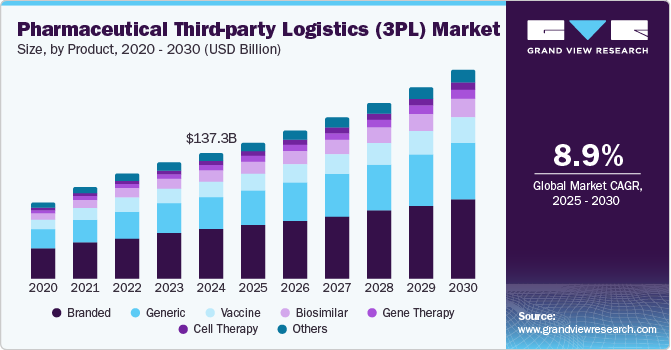

Pharmaceutical Third-Party Logistics Market Size, Share & Trends Analysis growing at a CAGR of 8.9% from 2025 to 2030

The global pharmaceutical third-party logistics (3pl) market size was estimated at USD 137,252.0 million in 2024 and is projected to reach USD 228,542.2 million by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide (TiO2)in the coming years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, branded accounted for a revenue of USD 53,613.1 million in 2024.

- Cell Therapy is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 137,252.0 million

- 2030 Projected Market Size: USD 228,542.2 million

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/pharmaceutical-third-party-logistics-market-report/request/rs1

Pharmaceutical companies are focusing on streamlining their operations, reducing costs, and improving delivery timelines.

Furthermore, growing demand for temperature-sensitive pharmaceuticals and biopharmaceuticals is significantly fueling the expansion of the cold chain logistics segment. Growing demand for the safe storage and transportation of these delicate products has led the companies to innovative cold chain solutions that safeguard product quality and efficacy. These solutions are designed to maintain precise temperature control throughout the entire supply chain, from manufacturing to end-user delivery. Moreover, the integration of cutting-edge technologies, such as artificial intelligence (AI), is further accelerating the adoption of cold chain logistics in the pharmaceutical sector. AI-driven systems enable enhanced monitoring, predictive analytics, and real-time tracking, allowing companies to optimize routes, reduce risks, and improve overall supply chain efficiency, thus driving the demand for innovative cold chain logistics solutions.

In addition, strict regulations regarding the handling, storage, and transportation of drugs, especially temperature-sensitive biologics and vaccines are also driving the demand for pharmaceutical third-party logistics industry. Third-party logistics providers are increasingly relied upon to ensure that shipments meet these stringent regulatory requirements, including Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP). As regulations become more complex across different regions, the demand for 3PL providers with the necessary certifications and expertise to navigate these requirements is expected to increase.

Product Insights

The branded drugs segment captured the highest market share of 39.06% in the pharmaceutical third-party logistics industry in 2024. The growth is mainly due to their high market value and established demand. Pharmaceutical companies producing branded drugs often rely on third-party logistics providers to manage the complex and global supply chains necessary for distributing these products. These drugs, often protected by patents, are typically high-margin products that require stringent storage and transportation conditions, especially for temperature-sensitive medications.

Cell therapy segment is projected to experience the highest CAGR of 9.86% due to its potential to treat a wide range of diseases, including cancer, autoimmune disorders, and genetic conditions. Increasing demand for cell-based therapies would subsequently lead to the growing demand for specialized logistics services, particularly in handling and transporting these delicate and time-sensitive products. These therapies often require precise temperature control, unique storage solutions, and real-time monitoring to maintain their viability.