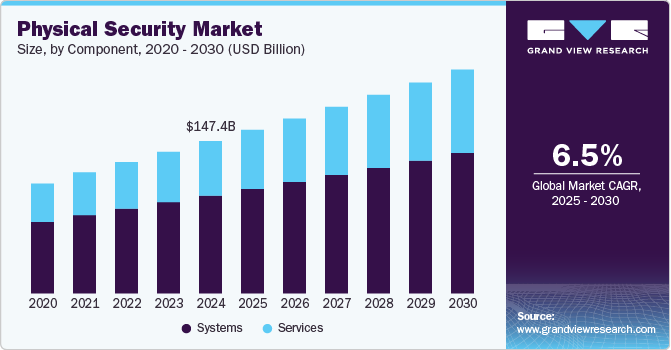

Physical Security Market Size, Share & Trends Analysis growing at a CAGR of 6.5% from 2025 to 2030

The global physical security market size was estimated at USD 147.36 billion in 2024 and is projected to reach USD 216.43 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The need to secure the physical environment from activities such as crime, vandalism, potential burglaries, theft, and fire incidences is one of the crucial factors expected to drive the industry.

Key Market Trends & Insights

- North America physical security market dominated the global industry in 2024, accounting for over 37.0% share of the global revenue.

- The physical security industry in the U.S. is anticipated to exhibit a significant CAGR over the forecast period.

- By component, the system segment led the market in 2024.

- By end-use, the government segment led the market in 2024.

- By organization size, the large enterprise segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 147.36 Billion

- 2030 Projected Market Size: USD 216.43 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/physical-security-market/request/rs1

Moreover, factors such as increased spending on security to protect the organization’s critical assets, adoption of cloud-based data storage, advanced analytics, as well as technological developments in access control and video surveillance are some of the key trends expected to drive the industry. In addition, the shifting focus from legacy solutions such as badge readers, alarm systems, and door locks to advanced logical security, which encompasses breach detection, threat management, and intrusion prevention, among others, has helped the organization and government agencies to deter crime incidence and breaches at a higher success rate.

Governments across different countries and regions are taking up smart city initiatives to enhance their infrastructure and are hence deploying improved security systems. Additionally, modernizing the existing infrastructure with robust security measures and strengthening the security of government agencies have been some of the top priorities for governments across developed countries. Organizations are increasingly concerned about employee safety and are hence setting up systems to prevent unauthorized access, further driving the demand for physical security solutions.

The physical security environment continues to evolve globally. Over the past few years, numerous sectors and leading industries such as BFSI, residential, government, and transport, among others, have witnessed a swift growth in the number of security breaches. Furthermore, growing concerns to ensure the safety of resources, people, and vital assets, against physical threats and unique vulnerabilities, are anticipated to become major factors driving the need for a robust security environment. Moreover, rising threat incidents have increased the need to strengthen efforts to maintain a highly secured physical infrastructure at residential as well as business premises.

Governments across major regions are continuously involved in strengthening their physical security infrastructure to curb the growing threats. For instance, in December 2021, Axis Communications AB., a Sweden-based company that provides services to private sectors and governments around the world, launched its body-worn camera for the private security of government officials. The body-worn cameras have advantages of multiple benefits for liability protection, personal safety, and operational efficiency.

Physical Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 158.14 billion |

|

Revenue forecast in 2030 |

USD 216.43 billion |

|

Growth rate |

CAGR of 6.5% from 2025 to 2030 |

|

Historical data |

2017 – 2024 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, organization size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc.; Genetec Inc.; Cisco Systems Inc.; Axis Communications AB; Pelco; Robert Bosch GmbH; Johnson Control International Plc; ADT LLC; Siemens. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |