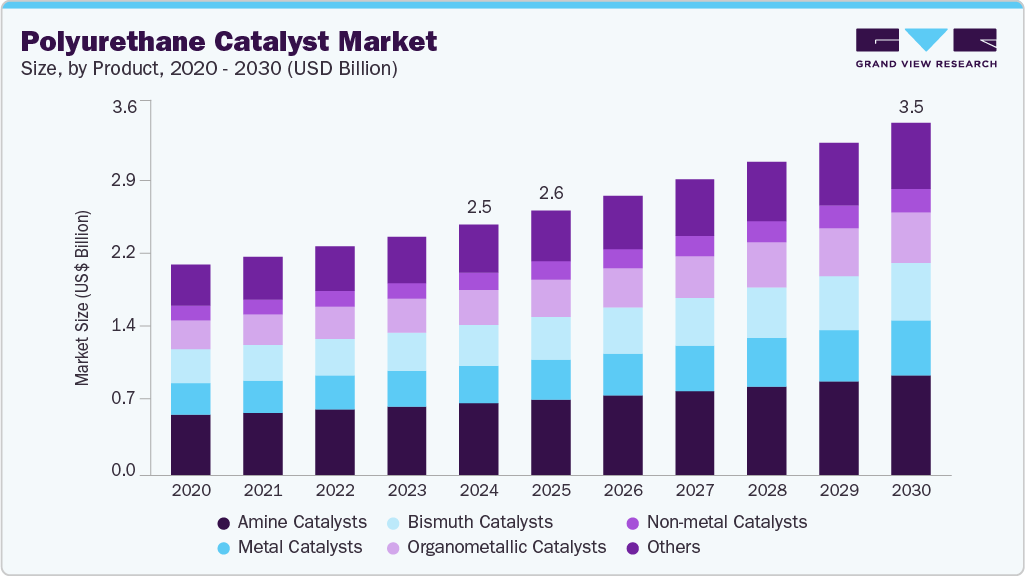

Polyurethane Catalyst Market Size, Share & Trends Analysis growing at a CAGR of 5.9% from 2025 to 2030

The global polyurethane catalyst market size was estimated at USD 2.46 billion in 2024 and is projected to reach USD 3.46 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The market is witnessing significant growth driven by the expanding usage of polyurethane across the automotive, construction, electronics, and furniture industries.

Key Market Trends & Insights

- Asia Pacific captured the largest revenue share of 40.07% in 2024.

- The polyurethane catalyst market in China is the largest contributor in Asia Pacific.

- In terms of product segment, the amine catalysts segment led the market with the largest revenue share of 28.6% in 2024.

- In terms of application segment, the flexible foam segment dominated the market with the largest revenue share of 33.69% in 2024.

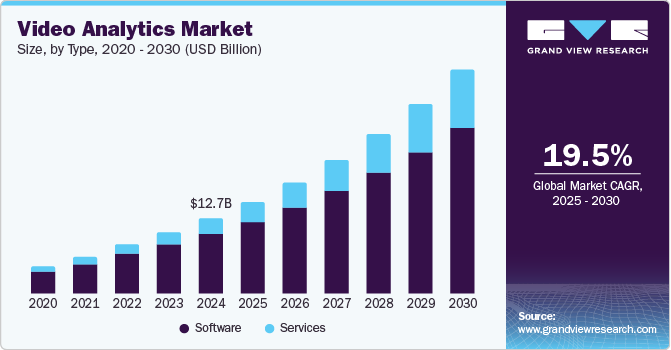

Market Size & Forecast

- 2024 Market Size: USD 2.46 Billion

- 2030 Projected Market Size: USD 3.46 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest Market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/polyurethane-catalyst-market-report/request/rs1

Polyurethane catalysts are pivotal in accelerating the reaction between isocyanate and polyol during PU synthesis, directly impacting foam quality and curing time. Rapid industrialization in emerging economies and the growing demand for energy-efficient buildings and lightweight automotive components propel market expansion. Polyurethane catalysts are critical in controlling the speed and specificity of the chemical reactions that form polyurethane, ensuring optimal polymer structure and performance. They enable manufacturers to fine-tune reaction profiles for different end-use applications, such as achieving desired foam density, elasticity, or curing time. The PU formation process would be inefficient, inconsistent, and commercially unviable without catalysts.

The market faces challenges from stringent environmental regulations that restrict the use of toxic metal-based catalysts, such as those containing tin or mercury. Compliance with global safety standards while maintaining performance and cost-effectiveness poses a significant hurdle for manufacturers. Moreover, price volatility of raw materials adds to the complexity of managing production costs.

The shift toward sustainable, non-toxic, and bio-based catalyst alternatives presents lucrative growth opportunities for market players. Rising R&D investments in developing advanced, high-selective catalysts tailored to specific PU formulations further open new avenues for innovation. Growing awareness of green chemistry, especially in Europe and North America, supports the uptake of environmentally friendly catalyst solutions.