Power Electronics Software Market Size, Share & Trends Analysis growing at a CAGR of 9.8% from 2025 to 2033

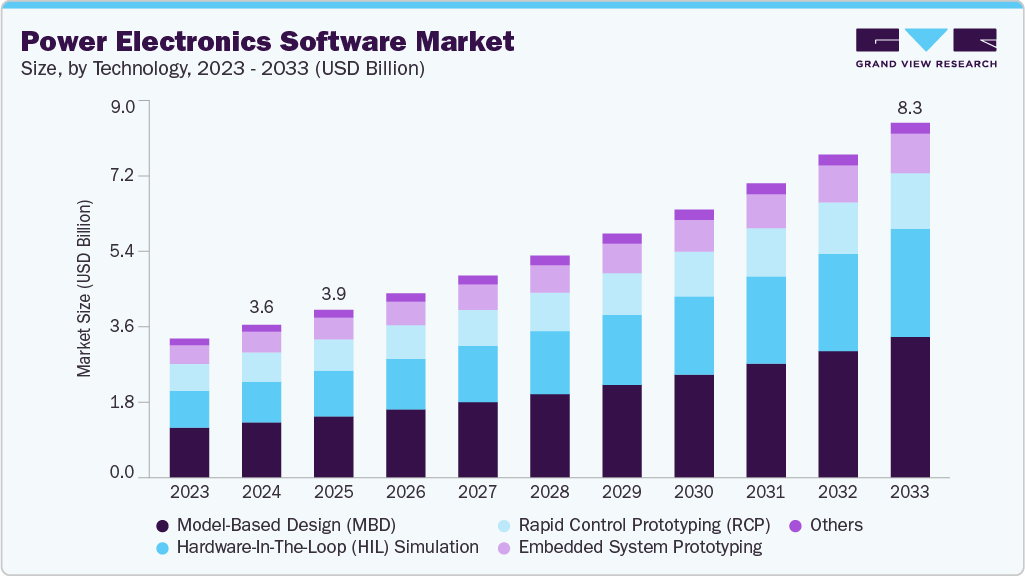

The global power electronics software market size was estimated at USD 3.56 billion in 2024 and is projected to reach USD 8.27 billion by 2033, growing at a CAGR of 9.8% from 2025 to 2033. This growth is driven by the growing demand for efficient power management in electric vehicles, renewable energy systems, and industrial automation, supported by advancements in simulation, control, and embedded design tools.

Key Market Trends & Insights

- North America dominated the global power electronics software market with the largest revenue share of 30.4% in 2024.

- The power electronics software market in the U.S. led the North America market and held the largest revenue share in 2024.

- By technology, Model-Based Design (MBD) led the market, holding the largest revenue share of 36.3% in 2024.

- By application, the industrial segment led the market, holding the largest revenue share in 2024.

- By type, the design software segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.56 Billion

- 2033 Projected Market Size: USD 8.27 Billion

- CAGR (2025-2033): 9.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/power-electronics-software-market-report/request/rs1

The increasing complexity and integration of power electronic systems across diverse industries shape the current landscape of the power electronics software market. Increasing demands for accurate design, simulation, and validation tools drive the adoption of advanced software platforms that allow engineers to optimize efficiency, reliability, and performance. The rise of embedded control systems, along with the need for hardware-in-the-loop testing and real-time simulation, fosters widespread use of these software solutions in sectors such as automotive, industrial automation, aerospace, and renewable energy.

In addition, the accelerating transition toward electrification and sustainable energy solutions promotes market growth. The expansion of electric vehicles and renewable energy infrastructures requires software capable of managing complex power management, battery optimization, and converter control. Stringent regulatory standards on energy efficiency and emissions compel manufacturers to deploy more advanced power electronics systems, which depend heavily on comprehensive software tools for compliance and performance enhancement.

Furthermore, integrating AI, ML, and cloud computing into power electronics software fuels the market growth. These technologies enable predictive analytics, improved fault detection, and collaborative development environments that enhance design accuracy and operational resilience. The convergence of software with hardware testing platforms allows for seamless real-time validation and troubleshooting, addressing the growing complexity of modern power electronic devices. As industries emphasize automation, sustainability, and digital transformation, the demand for versatile, scalable, and intelligent software solutions is projected to drive the growth of the power electronics software industry.

Technology Insights

The Model-Based Designs (MBD) segment accounted for the largest revenue share of over 35% in 2024, driven by enabling operators to create detailed virtual representations of complex telecom networks and analytics workflows. This capability allows for precise simulation and network performance testing under diverse scenarios, reducing development cycles and operational risks. By providing a unified design, validation, and optimization platform, MBD supports proactive network management and enhances decision-making processes, which are essential in handling the increasing data volumes and dynamic traffic patterns characteristic of modern telecom environments.