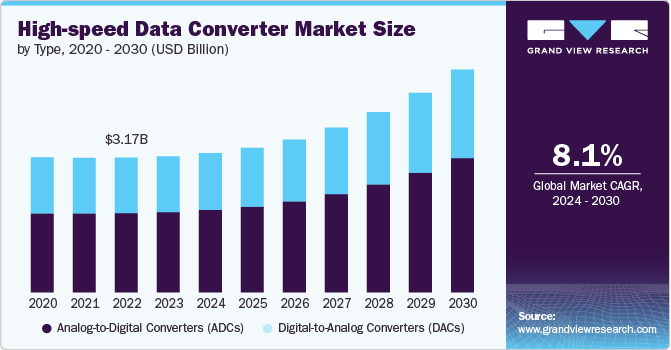

Point-of-Sale Terminal Market Size, Share & Trends Analysis growing at a CAGR of 8.1% from 2025 to 2030

The global point-of-sale terminal market size was estimated at USD 113,381.0 million in 2024 and is projected to reach USD 181,473.4 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. Point-of-Sale (POS) terminals are electronic devices designed to process card-based transactions across a wide range of establishments, including retail outlets, restaurants, hotels, gas stations, pharmacies, hospitals, and resorts.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, fixed pos terminals accounted for a revenue of USD 71,128.1 million in 2024.

- Mobile POS Terminals is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 113,381.0 Million

- 2030 Projected Market Size: USD 181,473.4 Million

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/point-of-sale-pos-terminals-market/request/rs1

The increasing adoption of cost-effective wireless communication technologies has significantly contributed to the expansion of the POS terminal market. These systems leverage wireless connectivity to enable seamless payment processing for goods and services.

Restaurants, bars, and food service providers heavily rely on POS technologies to streamline operations, manage inventory, monitor product movement, and track sales effectively. Modern POS systems often integrate various hardware components such as cash registers, barcode scanners, and computers, along with digital displays, to facilitate seamless online and offline transactions. The market is being propelled by the growing use of mobile-based POS terminals, advancements in payment technologies, and the widespread adoption of EMV (Europay, Mastercard, and Visa) standards. In addition, the expanding application of POS systems across the e-commerce and retail sectors is playing a significant role in driving market growth.

The point-of-sale terminal market has also been influenced by rising concerns regarding security and privacy, particularly in relation to data breaches. One key factor driving market growth is the increasing popularity of modern drive-thru services. Many businesses have begun adopting advanced POS systems to integrate their drive-thru lines, kitchen operations, and back-office functions, ensuring a more efficient and seamless order fulfillment process. For example, fast-casual chains such as Chipotle, Starbucks, and Panera have incorporated drive-thru features into several of their locations. Moreover, the growing adoption of mobile POS terminals has further opened new opportunities for market expansion, enabling businesses to provide faster, more flexible payment solutions.

The enhanced return on investment (ROI) provided by POS systems has positively influenced the market, encouraging greater adoption. In addition, the growing need for efficient customer and employee management, inventory tracking, and the integration of in-store and online sales through tablets has further fueled the demand for these solutions. The increasing popularity of contactless payments and the widespread adoption of Near Field Communication (NFC) devices across various industries have significantly boosted market growth. Moreover, remittance companies are introducing innovative solutions tailored to specific industry needs, driving profitability. POS systems enable retailers to streamline business operations and manage inventory more effectively, contributing to the point-of-sale terminal industry.

The benefits of modern drive-thru services, such as enhanced convenience, have significantly improved the overall customer experience, creating promising growth opportunities for the POS terminal market. However, challenges such as privacy concerns and the risk of data misuse, including potential card information leakage, remain significant barriers to market growth. In addition, a lack of awareness among consumers about the security risks associated with POS systems further restricts market expansion. The market also faces security challenges due to the exposed nature of these systems within networks, as they handle critical information that requires robust protection. Managing these systems, especially in rural areas, adds another layer of complexity to ensuring their security and operational integrity.

Product Insights

The fixed segment dominated the market and accounted for the revenue share of over 58.0% in 2024. The fixed POS segment is divided into kiosks and others. Large-scale vendors often opt for fixed POS terminals, driven by their substantial procurement and installation investments, which continues to support the growth of this segment. In addition, end-users with understanding of cloud and on-premises data storage solutions tend to prefer fixed POS systems for their ability to securely store data locally. These terminals are widely used for various functions, including bill printing, Customer Relationship Management (CRM), inventory control, and integration with diverse payment devices, making them a vital component in streamlining business operations.

The mobile segment is anticipated to grow at a CAGR of 10.8% during the forecast period. The mobile POS segment is divided into tablet and others.The growth is largely driven by the increasing adoption of in-store mobile payments by consumers worldwide. Mobile POS (mPOS) terminals enable transactions to be processed from any location within a store, enhancing flexibility and operational efficiency. Various end-users, particularly in the food service industry, such as restaurants, are increasingly implementing mPOS solutions to streamline payment processes during peak hours. This not only minimizes delays and prevents potential revenue loss but also boosts customer satisfaction. For example, Quick-Service Restaurants (QSRs) in China have adopted technologies such as digital kiosks and tablets for menu display and order placement. These innovations contribute to improved service delivery and customer experience, thereby propelling market growth.