected Market Size: USD 22.10 Billion

- CAGR (2025-2033): 14.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/procurement-as-a-service-market/request/rs1

The ability of procurement as a service (PaaS) providers to offer modular and scalable services, such as spend analysis, supplier management, and category management, enables companies to adapt procurement solutions based on specific business needs and growth stages. This flexibility and a growing focus on core competencies drive adoption among small and medium-sized enterprises (SMEs) and large corporations.

Moreover, the accelerating digital transformation across supply chains also contributes to the procurement growth as a service industry. Integrating cloud computing, AI, machine learning, and analytics into procurement processes enhances transparency, improves spend visibility, and supports data-driven decision-making. Enterprises increasingly leverage these tools to mitigate supply chain risks, ensure compliance, and drive sustainability initiatives, making digitally-enabled PaaS offerings more attractive. For instance, in May 2024, GEP introduced the industry’s first AI-powered Total Orchestration Solution, designed to enhance enterprise procurement and supply chain operations. The new platform integrates a built-in AI co-pilot, streamlining complex workflows while delivering a more intuitive user experience.

Organizations are moving beyond transactional procurement toward a more strategic approach focusing on long-term value creation, supplier innovation, and risk resilience. Procurement service providers bring specialized capabilities in category management, supplier benchmarking, and strategic negotiations, helping clients make informed sourcing decisions and develop diversified supplier portfolios. In particular, public and private sector initiatives to include minority-owned, women-owned, or local businesses in supply chains have led enterprises to partner with PaaS firms to ensure proper vendor identification, onboarding, and compliance.

Component Insights

The strategic sourcing segment dominated the market and accounted for the revenue share of 31.9% in 2024, driven by the increasing need for businesses to optimize supplier relationships, manage costs proactively, and ensure supply chain resilience. Unlike traditional procurement, which focuses on transactional purchasing, strategic sourcing emphasizes data-driven decision-making, long-term supplier partnerships, and continuous improvement. Companies increasingly rely on PaaS providers for advanced sourcing strategies that balance cost, quality, risk, and innovation in an era marked by volatile supply chains, inflation, and shifting demand patterns. This growing demand for value-added procurement services has positioned strategic sourcing as a significant driver within the PaaS ecosystem.The transaction management segment is anticipated to grow at a CAGR of 15.9% during the forecast period, driven by the increased adoption of digital procurement tools and platforms. Cloud-based procurement systems, robotic process automation (RPA), and integrated e-procurement solutions enable PaaS providers to offer seamless and scalable transaction management services. These technologies help automate repetitive tasks while ensuring real-time tracking, auditability, and integration with clients’ ERP systems. The ability to process high volumes of transactions efficiently, while maintaining data accuracy and regulatory compliance, has made transaction management a cornerstone offering in the PaaS space, especially for large enterprises with complex and decentralized procurement functions.

Procurement As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 7.53 billion |

|

Revenue forecast in 2033 |

USD 22.10 billion |

|

Growth Rate |

CAGR of 14.4% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Accenture; Aegis Components; Capgemini; Genpact; GEP; HCL Technologies Limited; Infosys Limited; IBM Corporation; TATA Consultancy Services Limited; Wipro; WNS (Holdings) Limited |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |