Piling Machine Market growing at a CAGR of 4.2% from 2024 to 2030

The global piling machine market size was estimated at USD 5.06 billion in 2023 and is projected to reach USD 6.71 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030. The escalating demand for piling machines has primarily been propelled by the swift expansion of global infrastructure development.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The European market accounted for the second largest share in 2023.

- In terms of product, piling rigs led the market and accounted for 41.1% of the global revenue share in 2023.

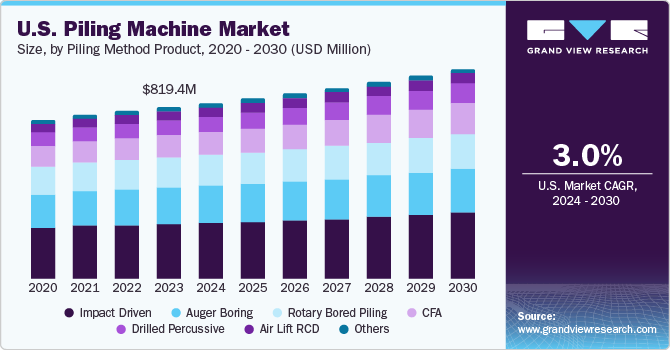

- In terms of piling method, the impact-driven segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.06 Billion

- 2030 Projected Market Size: USD 6.71 Billion

- CAGR (2024-2030): 4.2%

- Asia Pacific: Largest market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/piling-machines-market/request/rs1

Governments and private enterprises are making substantial investments in diverse construction endeavors. With urbanization steadily on the rise, the need for top-tier infrastructure is growing, consequently driving the market. The piling machine industry is strongly influenced by renewable energy projects, which encompass a diverse range of endeavors focused on tapping into sustainable energy sources like wind, solar, and geothermal power.

According to the International Trade Administration (ITA), there is a remarkable surge expected in global renewable capacity additions, with an increase of 107 gigawatts (GW) projected for 2023. This remarkable surge in renewable energy capacity is being propelled by the increasing support of policies favoring renewables, growing concerns about energy security, and the rising competitiveness of renewable energy compared to fossil fuel alternatives.

In the U.S., the growth of the construction industry is a key factor contributing to the demand for piling machines. According to the U.S. Census Bureau, the total construction spending (residential and non-residential) in the country grew by 3.5% in June 2023 on a y-o-y basis. Furthermore, government efforts toward bringing semiconductor production back to the U.S. have accelerated the construction of factories. For instance, the USD 1.20 billion Bipartisan Infrastructure Bill passed through the US Senate includes USD 550 billion in new spending on infrastructure. This particular bill is anticipated to boost the construction output in the U.S. in 2022 and 2023 and will further drive the infrastructure and construction activities.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Further, the market players have been undertaking strategic initiatives in order to cater to rising demand for piling machines by joint venture, product innovation, and research & development activities. For instance, BSP TEX launched Mk.3s RICs and accessories, such as drill tools, MX45-8 mast, and vibroflot. These products are used for a wide range of applications such as soil mixing and stone columns.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Mergers and acquisitions are undertaken to improve reach of their products in the market, by making these products & services available to end users over diverse geographical areas. For instance, Junttan Oy completed the acquisition of Canadian Pile Driving Equipment, Inc., a Canada-based authorized distributor of Junttan Oy since 2007. Through this acquisition, the company strengthened its position in North America.

Regulations play a crucial role in shaping the landscape of the market. It influences the product development, safety standards, and market access. Market players are increasingly prioritizing sustainability by opting for carbon-efficient processes to manufacture the equipment used in carbon deposition. By embracing sustainable operations, manufacturers are able to not only contribute to environmental conservation but also improve their brand positioning and market penetration rate.

Product Insights

Piling rigs segment led the market and accounted for 41.1% of the global piling machine market in 2023, and expected to grow at a significant CAGR over the forecast period. According to a policy paper of the UK government published in 2019, the infrastructure pipeline, including both public and private sectors, accounts for an investment over USD 656.1 billion planned during the period 2020-2030. Out of this, USD 50 billion will be spent on affordable housing. Moreover, according to a news article published by Travel in 2021, the Saudi government has been working on 15 mega projects related to infrastructure, such as the Journey through Time and Qiddiya. With all these developments, the demand for piling rigs in the global market is anticipated to rise in the coming years to construct transportation structures, infrastructure buildings, and water treatment plants.

The impact hammer segment is likely to grow at the second-highest pace over the forecast period. Impact hammers are used in the construction of residential, commercial, and industrial buildings to create a stable foundation for the structure. According to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau’s August 2023 report, a total of 1,543,000 building permits have been issued to construct new residential buildings, which is a 6.9% month-on-month growth as compared to the preceding month of July. Hence, with the growth in demand for residential housing, the demand for impact hammers is expected to rise.

Regional Insights

Asia Pacific dominated the market in 2023 and expected to grow at 5.0% CAGR over the forecast period. The economies in the region are anticipated to flourish over the forecast period on account of the massive investments by governments for the development of public infrastructure and the expansion of the residential construction industry, which is expected to benefit the market in Asia Pacific. Furthermore, the region is expected to account for USD 2.5 trillion of growth in construction output from 2020 to 2030, growing by over 50% to become a USD 7.4 trillion market by 2030, according to the Oxford Economies 2021 report. These aforementioned factors are anticipated to propel the demand for piling machines over the forecast period.

Piling Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5,244.0 million |

|

Revenue forecast in 2030 |

USD 6.71 billion |

|

Growth rate |

CAGR of 4.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 – 2022 |

|

Forecast period |

2024 – 2030 |

|

Report updated |

January 2024 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, piling method, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Scandinavia; Russia; China; India; Brazil; UAE; Qatar; Saudi Arabia |

|

Key companies profiled |

Casagrande S.p.a,; WATSON DRILL RIG; BSP TEX; BAUER Group; TONTI TRADING S.R.L.; Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.); International Construction Equipment; ABI Maschinenfabrik und Vertriebsgesellschaft mbH; Epiroc AB; Fundex Equipment; Dieseko Group; MKT Manufacturing Inc.; IQIP; XCMG Group; Junttan Oy; Sany Group; Liebherr-International Deutschland GmbH; Soilmec S.p.A; Changsha Tianwei Engineering Machinery Manufacturing Co., Ltd; Kejr, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |